Sustained competition or inevitable concentration: Gaming out market structure evolution in AI

The recent proliferation of AI offerings has caused customers to agonize over the noisy landscape. How should we think about fragmentation vs consolidation as AI markets mature?

I was in New York last week at The Wall Street Journal’s CIO Network Summit to discuss “What’s Next in Enterprise Tech Investing?”. CIOs play a crucial procurement role for their organizations, with a unique dual mandate to execute core initiatives that are essential for day-to-day operations while also investing in strategic technologies that can drive future competitive advantage. Naturally, the impact of AI on organizations was a recurring theme throughout the Summit as CIOs are currently at the frontline evaluating AI solutions for their companies. Many CIOs highlighted how the increasing proliferation of AI vendor options has led to choice fatigue. Considering the crowded landscape, a few CIOs mentioned how their organizations may be better off waiting for stronger reliability signals — be it more consolidation, the emergence of clear winners on the startup side, or incumbents incorporating AI functionality — before making major AI investments.

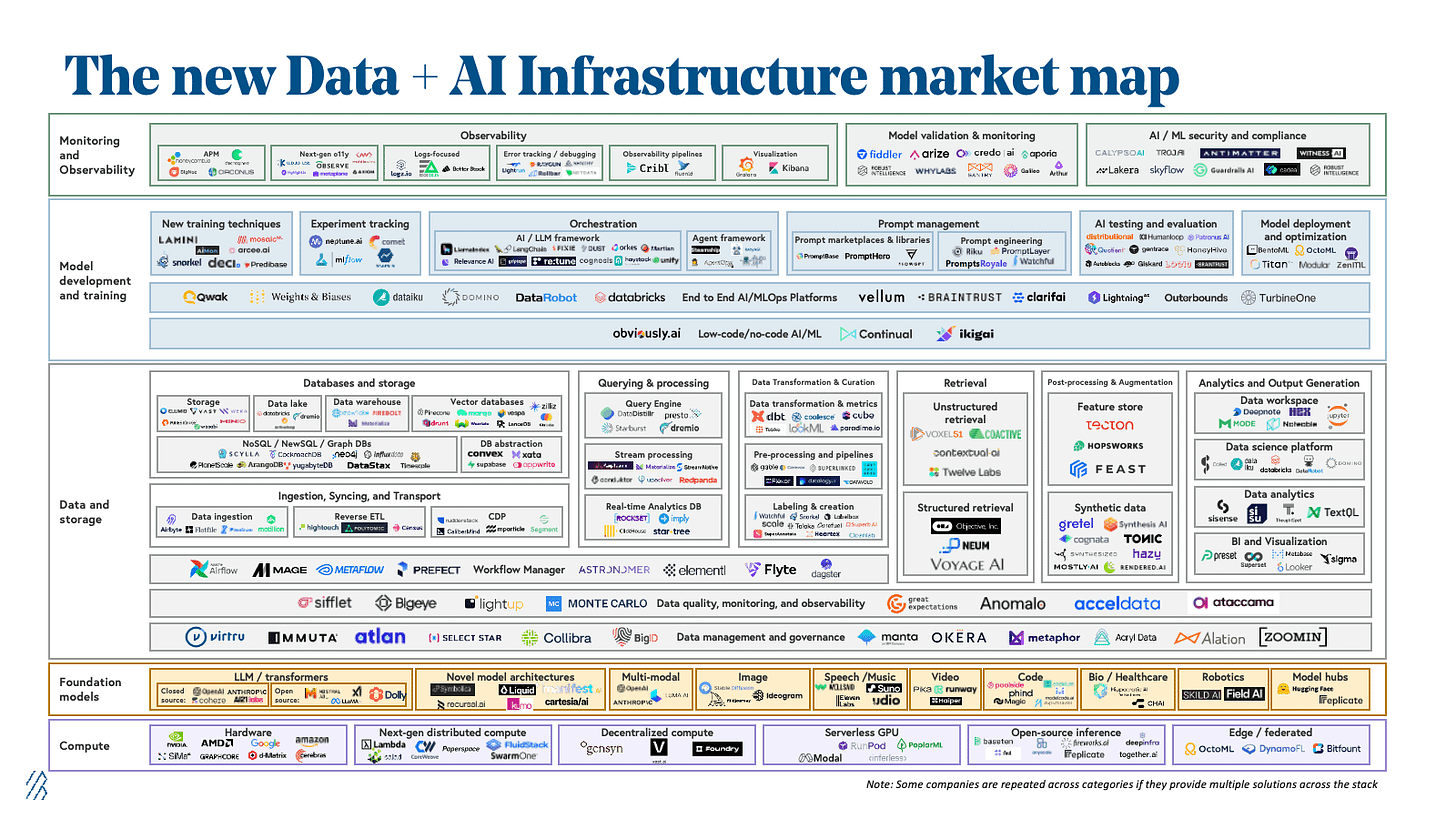

It’s not surprising to hear these concerns. Let’s zoom in on the AI infrastructure landscape as an example. Looking at the number of logos on the AI Infrastructure market map my colleagues and I at Bessemer put together recently is a shocking visual representation of how crowded some AI categories have become:

It’s not unexpected to see a highly fragmented ecosystem during the early innings of a new tech cycle; just recall how many browsers and search engine options there were at the start of the internet age! VC funding at the infrastructure layer in this AI revolution has also been a compounding factor. A recent J.P. Morgan report estimated that ~77.9% of the ~$47.9Bn of equity funding raised by generative AI startups from 2Q22-3Q24 went to infrastructure companies, sowing tremendous vibrancy in this layer.

As AI markets mature, it’s plausible to assume that some consolidation will happen, but there isn’t necessarily a clear consensus amongst VCs on how particular market structures will eventually shake out. Within AI infrastructure, my sense is that we could likely see significant variance in how, when, and to what degree, consolidation occurs across different categories. During the panel, I proposed a framework centered on demand nuances and innovation