The Cloud 100 2021 Benchmarks Report

Bessemer reveals six years of insights and trends on the top 100 private cloud companies.

Originally published in Bessemer’s Atlas. Co-authored by Mary D’Onofrio and Janelle Teng.

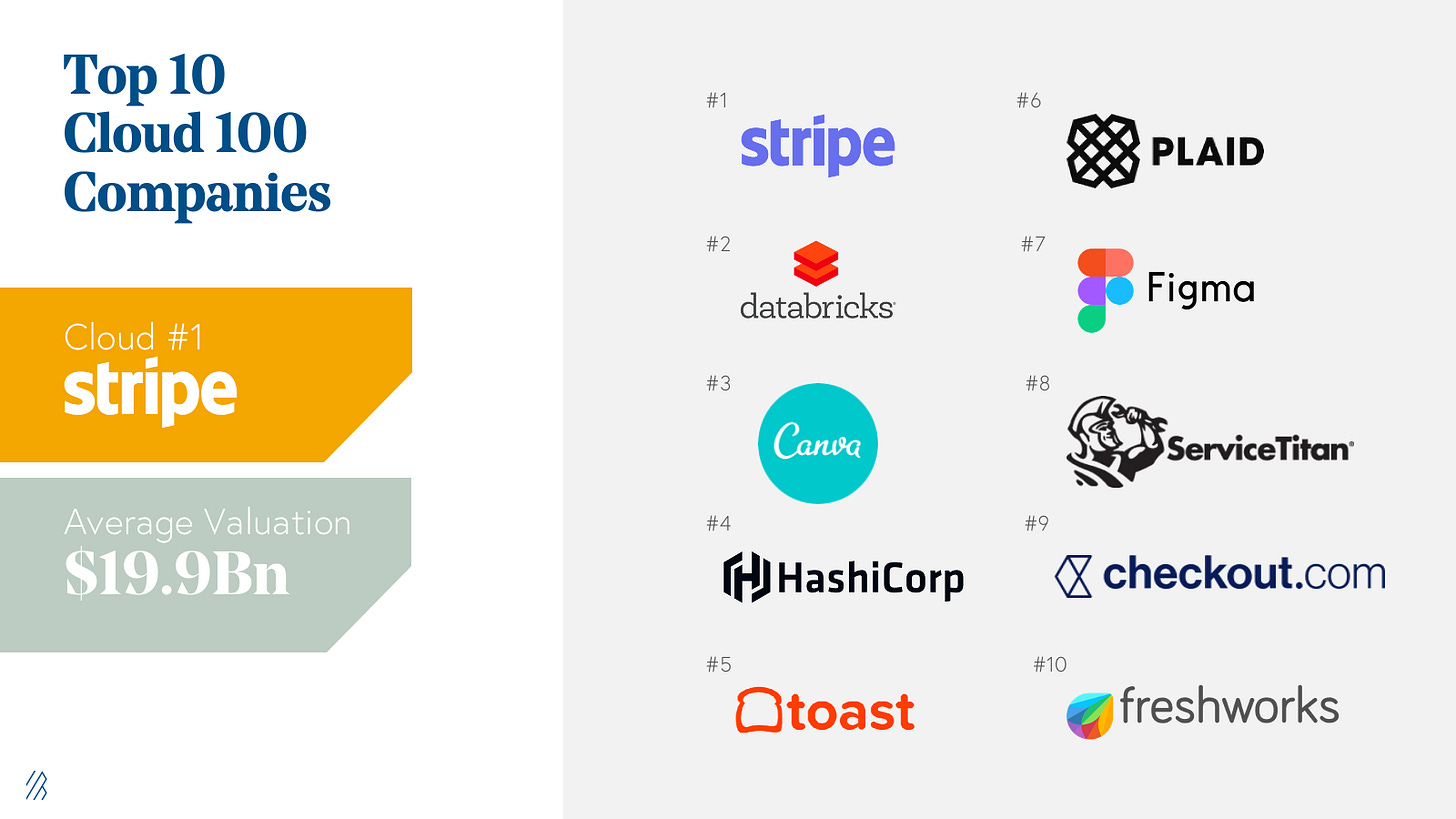

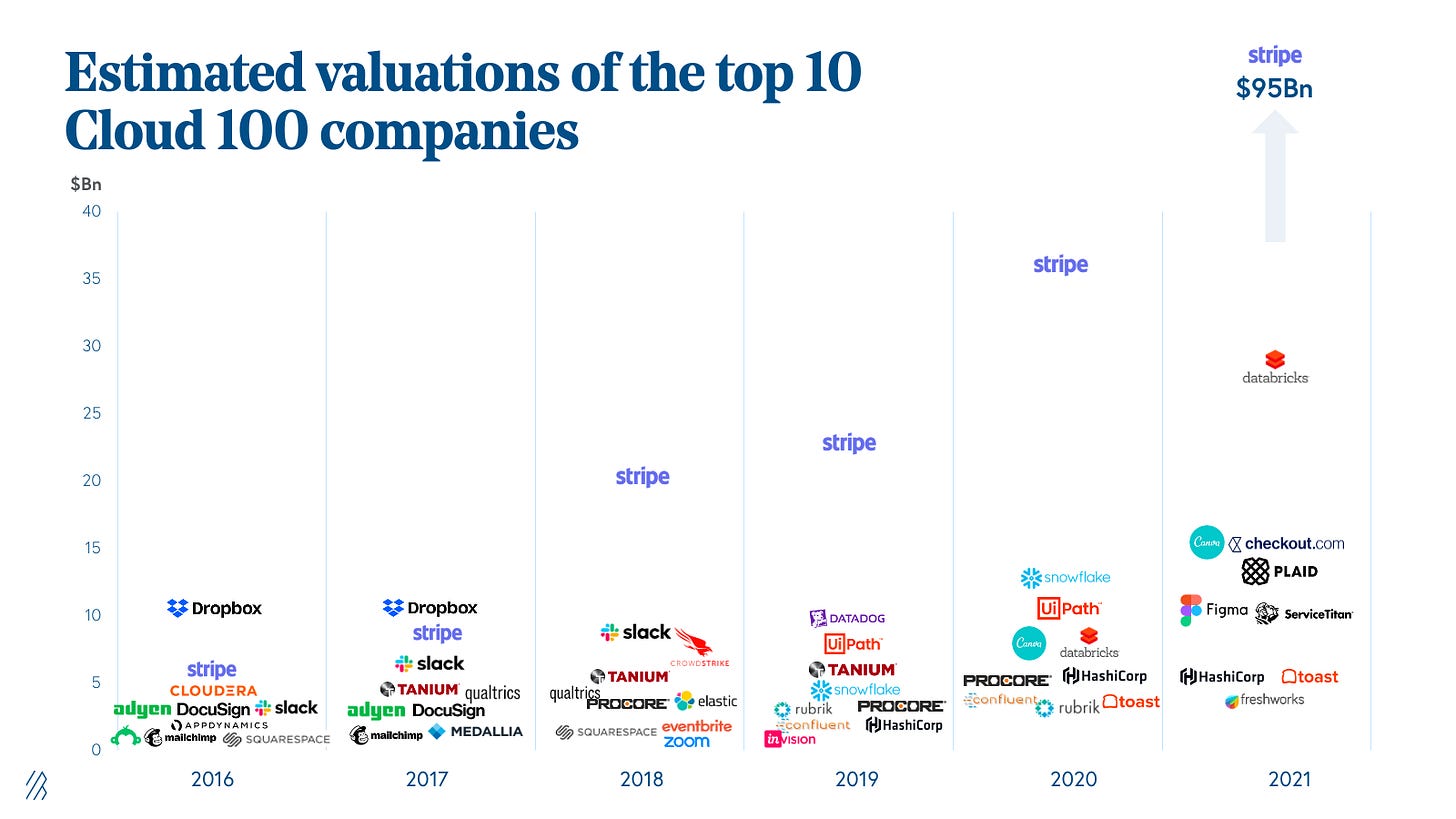

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the 2021 Cloud 100 List, the definitive ranking of the top 100 private cloud companies. And — keeping consistent with previous years’ trends — the 2021 list was even stronger than the last. This year features bigger companies, higher valuations, and more market tailwinds than ever before — so much so, in fact, that the estimated valuation required to make the list was over $1 billion*. That’s right. The bar for this year’s list was so high that each honoree achieved the unicorn milestone. Between Stripe at $95 billion, Databricks at $28 billion, and Checkout at $15 billion, to get on the 2021 Cloud 100 list was a fight among giants. These honorees truly represent the best cloud companies globally.

With six years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2021 Cloud 100 cohort and what it tells us about the state of the private cloud market today.

