New frontlines, New primes

Defense tech innovators are deploying into a new age of disruption, as major macro and structural shifts pave the way for a generational transformation.

While Figma’s much-anticipated S‑1 filing has dominated headlines this month, another important IPO move has flown somewhat under the radar: Firefly Aerospace recently announced plans to go public, marking the second space-related public offering in the span of a few months following Voyager’s high-profile debut in June. 2025 has seen a flurry of aerospace and defense (A&D) IPO activity, with Karman Holdings and AIRO Group Holdings also entering the public markets earlier this year, underscoring rising investor appetite for the sector.

Capital markets are showing excitement for the next wave of defense innovators

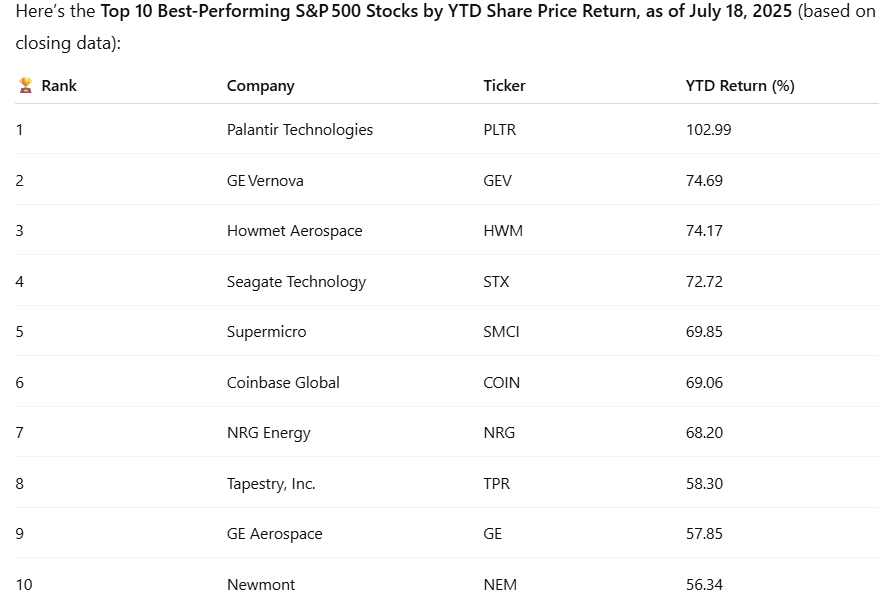

Defense tech’s momentum in the public markets is not just limited to IPOs. A look at the top performers by year-to-date stock price returns within the S&P 500 shows a notable presence of A&D and core infrastructure players, with Palantir leading the pack:

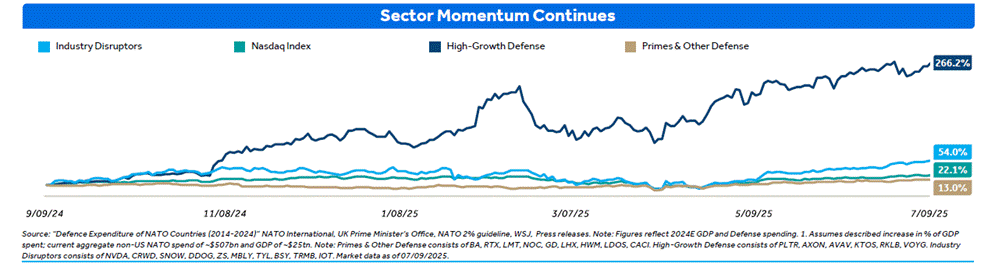

A unifying trend amongst these observations is that recent excitement in the A&D sector seems to have skewed toward newer high-growth defense names, rather than the traditional primes:

