AI Model Layer: The New Frontline of the Cloud Wars

The model layer has emerged as the main battlefield for the Big 3 Cloud Giants in the current AI race. Domination in this layer could determine who rules the cloud markets in the coming years.

Browser wars, search wars, mobile wars, social network wars… every major platform shift tends to catalyze a vicious land grab. Over the last two decades in software, we’ve witnessed an aggressive turf war play out during the on-prem to cloud migration, where Amazon, Microsoft, and Google, have emerged triumphant as the Big 3 providers in the cloud wars:

The battle for tech dominance continues to be fought for largely in the cloud. For the leaders Amazon and Microsoft, the cloud-related portions of these hyper-scalers are so valuable that AWS and Azure account for more than half of each company’s enterprise value respectively (graph below). In an ultimate testament to the importance of winning the cloud wars, both Microsoft and Amazon chose to elect the former heads of their cloud units as CEO.

Given the importance of cloud services to enterprise value, there is a strong incentive for Cloud Giants to do everything they can to hold on to market share and find incremental gains. The cloud wars have continually intensified over the past year as the markets have gotten more challenging, with meaningful growth deceleration impacting all players:

As greenfield opportunities begin to deplete, Cloud Giants are turning to AI as the next frontier for cloud spending. Microsoft boldly ascribed 1% of Azure growth to AI services (this sounds small but translates to ~$400-$500MM annualized run rate according to Morgan Stanley). In fact, AI as a % of cloud spend is expected to increase from 3% to 9% just within the next three years:

Model layer within the AI stack is critical to cloud dominance

The race is on! In recent earnings calls, every Cloud Giant CEO addressed not only the opportunity of AI as a vector for cloud services growth, but also specifically highlighted foundational models as a core way to capture value for the cloud arm:

Andy Jassy, AMZN 1Q23 Earnings Call (4/27/23): “We're not close to being done inventing in AWS. Our recent announcement on large language models and generative AI and the chips and managed services associated with them is another recent example. And in my opinion, few folks appreciate how much new cloud business will happen over the next several years from the pending deluge of machine learning that's coming.”

Sundar Pichai, GOOG 1Q23 Earnings Call (4/25/23): “Our [GCP] growth is also driven by our product leadership. We are bringing our GenAI advances to our Cloud customers across our Cloud portfolio. Our PaLM GenAI models and Vertex AI platform are helping Behavox to identify insider threats; Oxbotica to test its autonomous vehicles; and Lightricks to quickly develop text-to-image features.”

Satya Nadella, MFST 3Q23 Earnings Call (4/25/23): “We have the most powerful AI infrastructure, and it’s being used by our partner OpenAI, as well as NVIDIA, and leading AI startups like Adept and Inflection to train large models…. we now have more than 2,500 Azure OpenAI Service customers, up 10X quarter-over-quarter.”

As seen in the chart above, it makes a lot of sense for the Cloud Giants to aspire to dominate the model layer, since this slice sits right above the infrastructure layer and can drive consumption (e.g. compute, storage, hosting, deployment, etc.) directly to the most lucrative part of the business — cloud services. Additionally, all the Cloud Giants have application offerings (great post from my friend

on this) that are differentiated by model layer inputs.Unsurprisingly, all the Cloud Giants are building their own proprietary models (see Google’s example above) and/or are partnered with best-in-class startups to achieve this goal. The top 4 most highly-valued GenAI startups are model layer companies, and all are aligned with one of the Cloud Giants:

OpenAI: Partnered exclusively with Microsoft where Azure powers all OpenAI workloads across research, products, and API services. Microsoft has invested over $10Bn in the company

Anthropic: GCP is the Anthropic’s preferred cloud provider. Google has invested $300MM in the company.

Cohere: The company was founded by former Googlers, and currently has a multi-year partnership to utilize Google Cloud's TPU computing power.

Hugging Face: AWS is the company’s preferred cloud provider.

Not only are all the Cloud Giants and some of the most highly-valued GenAI startups trying to conquer this domain, other Big Tech companies (e.g. Meta), academic institutions (e.g. Stanford), non GenAI startups (e.g. Databricks), and a very long-tail of providers (many of whom are open-source) are also in the fight:

An impending shake-up in the landscape…

Last month, I riffed with

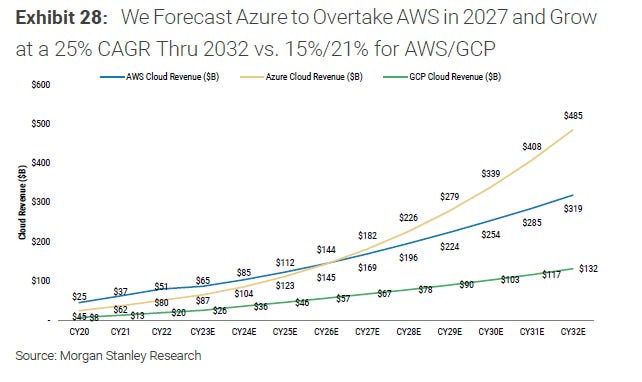

on TechCrunch Equity about the battle that is heating up in this part of the AI stack: enterprises vs. startups, open-source vs. closed-source, general vs. domain-specialized, Big Tech aligned vs. independent, etc. No one will be willing to concede easily given how critical this battleground is in determining who reigns supreme within the cloud services markets in the coming years.Morgan Stanley predicts that while all Big 3 hyper-scalers will benefit from the AI gold rush, the largest share gainer will be Microsoft (chart above) since the company has a stronger ability to monetize foundational technologies, and may receive a more durable advantage given OpenAI’s early lead. Morgan Stanley goes so far as to make a bold prediction that AI will power Azure to overtake AWS by 2027 (chart below). Even Google is expected to capture more AI spend than Amazon in the long-run since the company has been investing and innovating in AI for the last 7 years.

Regardless of who you think is poised to win this new battle (please comment with your thoughts below), it is clear that we are gearing up for a very fierce and expensive AI turf war in the cloud world.