Top highlights:

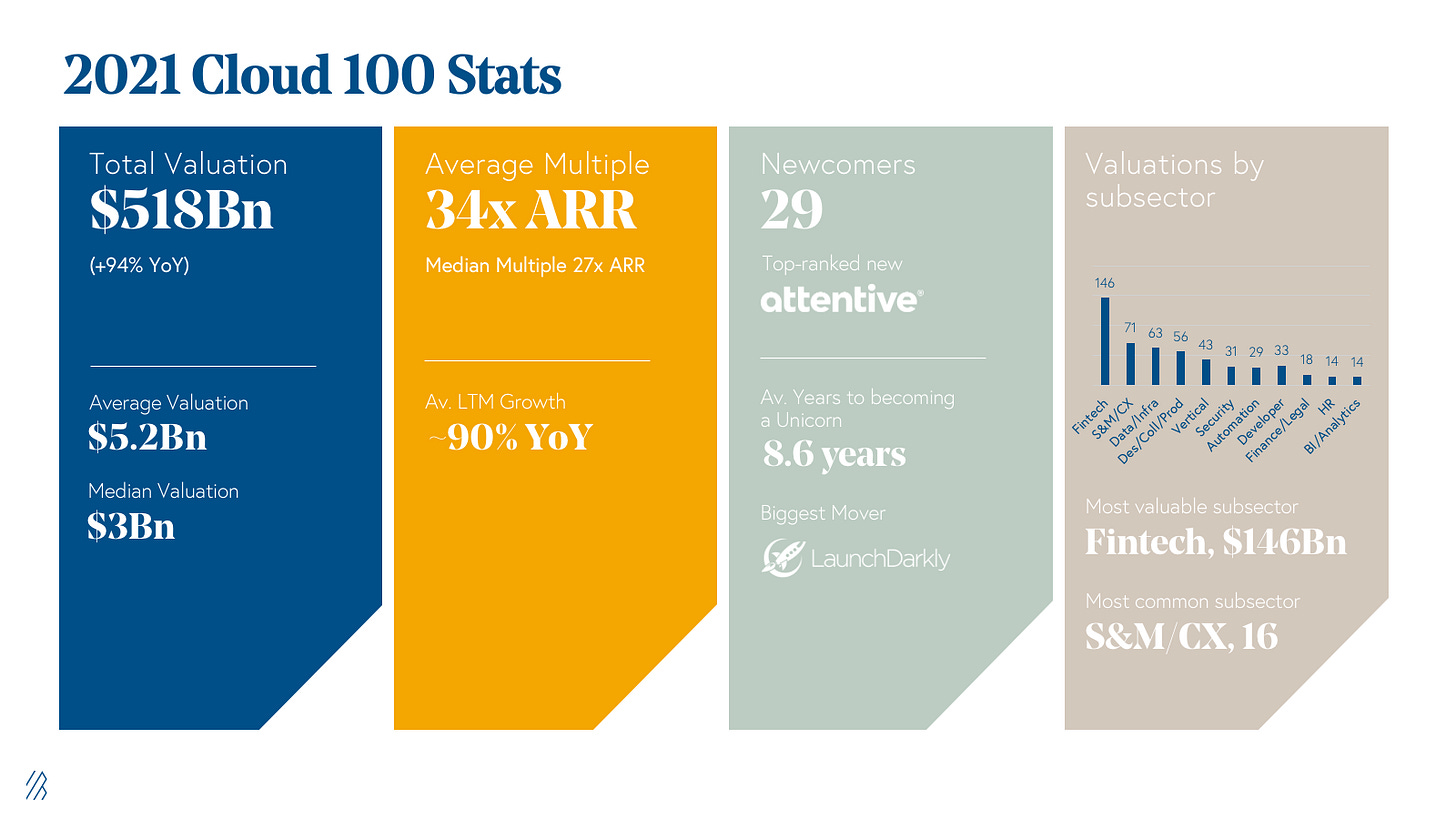

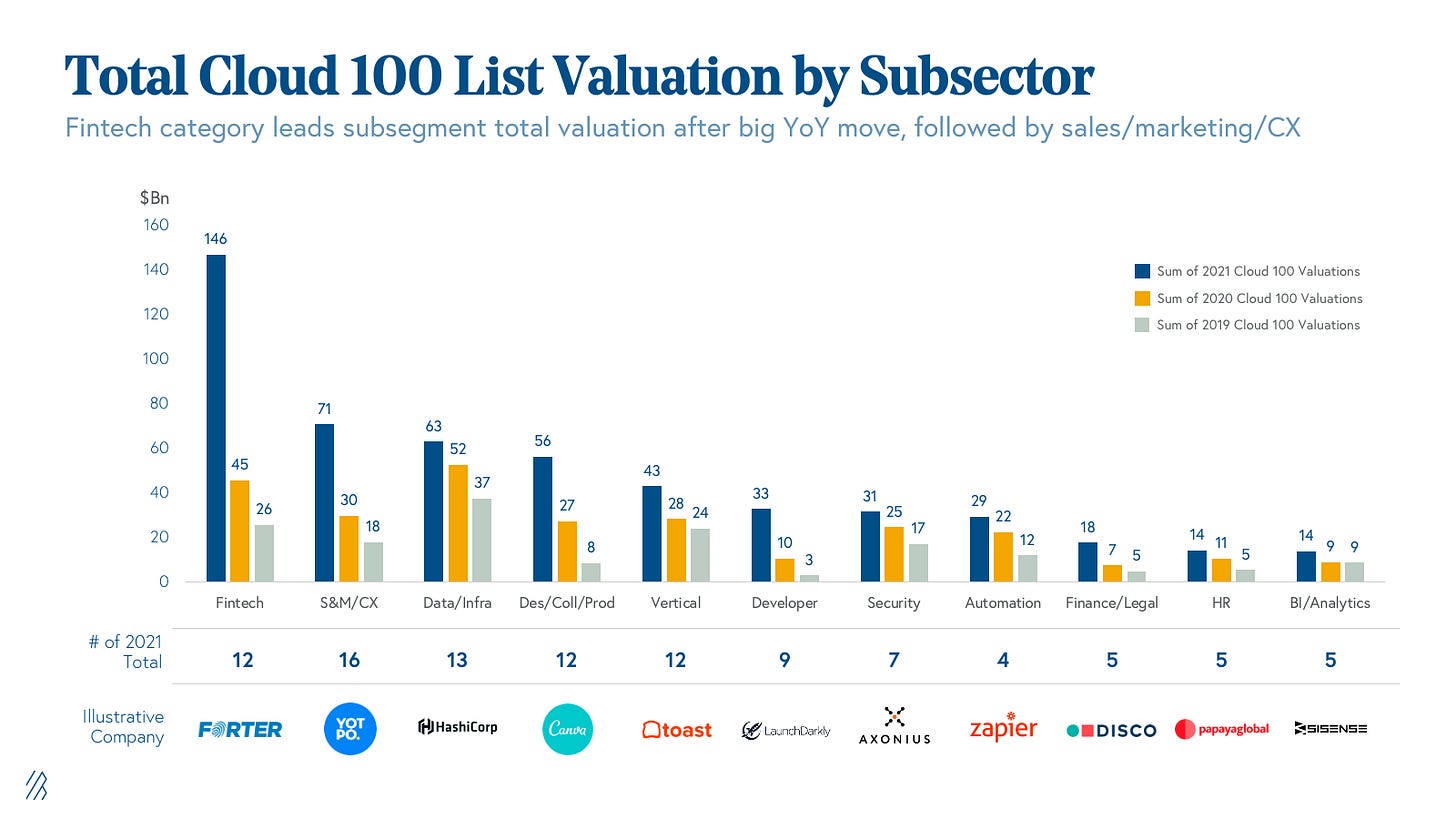

Private cloud valuations continue to get bigger. The Cloud 100 2021 is worth an aggregate of $518 billion in 2021 vs. $267 billion in 2020, which is a 94% increase year-over-year (YoY). The top 10 Cloud 100 companies alone contribute $200 billion of equity value (38% of list value), and fintech represents the highest value subsector at $146 billion (28% of list value).

