Introducing enterprise sales to a product-led growth organization

Six lessons from developer-centric platforms on how to launch an enterprise go-to-market engine in a PLG company

Originally published in Bessemer’s Atlas. Co-authored by Janelle Teng and Elliott Robinson.

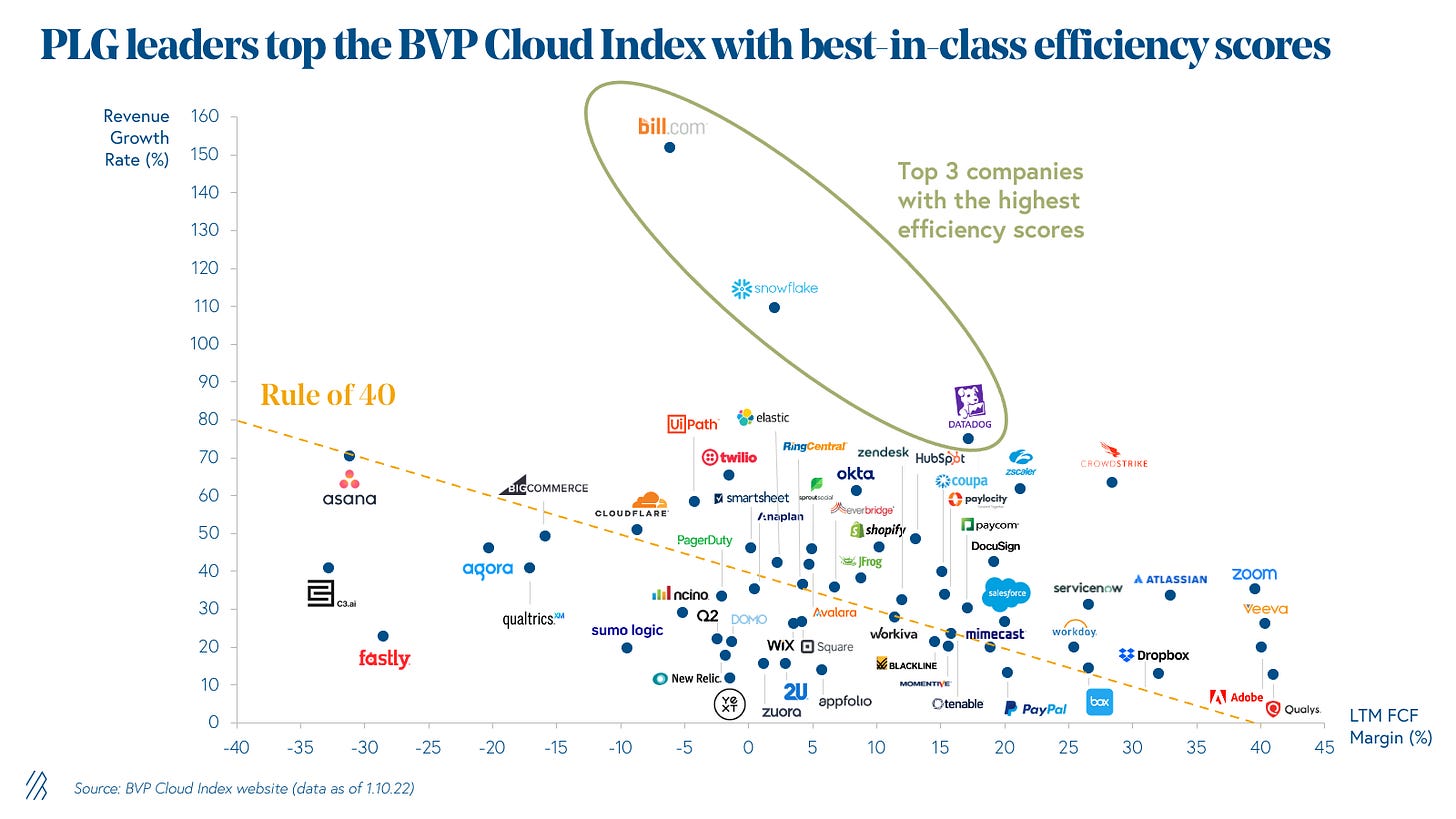

The power of product-led growth (PLG) is no longer a secret. Time and time again, top CEOs have attributed their scale and success to a bottoms-up strategy. A common benchmark of success in cloud software is a combined growth rate and free cash flow margin of more than 40%. PLG companies routinely outperform the “Rule of 40” since they can achieve rapid growth with unparalleled capital efficiency. The top three companies in the BVP Cloud Index with the highest efficiency scores are all PLG companies—Bill.com and Snowflake lead the charge with efficiency scores soaring past 100% and Datadog a close third with an efficiency score over 90%.

The PLG go-to-market approach has gained even more momentum in recent years, driven by strong macro tailwinds. One leading tailwind is the rise of decentralized and remote workforces, which has shifted decision-making power away from the top and into the hands of end-users. Another tailwind comes from infrastructure advances away from a monolithic architecture, allowing for more accessibility, flexibility, and democratization benefiting individual agents. The result has been astonishing— we’ve seen a more than 150x increase in the cumulative market capitalization for product-led growth companies within the last seven years. This trend showed no signs of slowing down in 2021 with blockbuster IPOs and successful direct listing from PLG companies such as Bessemer portfolio company HashiCorp.

Just as the cloud business model revolutionized the software industry more than two decades ago, we believe the PLG approach is a powerful accelerant that will help startups gain more traction faster than ever before.

Yet, there’s a critical paradox facing every product-led growth company: While a bottoms-up strategy is instrumental for initial traction, many companies ultimately need to layer in top-down sales in order to reach $1 billion ARR by leveraging enterprise adoption.

Introducing top-down enterprise sales in a PLG organization is an extremely delicate transition to make and can be disastrous if not executed well.

Timing is everything—the question is not simply how to implement an enterprise sales strategy, but when to do so. Operationalizing an upmarket motion too early in a PLG company’s lifecycle can be detrimental to momentum, but there is also a significant opportunity cost in waiting too long.

