Product metrics that matter the most: A flywheel framework for cloud business leaders

Product metrics can be “leading” indicators for “lagging” financial outcomes. Which product metrics matter the most to your cloud business & how do these act as a barometer for financial performance?

As a former product manager and venture investor now, I like to look at product metrics to supplement financial data and reveal insights about a company’s potential. This is especially so for earlier-stage start-ups that may not necessarily have a lot of financial traction yet and rely primarily on product “north stars” as a guide for commercialization outlook. I’ve written previously about how product metrics don’t just matter to product or engineering teams, but are also key to business teams since product metrics hold immense power as “leading” indicators for “lagging” financial outcomes. Just last month, I also spoke to Mixpanel about “The product data VCs want to see before investing in your startup”.

Measuring product reliability using performance metrics such as bug counts and load times are table stakes, but there are also innumerable product metrics that can be tracked to shed light on different aspects of a cloud business. Unlike financial metrics which follow GAAP or IFRS, no universal reporting standard exists to provide formal guidance on which product metrics business stakeholders should pay close attention to. It makes sense not to be prescriptive since heuristics and benchmarks are very much context dependent on factors such as the type of company and nature of the product. For instance, the product metrics that are most important to a social networking consumer app might be different from an enterprise data infrastructure company. In the same vein, the best-in-class product metric standards for a daily-use B2B email productivity tool will look different from those of a more seasonal B2B marketing campaign platform or sales forecasting solution.

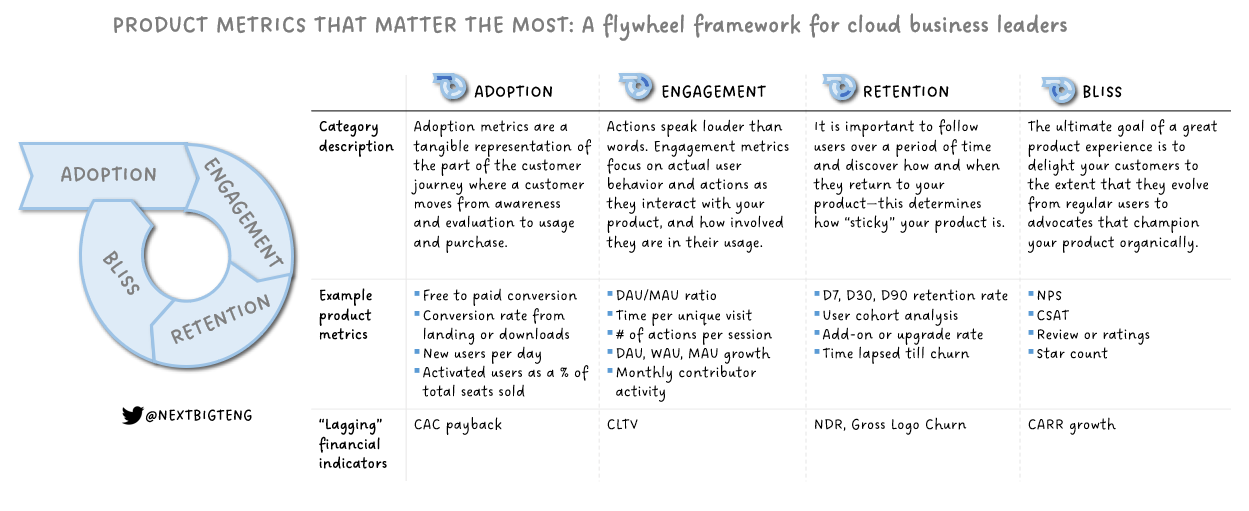

Because there is no one-size-fits-all approach, it is often more helpful to consider product metric categories that are most important to set KPIs against. Here are the long-form notes from my Mixpanel feature on a product metric flywheel framework to contextualize the product metrics that matter the most to a cloud business and how these link to financial outcomes (such as the 6Cs of Cloud Finance):

I. ADOPTION

Adoption metrics are a tangible representation of the part of the customer journey where a customer moves from awareness and evaluation to usage and purchase. Examples in this category include:

Free to paid conversion rate

Conversion rate from landing or downloads

New users per day

Activated users as a percentage of total seats sold

These metrics are a leading indicator of whether your customer acquisition engine is running efficiently and how effectively customer acquisition cost (CAC) dollars are being spent. This ultimately shows up in CAC payback.

For product-led growth companies, such metrics reveal signs of whether your self-serve motion is working and can allow you to take action around rationalizing channels or ideal customer profiles with highest adoption success. For companies focused on a top-down or sales-led distribution model, tracking activated seats in relation to total seats sold can reveal information around whether your initial value proposition is resonating with customers’ employees or signaling that an account might need more help with onboarding and implementation.

II. ENGAGEMENT

Engagement metrics focus on user behavior and actions as they interact with your product, and how involved they are in their usage. Examples include:

DAU/MAU ratio

Time spent per unique session or visit

Number of actions per session

DAU, WAU, MAU growth

Monthly contributor activity

More engaged users tend to be correlated with strong product-market fit. This is subsequently linked to higher customer lifetime value (CLTV) as customers derive tangible ROI from engaging with your product over time. As highlighted previously, it is important to choose and benchmark an engagement metric wisely depending on the nature of your product and intended usage. Engagement is particularly important for product-led growth companies, since highly engaged users can be leveraged as powerful customer champions to fuel bottoms-up acquisition and expansion momentum.

III. RETENTION

Retention follows users over a period of time and looks at how and when users return to your product. This determines how “sticky” your product is. Examples in this category include:

D7, D30, D90 retention rate

User cohort analysis

Add-on or upgrade rate

Time lapsed till churn

Here, it is key to properly define the event and period of churn that best fits your business since this differs from organization to organization. Across all types of companies, user retention is directly linked to “lagging” financial performance indicators such as net dollar retention (NDR) or gross logo churn. The power of this category of metrics is that action can be taken to improve “lagging” indicators before it is too late. For instance, when poor user retention is observed, it is imperative that such signals are flagged to customer success teams to save these “at-risk” accounts before any account cancellations, non-renewals, or logo loss happens.

IV. BLISS

The ultimate goal of a great product experience is to delight your customers to the extent that they evolve from regular users to advocates that will champion your product organically. This level of user excitement goes beyond being content with your product into sheer bliss. At bliss point, users will not just pound the table if your product was removed, they are also effusively recommending your product to others. Examples of metrics in this category include:

Net Promoter Score

Customer Satisfaction Score

Review or ratings

Star count

This product bliss metric is specific to the product offering and is separate from other aspects of the customer experience journey such as customer service. These bliss metrics may not be easily observable in user behavior data and commonly involve distinct input from your users. Some simple ways companies collect such product-centric commentary include feedback channels placed within an application or survey pop-ups following certain user click paths.

For bottoms-up companies in particular, a high product bliss score often signals more delighted users promoting your product through word-of-mouth, thus completing a flywheel of network effects and viral adoption.

Leverage product metrics as a dynamic barometer for business outcomes

Product metric categories are dynamic and interact closely with each other in a flywheel rather than a linear value chain — more engaged users lead to higher retention, and happier users promote the products they love leading to more adoption! Most importantly, product metrics can be powerful forward-looking drivers to guide operational decision-making and improve businesses performance. So don’t forget to leverage these “leading” indicators to impact future “lagging” financial outcomes before it is too late.

What are your favorite product metrics to track and why are they a good fit for your business? Drop me a DM on Twitter at @NextBigTeng to discuss!