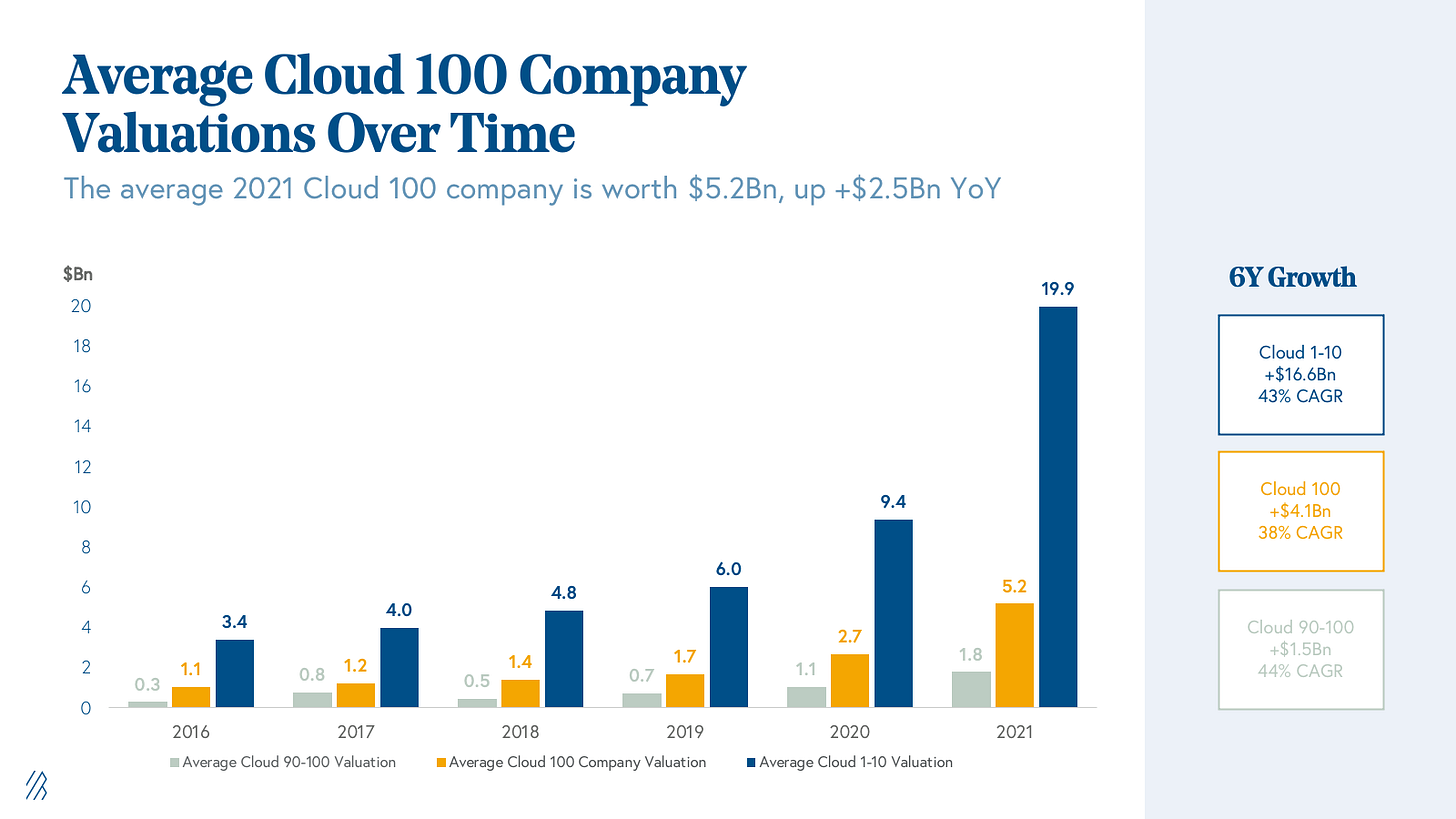

The threshold to make the Cloud 100 continues to get higher: this year, every company on the list has at least hit the unicorn milestone. In addition, the average cloud company valuation was $5.2 billion, an increase of $2.5 billion YoY.

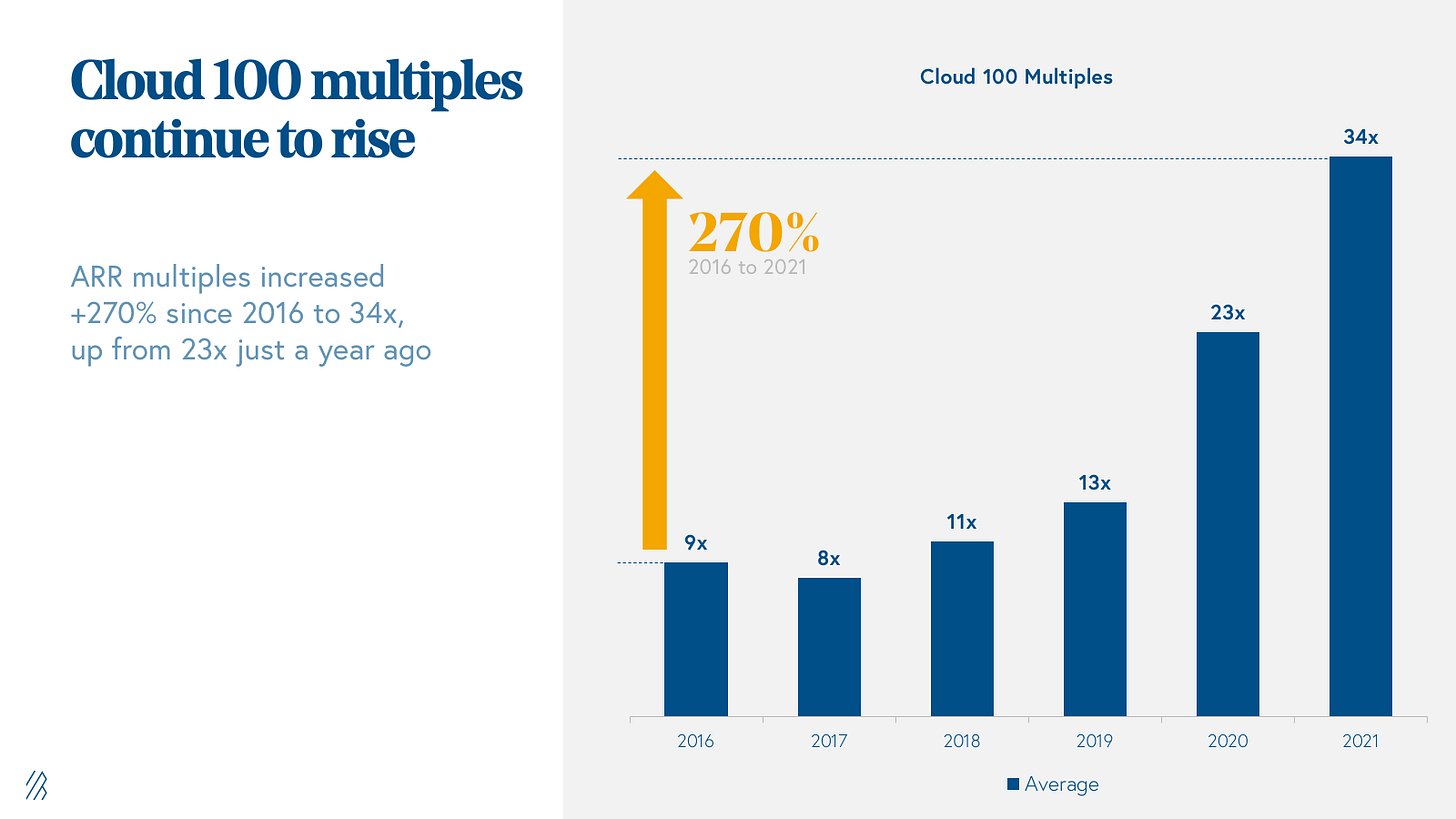

The growth in valuations comes from both increased growth rates for Cloud 100 businesses and higher multiples being paid. The average Cloud 100 valuation multiple increased by approximately 270% in the last six years, from 9x ARR in 2016 to 34x in 2021, while the average Cloud 100 company revenue growth rate increased to 90% YoY.