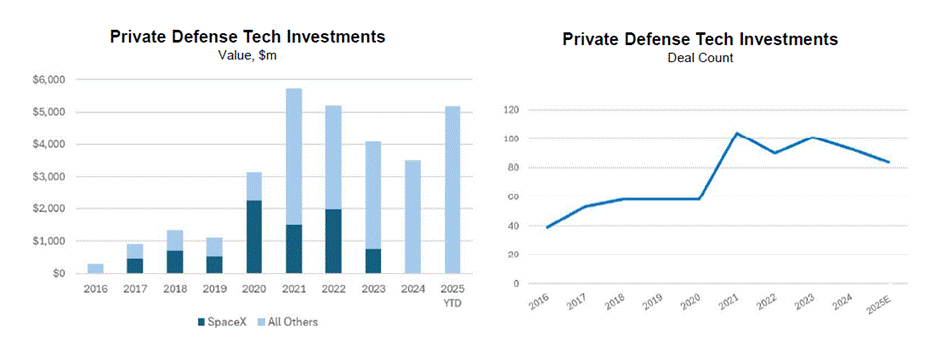

Private markets have mirrored the public market enthusiasm for new disruptors in the A&D space. Venture investment in defense startups are at record highs, with dollars distributed across an increasingly diverse set of companies:

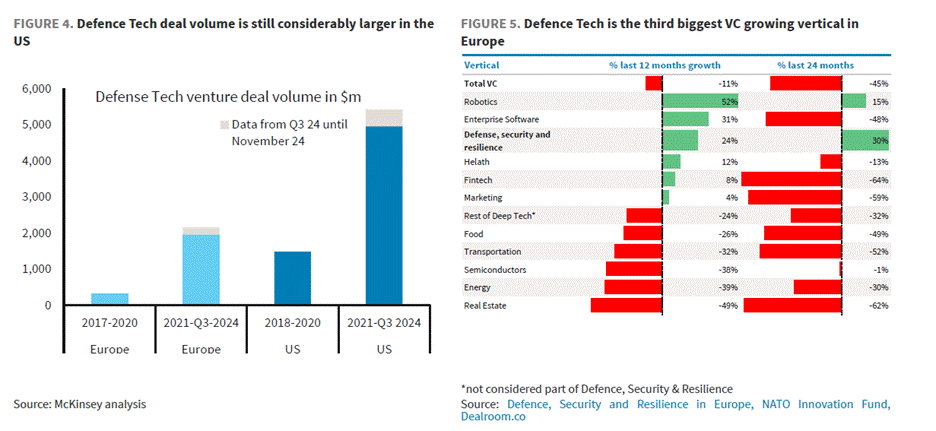

Furthermore, this enthusiasm is becoming more global in nature, as geopolitical uncertainty has accelerated interest in defense innovation worldwide:

Today, SpaceX stands as the most valuable private tech company in the world. The startup is reportedly discussing a tender offer that would bump its valuation to $400Bn and further reinforce its position as an industry leader.