At Bessemer Growth, we’ve witnessed many of our highest-performing PLG portfolio companies in a few short years scale to $100 million of ARR and beyond by successfully introducing an enterprise sales engine as they passed the $25 million ARR mark. It makes sense to explore a formal enterprise sales engine when the bottoms-up momentum is more mature with consistent end-user demand.These are requirements needed to initially spark the enterprise flywheel (see Tactic 1).

In this deep dive, we break down six lessons from some of Bessemer’s most beloved developer platforms, including Auth0, HashiCorp, Imply, PagerDuty, and Twilio. We distill what these teams discovered when they first introduced an enterprise sales motion to their product-led organizations. The same high degree of rigor and discipline applies in GTM teams across product-led and sales-led companies. But we’ve witnessed that many of the best practices applied by PLG leaders to kickstart top-down sales momentum differ from the commonly used techniques adopted by “traditional” enterprise sales-led organizations. These unique enterprise sales strategies have been optimized to not just complement, but to further amplify an organization’s product-led DNA. PLG founders read on—you might be surprised to learn that there are many foundational practices to put in place before hiring your first enterprise sales leader!

1. Generate enterprise pipeline with end-users driving the top-of-funnel

When first building out an enterprise sales engine, many PLG companies mistakenly believe that they have to emulate the playbook of sales-led companies. As a result, leaders look to build out their pipeline using “traditional” enterprise demand generation methods such as through features in Gartner or Forrester reports, or investing significantly in direct marketing aimed at senior executives. But this approach often contradicts the factors such as word-of-mouth referral and end-user advocacy that made the company’s bottoms-up distribution strategy so successful in the first place.

Instead of taking an approach to building top-of-funnel momentum that is incongruous with the company’s product-led nature, PLG companies can leverage their existing bottoms-up tailwinds to drive top-down sales pipeline. With this in mind, we often see the most successful companies leveraging their most engaged end-user advocates as “Trojan horses” to sell into larger organizations.