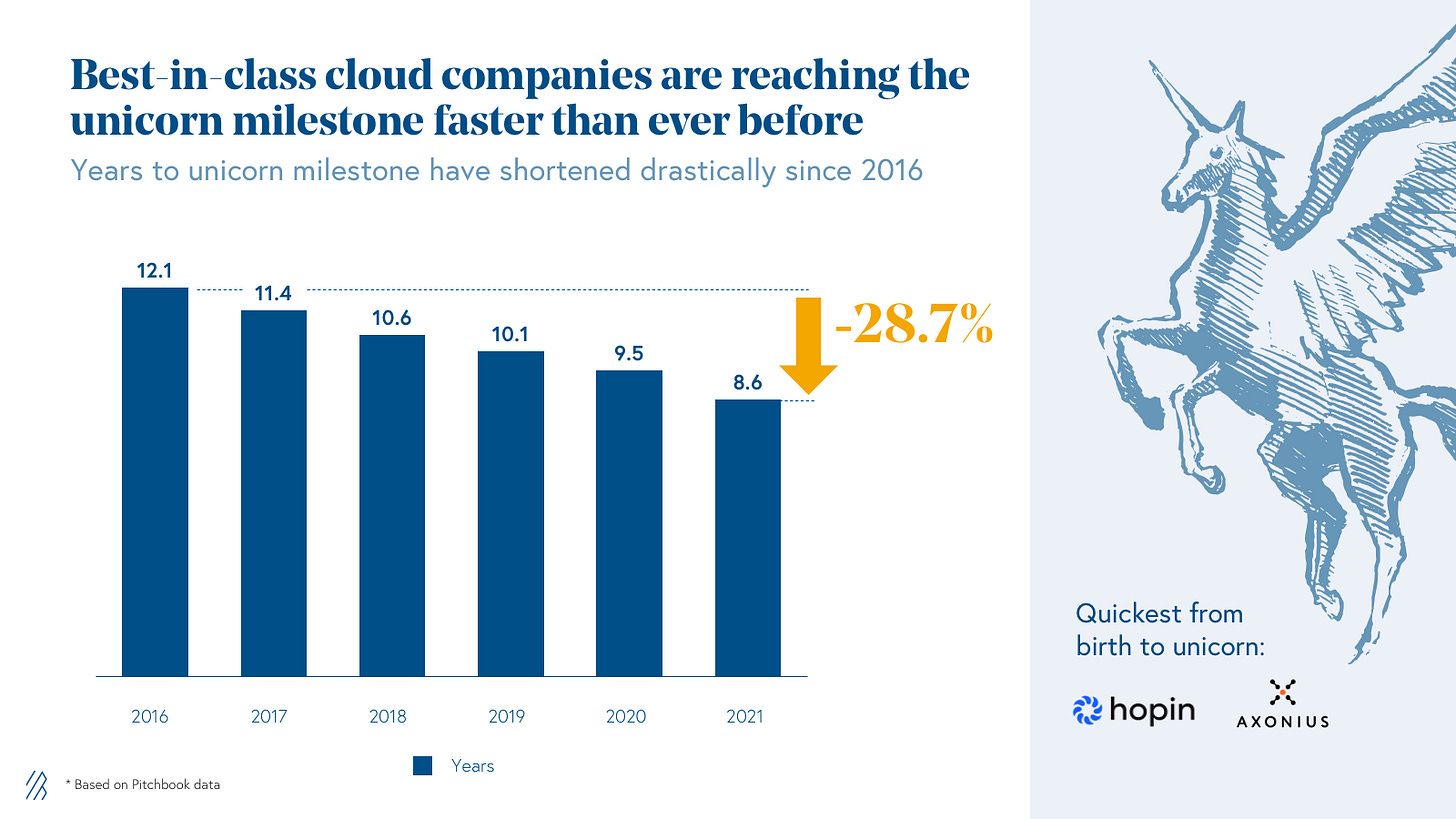

Cloud 100 companies are reaching the unicorn milestone faster than ever before. When we look at the 2021 basket, it took the average Cloud 100 honoree 8.6 years from founding to grow into a unicorn, as compared to 12.1 years in 2016. Cumulatively, the Cloud 100 2021 basket has raised more than $50 billion over its lifetime.