generalizability to evaluate the intensity of potential consolidation. For instance, the AI video generation market could remain fragmented for longer compared to the AI code generation market due to a mixture of 1) enough differentiated use cases with requirements to sustain specialized capabilities, and 2) less generalizability of innovations (such as training techniques) within these spaces.

That said, even in AI categories where functionality converges quickly, “taste” preferences can serve as a vector to support continued diversity. Referencing the general-purpose AI chatbot market,

articulated this point in her viral essay on “Taste is eating Silicon Valley”:OpenAI’s ChatGPT came out strong as the market leader. Since then, Anthropic’s Claude, Google’s Gemini, Meta’s Llama, Microsoft Copilot, Perplexity, Poe, and others have joined the race from different angles. Yes, they’re competing on technical merits, but with how quickly AI is improving, it feels like they’ll converge on similar functionality.

So how do they compete? On how they look, feel, and how they make users feel. The subtleties of interaction (how intuitive, friendly, or seamless the interface feels) and the brand aesthetic (from playful websites to marketing messages) are now differentiators, where users favor tools aligned with their personal values. All of this should be intertwined in a product, yet it’s still a noteworthy distinction.

We also discussed on the panel how platformization pressures can serve as a defining force to shape market structures. Industries are not static as they constantly undergo bundling or unbundling; this dynamic presents opportunities in different directions for startups. In general, accelerating platform initiatives to expand from an initial wedge or point solution continues to be a tried-and-true strategy for startups to strengthen market leadership at the start of a tech cycle. We’re already seeing signals of this from early AI movers in the model layer, with industry observers writing eulogies for a wave of startups after every OpenAI Dev Day.

We’re just at the beginning of the current AI paradigm shift with the ultimate winners still to be determined, so I reckon that we’ll be revisiting this discussion multiple times as startups could be grappling with the tension between fragmentation and consolidation for years to come. For now, more than ever before, startups need to think strategically — defensively and offensively — about how to position against existential threats given the rapidly evolving competitive landscape.