From the start, HashiCorp recognized the power of a developer-driven acquisition model to drive its enterprise pipeline generation efforts. HashiCorp’s top-of-funnel demand generation efforts focused on its end-users – developers – to build awareness and promote evangelism across communities. This included hosting its annual HashiConf community conferences globally, as well as learning material, documentation, certification programs, and forums all targeted at the developer community.

Developer advocacy was so important to HashiCorp that the team formally established a “Developer Relations” team to focus on continual engagement with the developer ecosystem.

Winning the hearts and minds of developers proved extremely effective in opening the doors to enterprise accounts. For example, over 80 developers at Roblox were using Terraform open source, which served as a catalyst for the company to shift to Terraform Enterprise.

Rooted in a philosophy of empowering end-users advocates to land and expand enterprise accounts, HashiCorp has evolved from a humble open-source platform into a company with more than 2100 customers and a market capitalization of almost $14 billion at IPO in less than eight years. In fiscal 2021, HashiCorp’s products were downloaded approximately 100 million times, and by approximately 79% of the Fortune 500—a powerful testament to their ability to capture the attention of the largest companies in the world.

2. Mine for product-qualified leads (PQLs) to guide direct sales

The beauty of a PLG motion is that end-users have already had a chance to experience the value of a company’s product first-hand, often through distribution methods such as a freemium, free trial, or open source model. End-users develop into authentic evangelists after experiencing the power of the product. But how exactly do the best PLG companies convert such customer love into credible account leads to drive an enterprise sales strategy?

Instead of only relying on “marketing-qualified leads (MQLs)”, where a prospect is nurtured through the sales funnel via marketing efforts, PLG companies should leverage their best assets—the product and user adoption—as a starting point for intent signals to convert end-user demand into enterprise momentum.

Many of the best PLG companies do so by strategically mining for product-qualified leads (PQL)—users who have already tried out their product—to provide direction on where to push for enterprise sales. A strong example here is Imply, the real-time analytics database leader founded by the original creators of Apache Druid – a popular open source database that enables developers to build modern analytics applications offering interactivity at scale, high concurrency at the best price point, and insights from streaming and batch data. Imply delivers a complete software and SaaS database offering based on Druid, adding commercial features such as enterprise-grade security, ease of management and deployment, a pre-built visualization engine, as well as services and support.

Imply’s enterprise sales team closely monitors the company’s open source Druid base to inform them on which organizations might be ready for an enterprise proof of concept. PQLs that have previously used Imply’s open source offering (either in testing, development, or production) are coded as “pre-buyers,” while leads with no prior exposure to Druid are coded as “pre-believers.”

This qualification framework gives sales reps a better understanding of the types of conversations they need to have with prospective customers and which accounts are most ready for an enterprise sale. “Pre-buyers” already have technological readiness, and willingness to shift to the commercial suite hinges upon emphasizing enterprise benefits. More time needs to be spent with “pre-believers” to educate them about Imply’s technology before initiating a conversation about the business decision to take on the enterprise offering. As a result, the “pre-buyer” channel tends to be more efficient with shorter sales cycles and higher ACV potential since these prospects already embrace Imply’s technology at a fundamental level.

There is no one-size-fits-all practice for converting PQLs into enterprise purchases, but we’ve seen companies find success in a myriad of ways, including:

Collecting work email addresses during trial sign-ups to understand when a critical mass has been reached of daily-active users linked to an organizational account

Monitoring end-user usage, deployments, or instances exceeding a certain benchmark of individual or cross-team usage

Targeting end-users who have specific job titles on teams or departments with the most straightforward budget to unlock

Scanning company job postings for specific language around developer needs or requirements as a proxy for technological buy-in

3. Employ clear heuristics to triage leads and determine which areas to scale

Law 3 in our 10 Cloud Laws is “Invest behind the cloud sales and marketing learning curve” where the first rule of running sales organizations is to ramp only what works. Companies that invest too early in sales and marketing before nailing their product-market fit end up seeing precious dollars wasted that may have been better used elsewhere. We’ve seen PLG companies be vulnerable to a common pitfall: When they begin exploring enterprise sales, many believe they need to go on a hiring spree before they have sufficient enterprise demand to support additional headcount. As a result, they end up seeing precious dollars wasted.