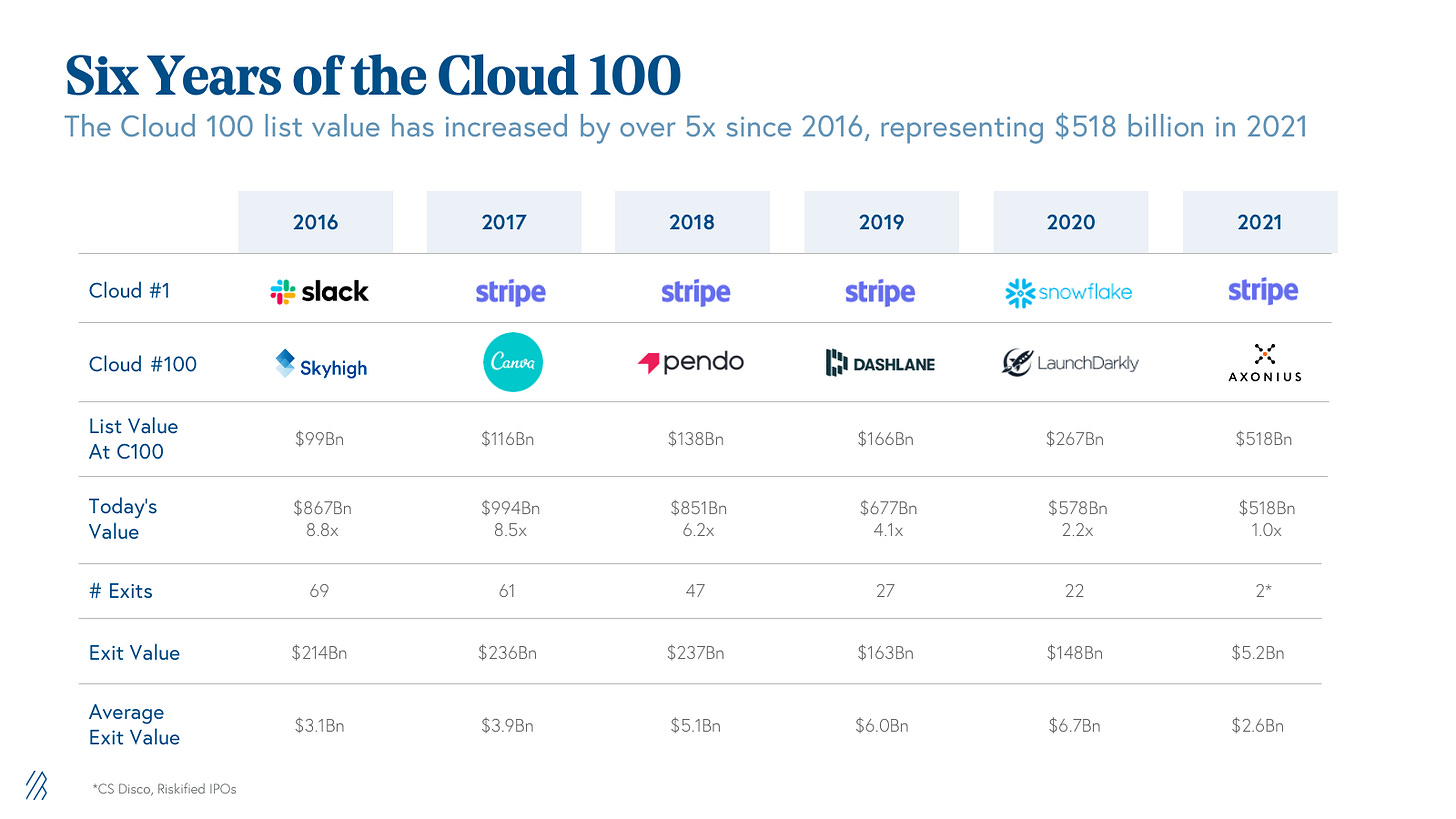

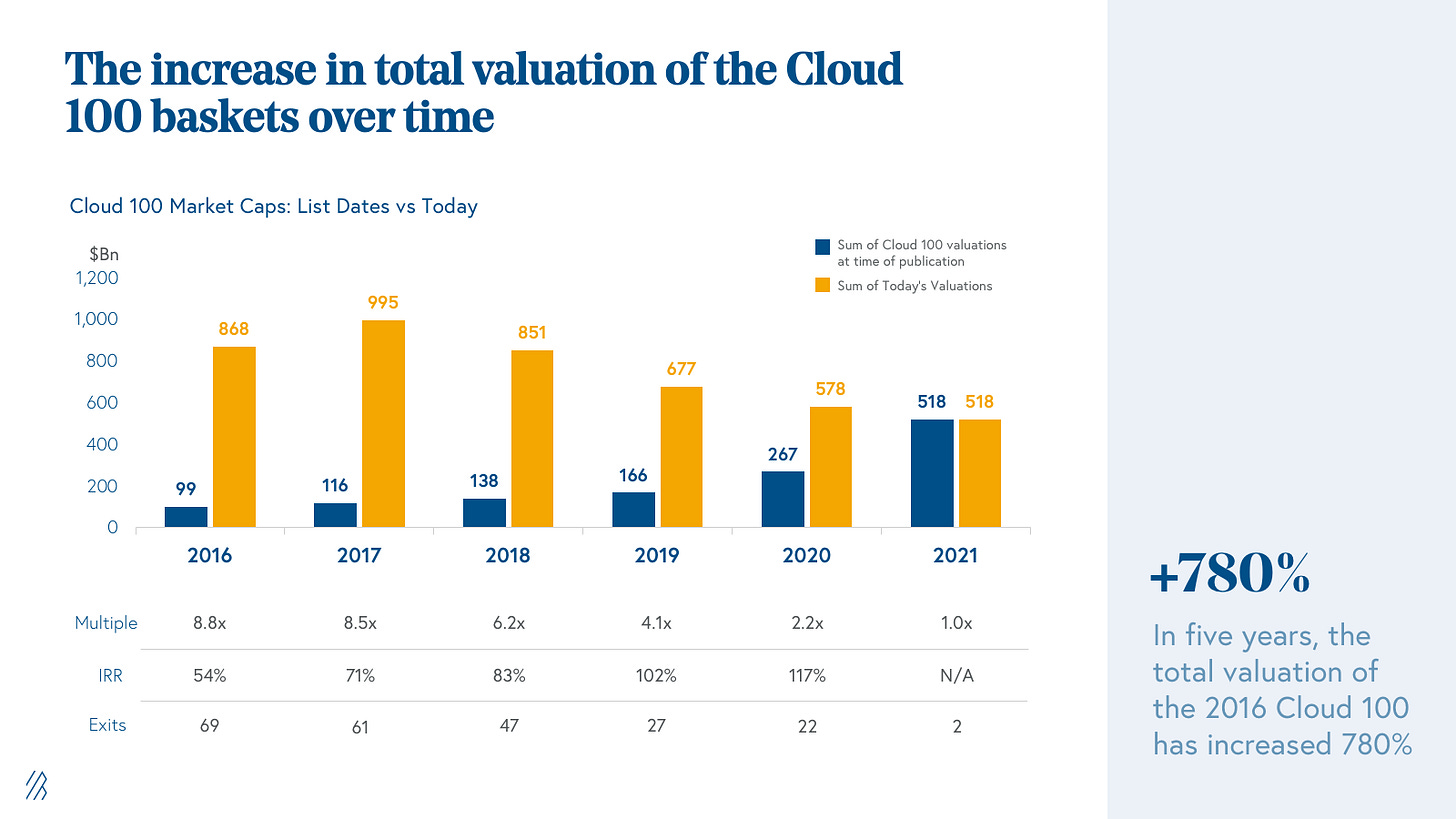

The Cloud 100 list continues to produce strong returns. In five years, the total valuation of the 2016 Cloud 100 list has increased by more than 780%, delivering an 8.8x and 54% IRR in that time. The 2017 Cloud 100 basket has delivered an 8.5x and 71% IRR as its aggregate value nears $1 trillion; the 2018 basket a 6.2x and 83% IRR; the 2019 basket a 4.1x and 102% IRR; and the 2020 basket a 2.2x and 117% IRR in just one year alone.

Let’s dig in!

The Cloud 100 2021 at a glance: $518 billion of equity value

The 2021 Cloud 100 list represents an astonishing $518 billion of equity value, with an average $5.2 billion valuation per company. The cumulative value of the Cloud 100 list is up a staggering +94% from the 2020 list’s aggregate value of $267 billion, in just one year.

The Top 10 Cloud Companies represent almost $200 billion of equity value alone. Stripe, which was unseated by Snowflake in 2020, secured its number one spot once again and is the top-ranked cloud company, valued at $95 billion. Joining Stripe on the top ten list includes Databricks (#2), Canva (#3), HashiCorp (#4), Toast (#5), Plaid (#6), Figma (#7), ServiceTitan (#8), Checkout.com (#9), and Freshworks (#10). Representing $200 billion of equity value as a group, these companies individually average a valuation of almost $20 billion, $10.5 billion more than in 2020 and an incredible $16.6 billion more than in the 2016 iteration of the Cloud 100. Some notable financings in this group include ServiceTitan’s $500 million round in March 2021, which put its valuation at $8.3 billion and Canva’s April 2021 round at $15 billion.

Fintech surpassed data infrastructure as the most valuable Cloud 100 category, though sales, marketing, and customer success software continues to have the plurality of companies on the list. With 16 companies, the Sales/Marketing/CX category was the largest category represented on the 2021 Cloud 100 list by company count, including such notable names as Attentive, Yotpo, and Intercom, and it was the second most valuable subsector with $71 billion of value. However, the data changes when looking at aggregate valuation by subsector. With only 12 fintech companies on the list, this subsector holds 28% of the list’s equity value at $146 billion and is the highest valued subsector, anchored by Stripe (18% of the list’s value alone).

There were 29 newcomers to this year’s Cloud 100 list. The highest-ranked new entrant was Attentive, appearing on the list as #12. Other newcomers include Loom and Calendly alongside Bessemer portfolio companies Forter, the leader in fraud prevention software, and PapayaGlobal, an international payroll solution. The biggest mover title goes to world’s leading feature management platform, LaunchDarkly, which announced its Series D today at over a $3 billion valuation.

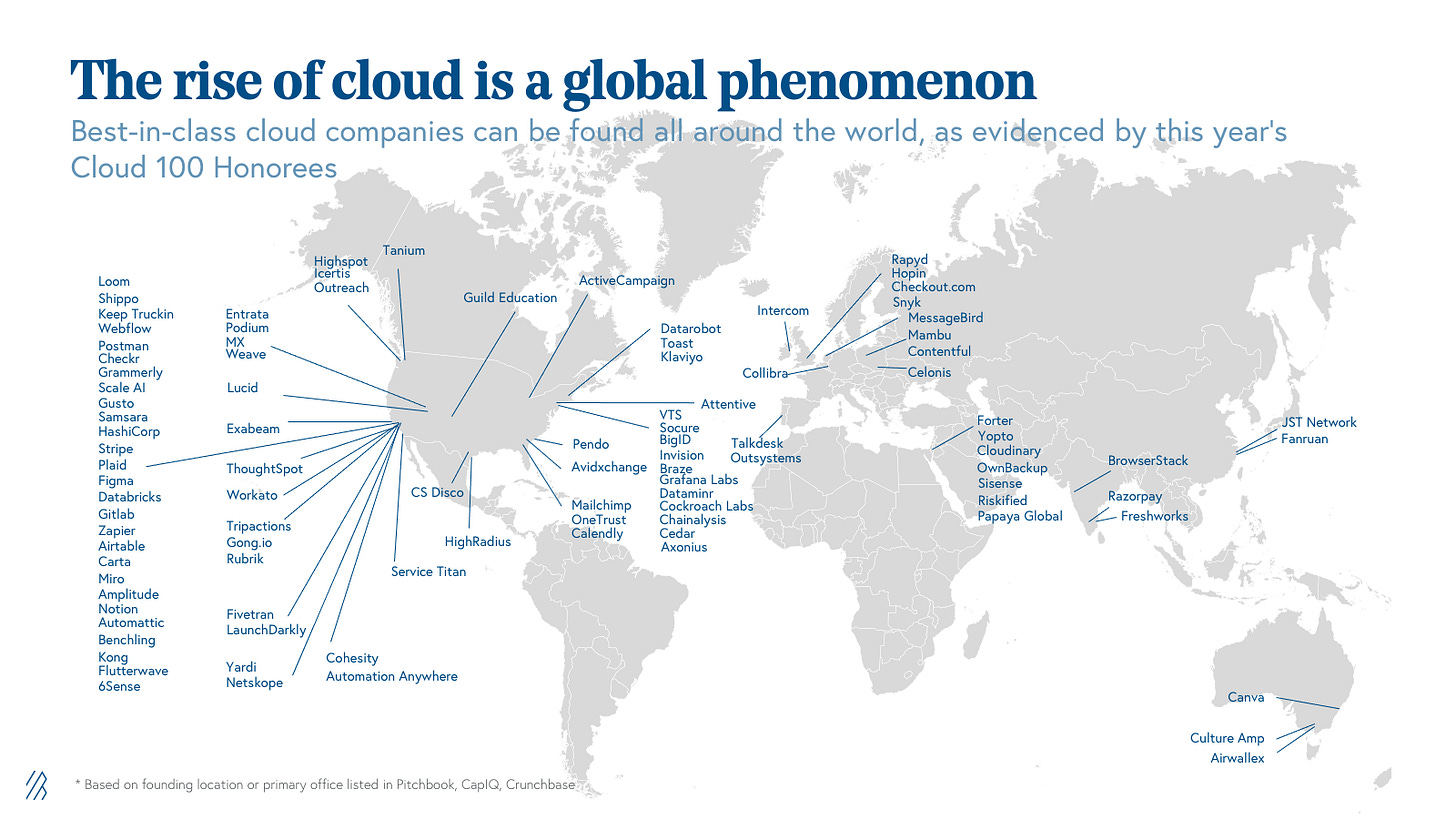

The globalization of cloud continues. As entrepreneurs, operators, and investors all around the world increasingly recognize the power of the cloud, we’re seeing cloud startups bloom in technology hubs globally. The Cloud serves as the backbone for emerging tech communities across the globe as startup teams have more flexibility and agency than ever before. In the Work from Anywhere movement, we’ve found that remote-first and distributed cloud teams across North and South America, EMEA, and APAC experienced more efficiency, increased scalability, and higher access to diverse pools of talent from all around the world. International representation on the Cloud 100 list reached almost 30% this year, and we expect this trend to continue for many more years to come, making the Cloud 100 more and more geographically diverse. We believe entrepreneurship is borderless, and we’re excited to continue to back cloud entrepreneurs around the world, from Canva in Australia to Mambu in Germany!