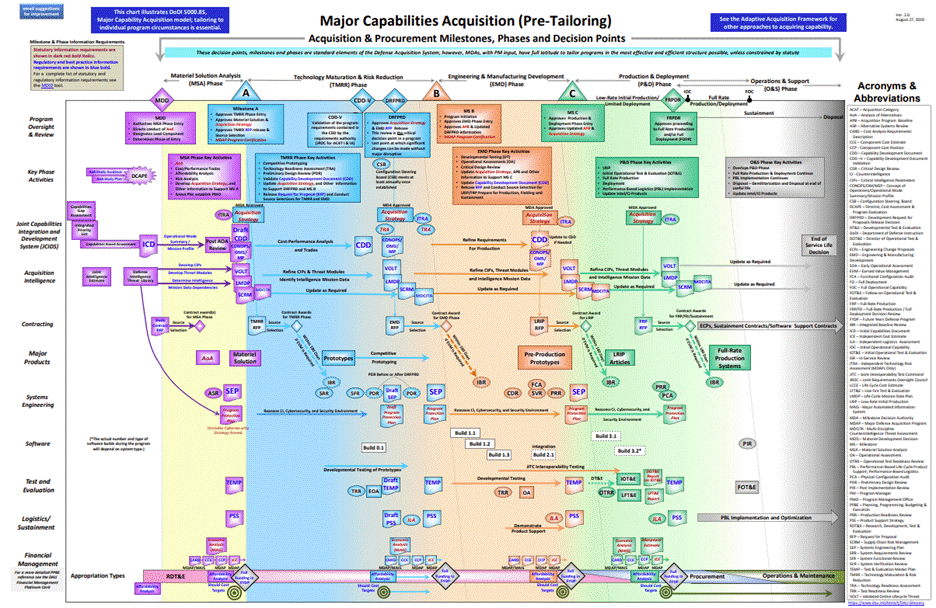

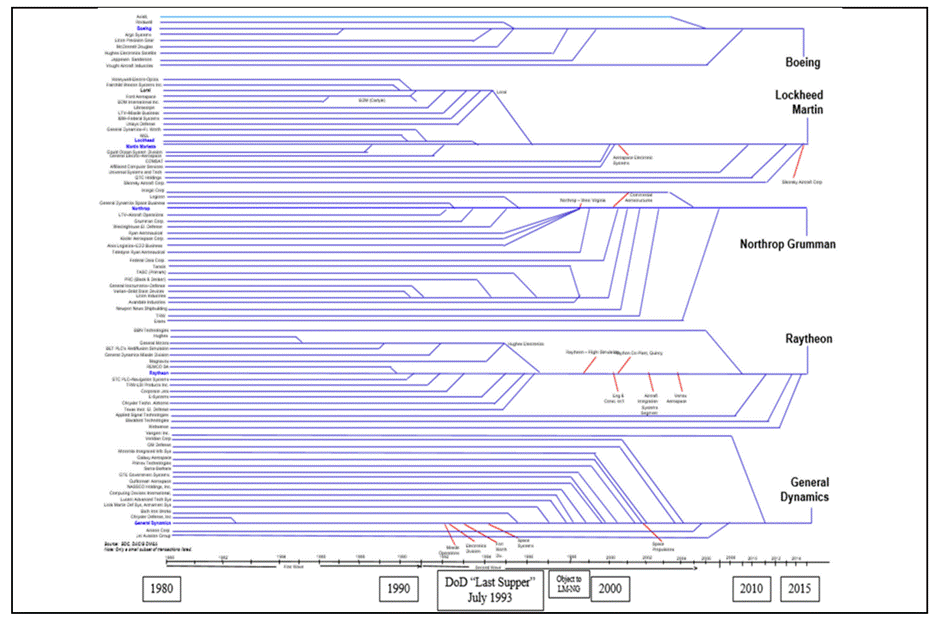

These trends reflect a meaningful shift in investor sentiment. For years, defense tech was perceived by VCs as the domain of legacy primes, not a realm where startups could thrive. Market dynamics such as complex procurement cycles and tangled implementation paths (see complex chart below) made the sector feel challenging for new entrants to navigate. But the tide is now changing.

Structural tailwinds are accelerating faster than ever before

Building on Bessemer’s long history of investing in frontier and dual-use technologies, my team and I released Bessemer’s Defense Tech Roadmap in early 2024. In it, we identified key “why now” trends — such as the emergence of defense innovation units and growing momentum around contracting reform — that we predicted would catalyze a startup-led growth cycle in an industry long resistant to change. In the year and a half since we first published this roadmap, tailwinds have only intensified. Here are some of the latest signals:

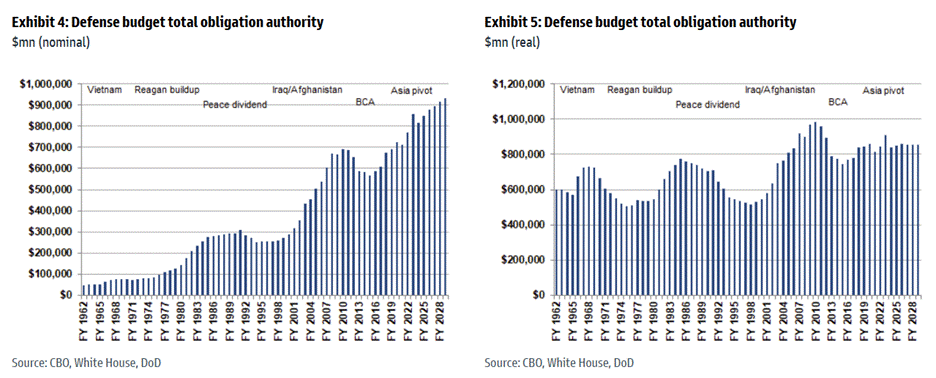

Sustained defense spending in domestic markets: Even in an era of DOGE, the U.S. defense budget remains strong, both in real and nominal terms (exhibit below), and is on track to hit a record $1 trillion following the passage of the “Big Beautiful Bill”.

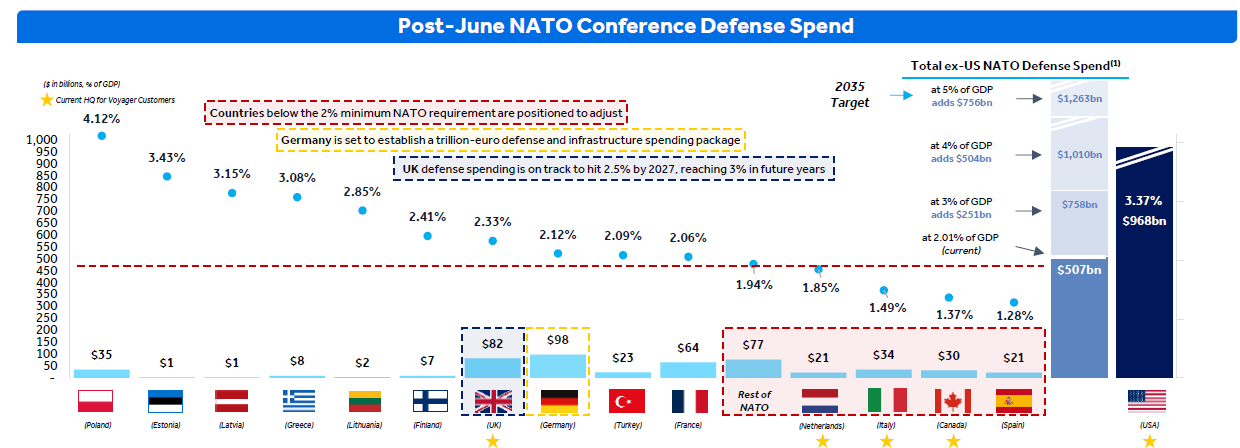

Market expansion is happening quickly: As highlighted earlier, geopolitical tensions have accelerated interest in defense innovation worldwide. Correspondingly, global defense spending is rising as countries allocate larger budgets toward defense, expanding addressable opportunities for defense tech startups:

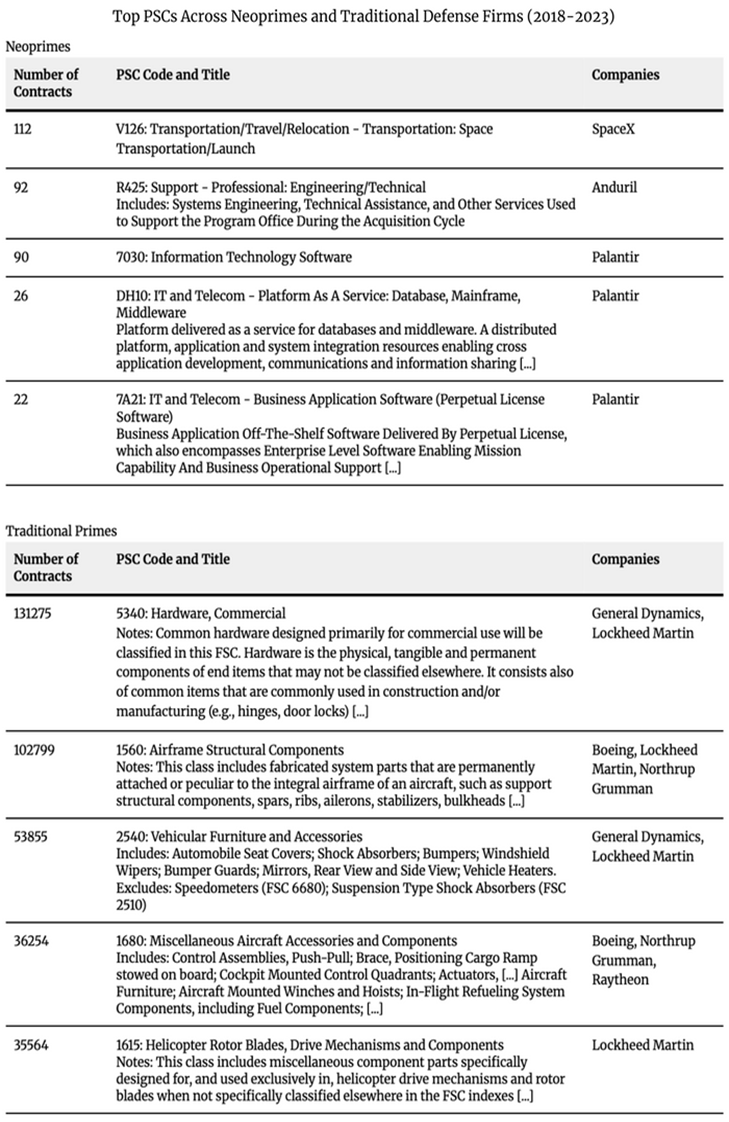

Critical technology priorities are evolving: There is growing recognition that the nature of warfare is rapidly changing, and advanced hardware alone is not enough. National security now depends on new forms of critical technological advantage across both hardware and software domains. Budgets are actively shifting to boost capabilities in these areas. As my friend Ernestine Fu from Brave Capital noted in her piece from last week, a new cohort of “Neoprimes” are emerging to fill critical technology gaps, especially in areas such as autonomy and AI, that have not been well-served by legacy primes:

Continued contracting and acquisition reform: As we noted in our roadmap, defense procurement has been gradually evolving and becoming more streamlined since 2015 with greater use of vehicles like Other Transaction Agreements. That trend has accelerated under the current administration. New initiatives, such as the FORGED Act and the Executive Order on Modernizing Defense Acquisitions, aim to further reform DoD contracting practices to prioritize speed and outcomes. This mindset shift is gaining traction across the defense ecosystem, with growing support from leaders across the community, and a rising number of successful startup engagements.

A new dawn for the defense industrial base

Since the “Last Supper” of the 1990s, the U.S. defense landscape has remained highly consolidated, with the number of major contractors shrinking from 51 to just 5 primes (visual below). This structure has shaped the sector for decades, but it may be about to change.

Today, I believe we are in the early innings of what could become the most dynamic and transformative period in the history of modern defense. Macro shifts, technological innovation, and structural reform, are converging to unlock a more innovative and resilient sector.

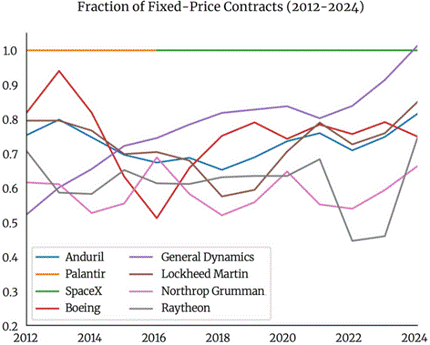

Defense tech innovators are not just entering the arena in “stealth mode”, they are taking flight by rewriting the rules. We’ve already witnessed how the “Neoprimes” are reshaping how the industry operates and competes through their impact on pricing norms (chart above). The way we build, buy, and deploy defense solutions is being rewritten in real time, and I expect startups to continue to play a defining role in this next chapter for the industry.