Twilio, founded in 2008 with a developer-first go-to-market model, navigated this inflection point very well by routing leads in an efficient way using a defined structure to triage opportunities. The company only scaled its sales teams when Twilio determined quantitatively that there was enough enterprise demand in place (as demonstrated by lead velocity rate surpassing a certain threshold in a segment). The company proceeded to hire incrementally only when the cost of sale and average deal sizes justified an external hire.

Overall, Twilio operates with an organization-wide philosophy of measuring and ensuring repeatability before prematurely layering on new initiatives or hires. As its sales organization matured and the company grew to over 250,000 active customer accounts (including Fortune 500 logos such as Nike, Dell, and Comcast), Twilio introduced more granular heuristics such as estimated time to close, organization size, and geography to determine where additional coverage was needed.

4. Introduce pricing and packaging flexibility to complement enterprise purchasing behavior

Many PLG companies employ a clear and straightforward self-serve pricing model. Such transparent pricing and packaging pairs well with a bottoms-up motion, since a low-touch experience removes friction in the buying and adoption process.

However, enterprises exhibit starkly contrasting purchasing behaviors compared to individual buyers, including:

Different discovery and procurement processes (e.g. requests for proposal)

Longer sales cycles involving negotiation and detailed demos

Complex cross-department approvals

Cyclical purchasing and budgeting timelines

As a PLG company begins to push toward the enterprise, it becomes critical to evolve pricing and packaging structure to accommodate the nuances of organizational purchasing.

Auth0 had a firm grasp of the differences in enterprise purchasing behaviors, and knew it had to introduce more flexibility to ensure success of its enterprise sales engine. When Auth0 was first founded in 2013, its pricing was very simple and transparent, based on the number of applications and the number and type of users to be authenticated.

As the company began to push more into enterprises, it evolved its pricing and packaging by introducing more specialized plans based on the needs of each customer archetype (individual, team, enterprise) at each step of the customer journey. It instituted meticulously-placed pay gates to capture value from premium features, such as governance controls.

As these bundles evolved, Auth0 still maintained its transparent pricing model in the self-serve tiers, with clear metered pricing components based on granular units of value (e.g. rule limits), but allowed for more flexibility in the enterprise tier. That way, sales teams could accommodate conversations around enterprise discounting, custom commitment terms, and other topics that require more negotiation.

This pricing and packaging strategy played a critical role in supporting Auth0’s enterprise push and enabled them to scale past $100 million ARR. Auth0 was acquired by cloud giant Okta in 2021 for $6.5 billion. By Q3 of that year, 20% of Okta’s topline growth rate was attributed to Auth0. As testament to Auth0’s success in the enterprise segment, Auth0 was named alongside Okta as Leaders in the 2021 Gartner Magic Quadrant for Access Management.

Pricing is both an art and a science, and is often unique to each company’s situation. In another example, Twilio evolved its original usage-based pricing structure as it pushed upmarket, allowing reps to grant more flexibility in volume and committed-use discounts.

5. Ensure product architecture supports an “expand and extend” value-based sale to enterprises

A key tenet of a successful PLG motion is that a product can deliver realized value instantaneously and seamlessly to end users. This principle still holds true when PLG companies begin layering on enterprise sales, but value needs to now be articulated and delivered to the organization-at-large, appealing to different departments, beyond just a single end-user or team.