Cloud 100 new norms: 34x+ ARR multiples and +90% YoY growth

As we discussed above, the Cloud 100 2021 list is worth an aggregate of $518 billion, an impressive +94% YoY growth over the $267 billion value of the 2020 list, increasing the average Cloud 100 winner’s valuation up a massive $2.5 billion YoY ($1.6 billion if you remove Stripe). Combining all years of the Cloud 100, the growth is even more phenomenal. In six years, the average Cloud 100 valuation has grown by $4.1 billion and a +38% CAGR, from $1.1 billion in 2016 to $5.2 billion today.

As investors in cloud companies and as students of the market today, we find these statistics incredible; they are a credit to the tailwinds behind cloud adoption combined with investors’ understanding of the superiority of the cloud business model broadly. And as we explored in the State of the Cloud 2021, we can attribute much of the growth in valuations to the combination of cloud company revenue growth and the multiples on that revenue expanding.

Across all the companies for which pricing data was disclosed, the 2021 Cloud 100 honorees commanded an average 34x ARR multiple in the most recent round of financing. This average Cloud 100 multiple has increased approximately 270% in the last six years from 9x ARR in 2016. The markets don’t look to be cooling off any time soon, with the average ARR multiple growing 47% in just a year, up from 23x in 2020.

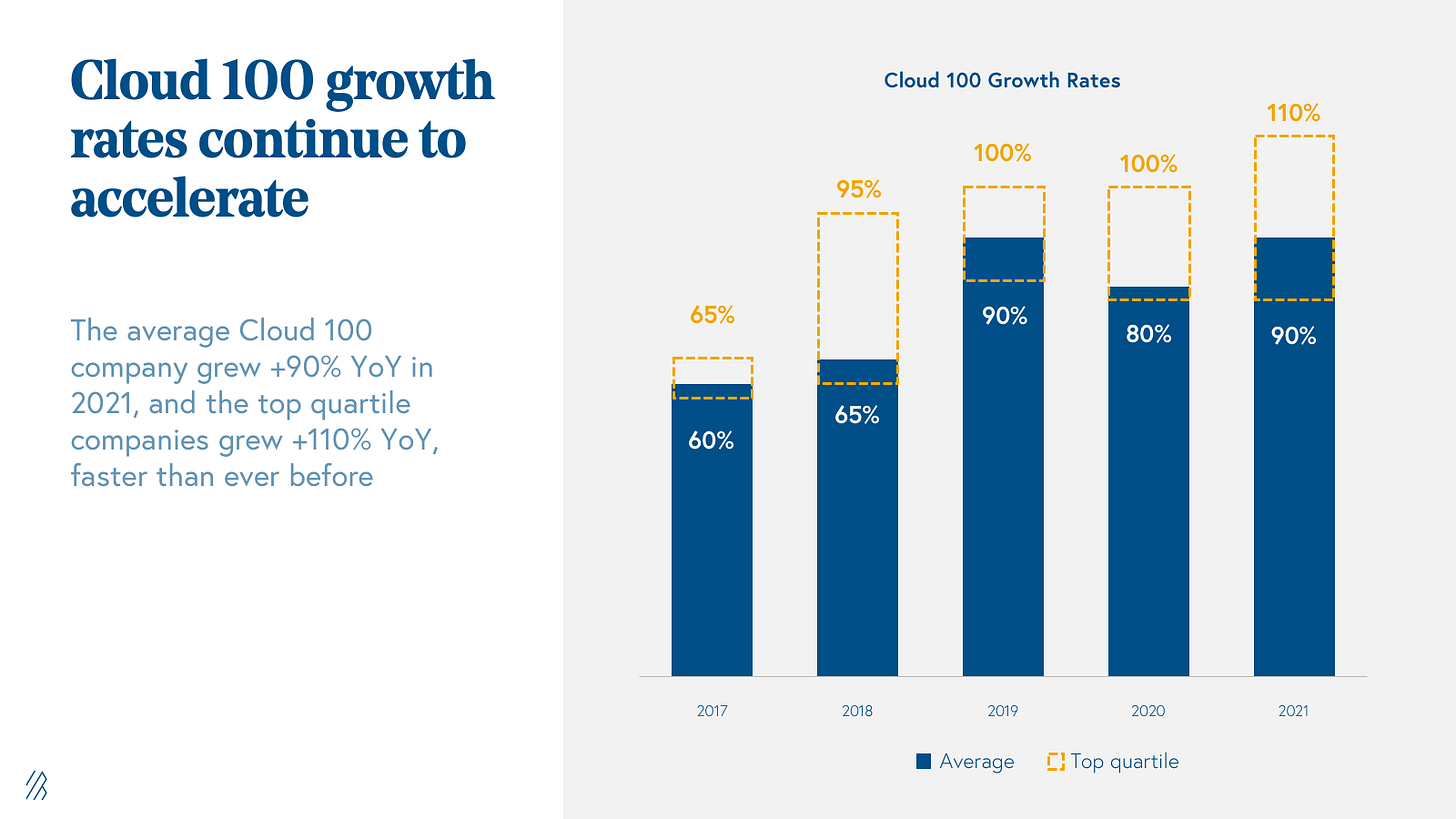

The average Cloud 100 growth rate also continues to accelerate, and top quartile companies are growing faster than ever before. Average growth rate increased from 60% in 2017 to 90% in 2019 given tailwinds for cloud adoption, though it dipped to 80% in 2020, which we largely attributed to COVID headwinds in certain industries. Today, average Cloud 100 growth rates have recovered and are back at 90% as more companies recognize the importance of moving to the cloud during the new normal.

It is also important to note that the top quartile cloud companies continue to pull away from the pack. Since 2017, the growth rates of the top quartile private cloud companies have increased 70%, from 65% in 2017 to 110% in 2021, including a 10% acceleration in the past year alone. We note that many of the fastest-growing companies have been beneficiaries of COVID tailwinds and include companies that facilitate distributed work and collaboration.

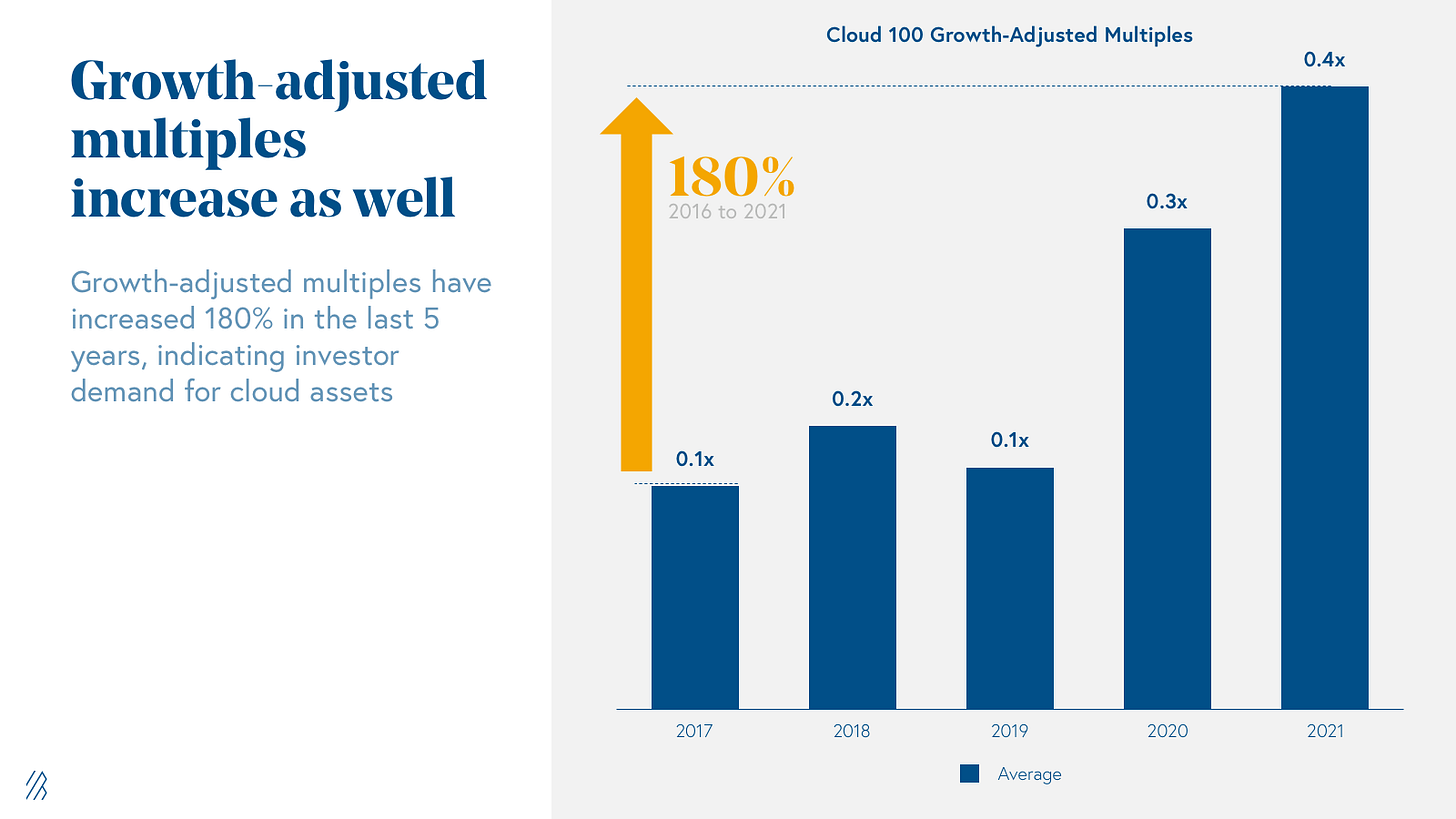

Cloud 100 data, however, points to the fact that in the private markets, multiples are expanding even on a growth-adjusted basis. From 2017 to 2021, the average growth-adjusted multiple for Cloud 100 companies increased by 180%, meaning that investors are willing to pay higher prices for the same growth rates; they are not both increasing in lock-step. We believe that this dynamic stems from high investor appetite for strong cloud businesses and the willingness to pay premium valuations for access to these special companies.

For founders, the takeaway is that building a cloud business today is as valuable as it has ever been before. The combination of unprecedented growth rates and increased investor demand have led to a proliferation of Cloud 100 unicorns.

This can be observed in the data. Best-in-class cloud companies are reaching the unicorn milestone faster than ever before. When we look at the 2021 basket, it took the average Cloud 100 Honoree 8.6 years from founding to become a unicorn, as compared to 12.1 years in 2016. The two companies that were fastest to achieve the unicorn milestone on this year’s list were Hopin and Axonius, which have both experienced explosive growth at record-breaking speed. Founded in 2019, Hopin reached unicorn status by the end of 2020, propelled by unprecedented demand for its event technology platform. Axonious was not far behind — founded in 2017 with Bessemer leading its Series A in 2019, the cybersecurity leader entered the unicorn herd in early 2021.

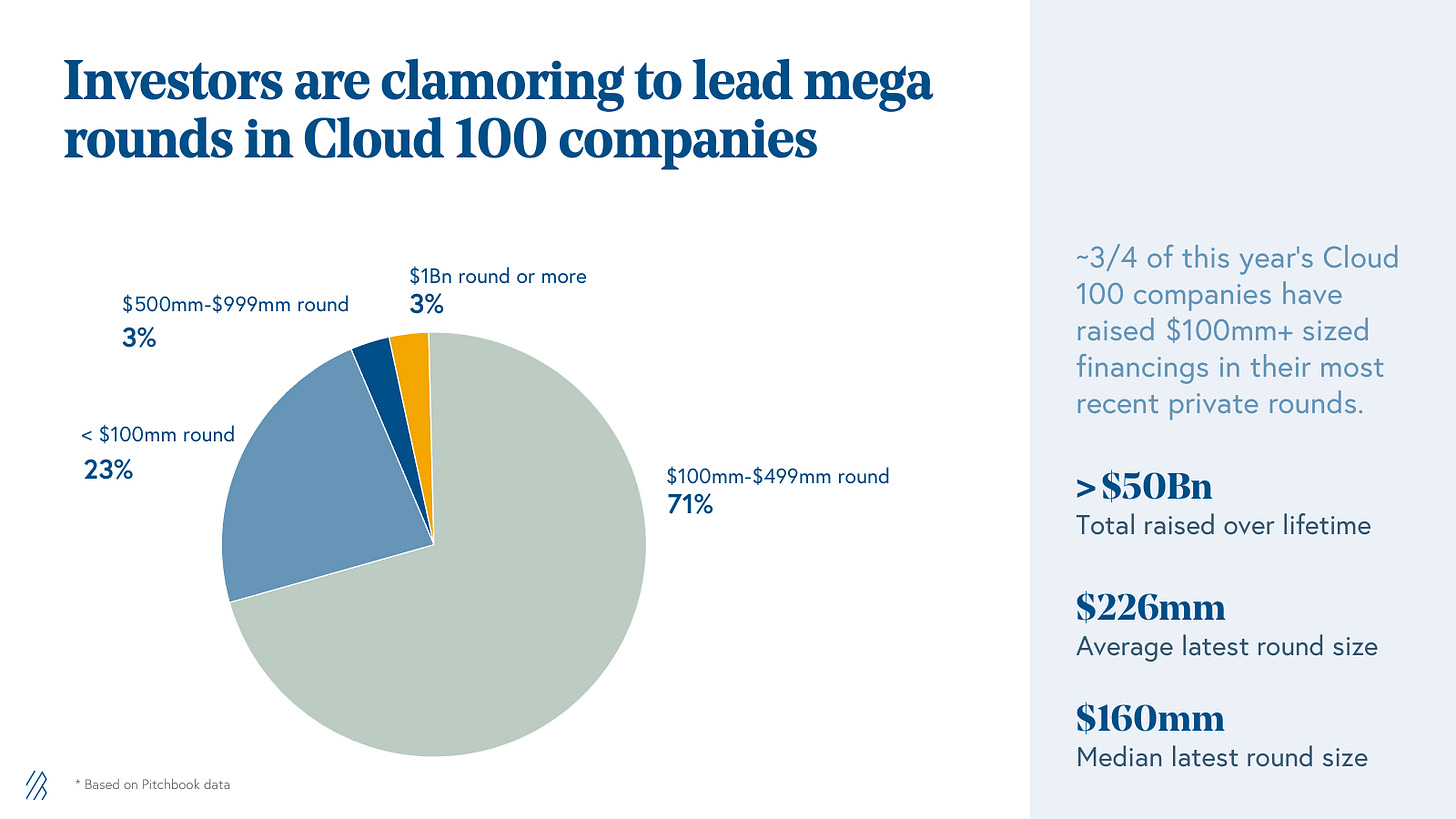

Investor excitement for strong cloud businesses has led to the growth in mega-rounds in Cloud 100 companies. Three-quarters of this year’s Cloud 100 companies have raised $100 million or more in their most recent financing rounds, with the average latest round size of a Cloud 100 company exceeding $225 million. Cumulatively, the Cloud 100 2021 basket has raised more than $50 billion over its lifetime!

Cloud 100 returns: +780% increase in valuation since 2016

The Cloud 100 is the definitive list of the world’s best cloud companies, and that legacy bears out in the returns it produces. In five years, the total valuation of the 2016 Cloud 100 list has increased by more than 780%, delivering an 8.8x and 54% IRR in that time. The 2017 Cloud 100 basket has delivered an 8.5x and 71% IRR as its aggregate value nears $1 trillion; the 2018 basket a 6.2x and 83% IRR; the 2019 basket a 4.1x and 102% IRR; and the 2020 basket a 2.2x and 117% IRR in just one year alone.