As mentioned in Tactic 4, enterprise customers have complex buying journeys involving multiple stakeholders. Enterprises also have more product requirements than end-users, such as admin controls and security guardrails. Many PLG companies stumble with their enterprise sales efforts when their product strategy is mismatched with an enterprise GTM motion. Examples of these mistakes include:

When top-down sales is layered on before table-stakes enterprise-grade features have been rolled out

When a product roadmap falls short of developing value-based feature upsells

When product strategy does not account for cross-sell opportunities to suit an organization-wide value-based purchasing narrative

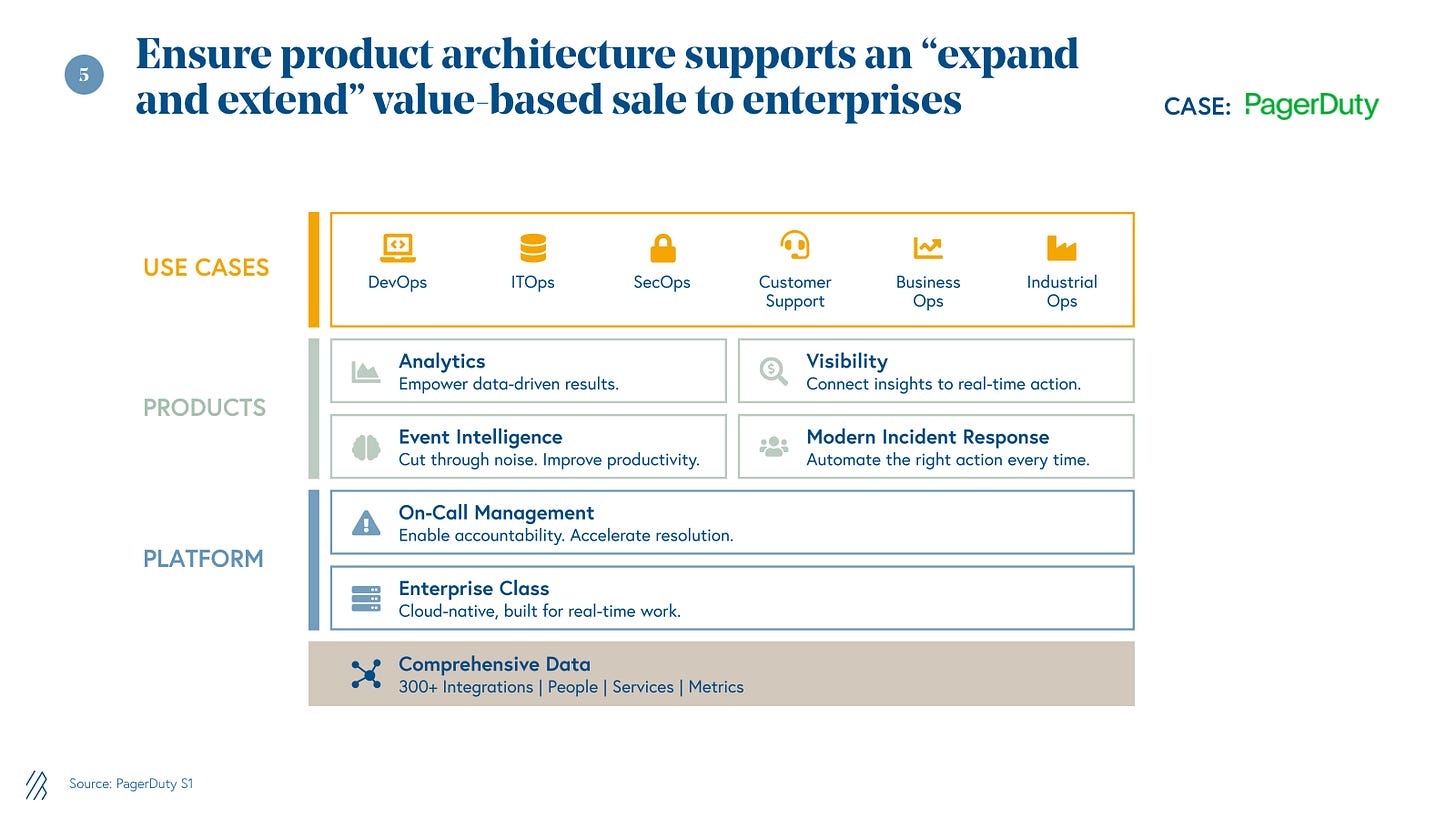

PagerDuty, the operations cloud for modern enterprise, ensured that its product architecture was ready to support value-based selling into enterprises before accelerating its top-down sales motion. This was a holistic, ongoing initiative, with the team investing years of effort to expand capabilities from a single product focused on on-call management to a real-time operations platform, spanning event intelligence, incident response, on-call management, business visibility, and analytics.