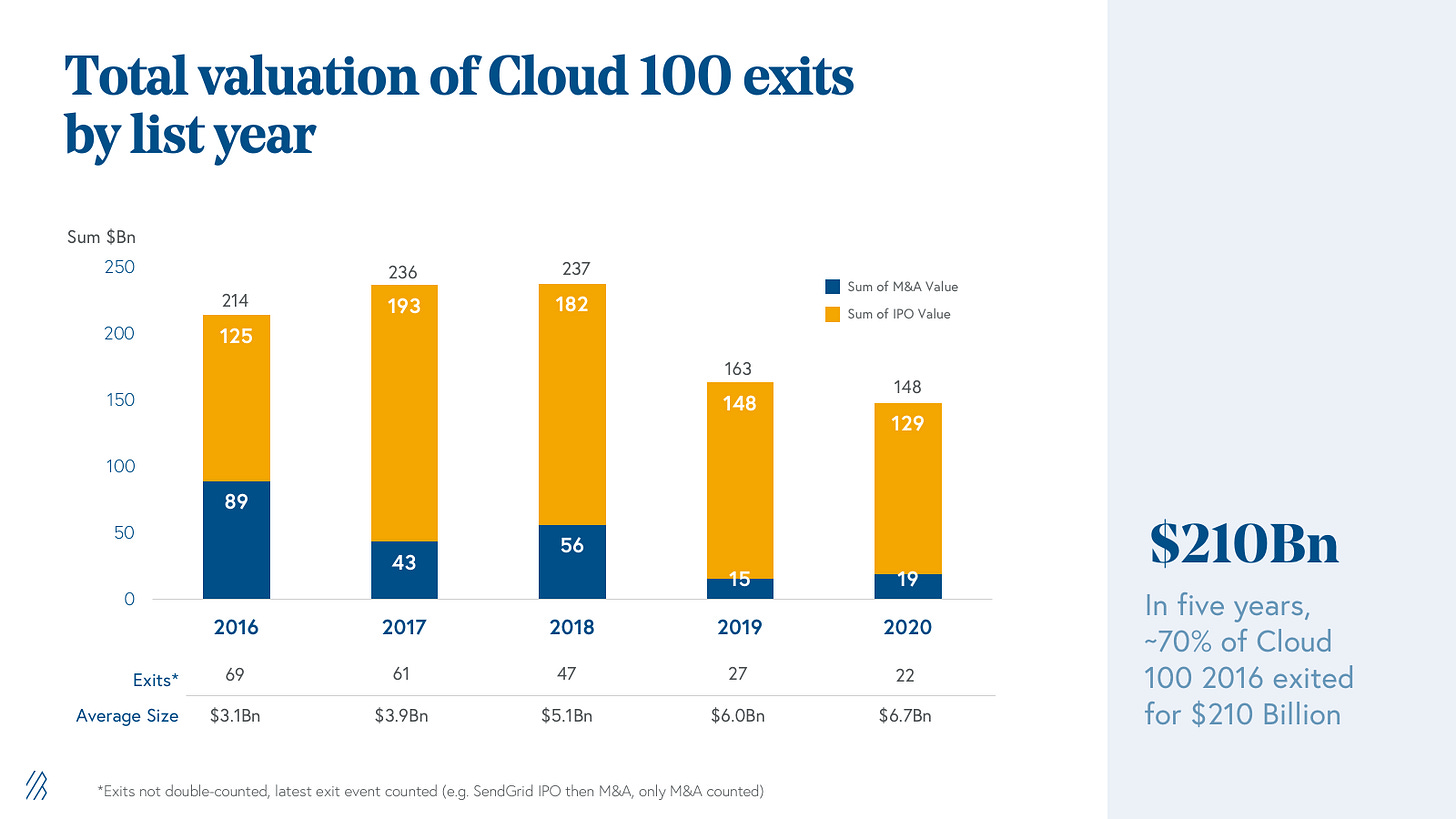

Much of the strong Cloud 100 returns — especially in the last year — have been driven by today’s strong market and exit environment for cloud companies. Almost 70% of the Cloud 100 2016 has exited, for an aggregate of $210 billion, while the average exit value has increased from $3Bn then to over $6.7Bn in 2020. Across the entire universe of 234 companies that have ever been on a Cloud 100 list, 86 companies (or 37%) have exited for a total of over $300 billion.

In 2021 alone we have seen over $100 billion of IPO exit value coming from past Cloud 100 winners, including Procore in its $9 billion IPO, UiPath in its $29 billion IPO, and Confluent in its $9 billion IPO. We also saw a direct listing from Squarespace and even a SPAC from DigitalOcean. All of this public market activity is happening against the backdrop of an average 22x multiple for BVP Nasdaq Emerging Cloud Index (^EMCLOUD) companies today.

The Cloud 100 has also delivered a meaningful portion of the public cloud software market capitalization, as measured by the BVP Nasdaq Emerging Cloud Index (^EMCLOUD). Twenty-six of the current ^EMCLOUD component companies are Cloud 100 graduates, contributing over $590 billion of public cloud market capitalization.

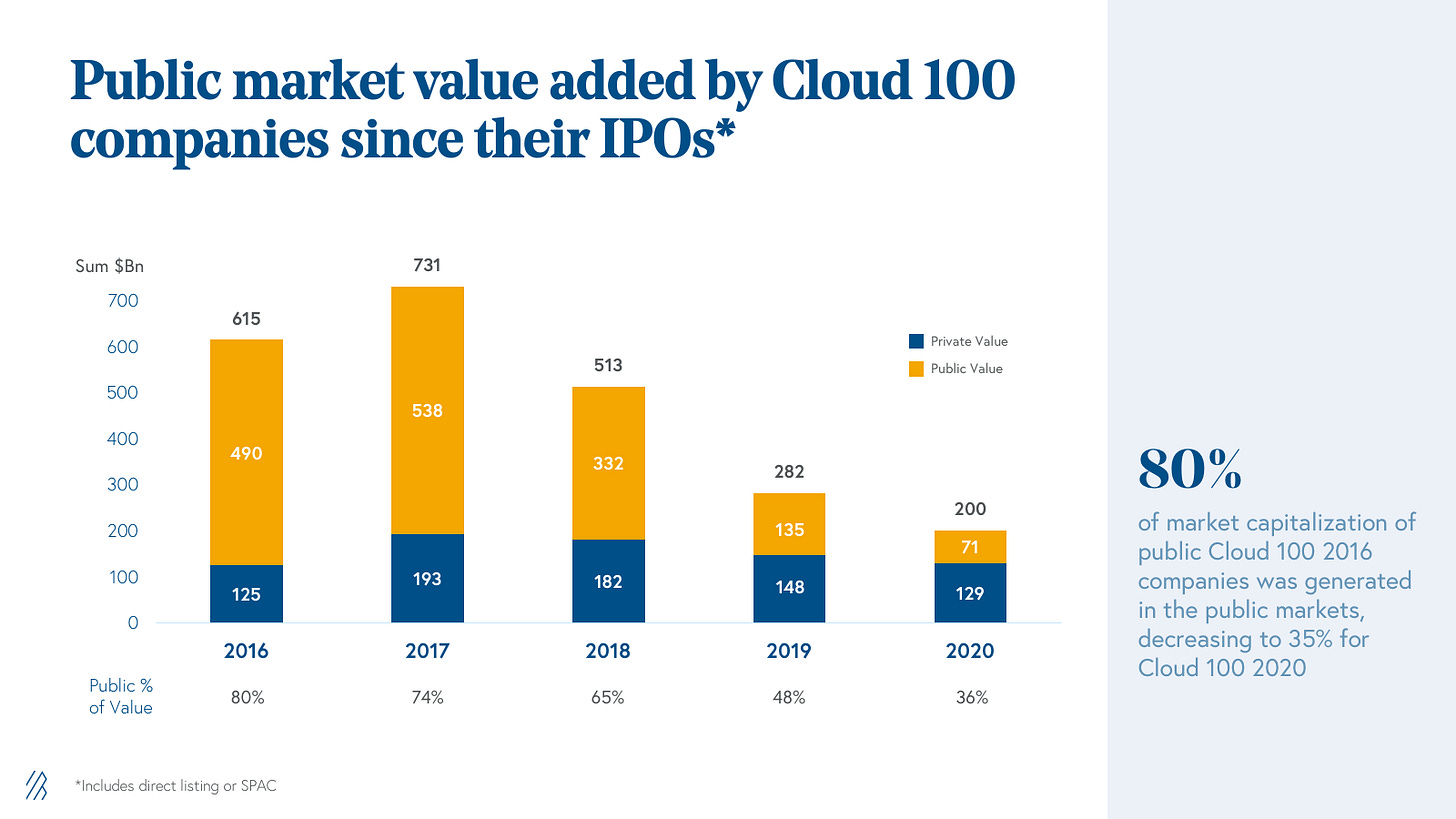

Looking into the value creation of public Cloud 100 companies from 2016, \~80% was generated in the public markets, with \~70% for 2017-2018; however, it is noteworthy that the 2019 and 2020 lists have materially less public contribution. Naturally more value will be captured in the public markets as these companies grow in revenue and in their valuations, but given the dynamic of increased multiples in the private markets, there is an argument to be made that companies are now capturing value in the private markets that historically was only reserved for the public markets.

What’s ahead

The Cloud 100 2021 companies have successfully captured industry tailwinds and combined it with strong execution and customer love to create equity value for themselves and value for the world. Most impressively, these companies have achieved such remarkable milestones during a period of unprecedented complexity and challenges, amidst the backdrop of the global pandemic. As this benchmark report has demonstrated, the 2021 Cloud 100 cohort has grown faster than ever before, doing so in a market that craves more supply. We expect that this trend will only continue throughout the rest of 2021 and beyond, and are excited to see what else lies ahead for the world’s best cloud companies.

See you for Cloud 100 2022!

*Note that not all companies’ last disclosed round valuations exceeded $1Bn, but this reflects valuation estimates determined by the combination of Bessemer, Salesforce, Forbes, and the judges.