Additionally, PagerDuty invested heavily in “enterprise-grade” features, developing the scalability, reliability, and security of their platform to address the needs of even the largest and most demanding customers. At the time of their IPO, PagerDuty’s product team had spent years building deep integrations into over 300 ecosystem partners including AWS, Salesforce, ServiceNow, HashiCorp, New Relic, and Splunk, so enterprise customers could leverage PagerDuty to gather and correlate digital signals from virtually any software-enabled system or device.

Core to PagerDuty’s value-based philosophy was that its product could expand and extend value to an organization where account growth was driven by both upsells (in scale and usage) as well as new use cases and cross-sells. The effectiveness of PagerDuty’s expand and extend strategy is reflected in its best-in-class net dollar retention rate: at the time of IPO, PagerDuty’s net dollar retention rate was 139%, with net dollar retention rate consistently exceeding 130% for historical cohorts. This surpassed even our “best” benchmarks in Bessemer’s good, better, best framework for enterprise net dollar retention.

6. Establish cohesive hiring strategies and sales compensation practices

Law 9 in our 10 Cloud Laws is “Tone starts at the top”, where leadership style sets the tone that filters throughout an organization. This is why hiring an enterprise sales leader whose values align with a PLG company’s approach is key to GTM success, since they’ll be the ones creating new norms and expectations as they build out a team. Unique from sales-oriented organizations, a revenue leader at a PLG organization must understand and navigate the nuanced nature of working in an organization that centers itself on a product-first culture.

These leaders need to be end-user-centric, deeply embedded in the product, and work in concert with other product, engineering, and marketing leaders to orchestrate an enterprise sales motion that amplifies bottoms-up momentum. Hiring a sales leader with a misaligned philosophy could jeopardize success of a new enterprise motion and worst still, be destructive to underlying PLG momentum.

Twilio’s leadership recognized that not every experienced or talented enterprise sales leader would be suited to do well in a PLG environment. The company was thoughtful in ensuring their first enterprise sales leaders were a strong culture-fit for their developer-first go-to-market philosophy. Beyond experience or tenure, a key attribute Twilio prioritized was a leader who was “an evangelist of the product, but with a quota.” On top of having strong love for and belief in the product, Twilio wanted to hire a leader who would be entrepreneurial and feel comfortable experimenting with different outbound and channel strategies, in addition to classic top-down sales tactics.

Beyond solving for the right leadership hire, Twilio went one step further by ensuring that the compensation structure for its new enterprise sales representatives was aligned with an “expand and extend” strategy (see Tactic 5) to incentivize the right behaviors in its sales representatives. The company rewarded representatives who did the hard work to cultivate accounts that would yield more revenue in the long term by tracking performance against the initial sale and any forecasted expansion (e.g. estimated through expected pay-as-you-go revenue, such as the number of voice minutes.)

A successful enterprise GTM motion requires more than just sales

Introducing enterprise sales at a product-led growth company is not an easy transition. It’s one of the many “chasms” a business has to successfully cross in order to reach its new phase of growth. As demonstrated by these role model companies, it takes significant cross-team collaboration across an entire organization in order for new enterprise GTM initiatives to be successful at a PLG company.

This effort shouldn’t be siloed, disjointed, or forced unnaturally from the top. That’s why we recommend that leaders share these strategies early on to get alignment and buy-in from stakeholders across the company, such as product, engineering, marketing, and operations, before proceeding further.

The six tactics we explore are derived from developer platforms which have been clear leaders in mastering the art of integrating enterprise sales to their PLG momentum. However, we see these notable patterns across different areas of our cloud portfolio beyond developer-centric tools including from successful PLG companies such as Canva, DocuSign, and Shopify.

If you’re a PLG company embarking on a new journey to build out an enterprise sales team, we would love to hear from you. Reach out on Twitter (@NextBigTeng, @TheValuesVC, @BessemerVP) to connect.