The Cloud 100 Benchmarks Report 2023

Bessemer reveals insights into the 2023 Cloud 100 cohort and how AI is taking center stage in the private cloud market.

Originally published in Bessemer’s Atlas; co-authored by Mary D’Onofrio, Grace Ma, Janelle Teng, Alex Yuditski, and Andrew Schmitt.

Today Bessemer Venture Partners, Forbes, and Salesforce Ventures announced the 2023 Cloud 100 List, the definitive ranking of the top 100 private cloud companies. And this year’s list feels different – is different – for two core reasons.

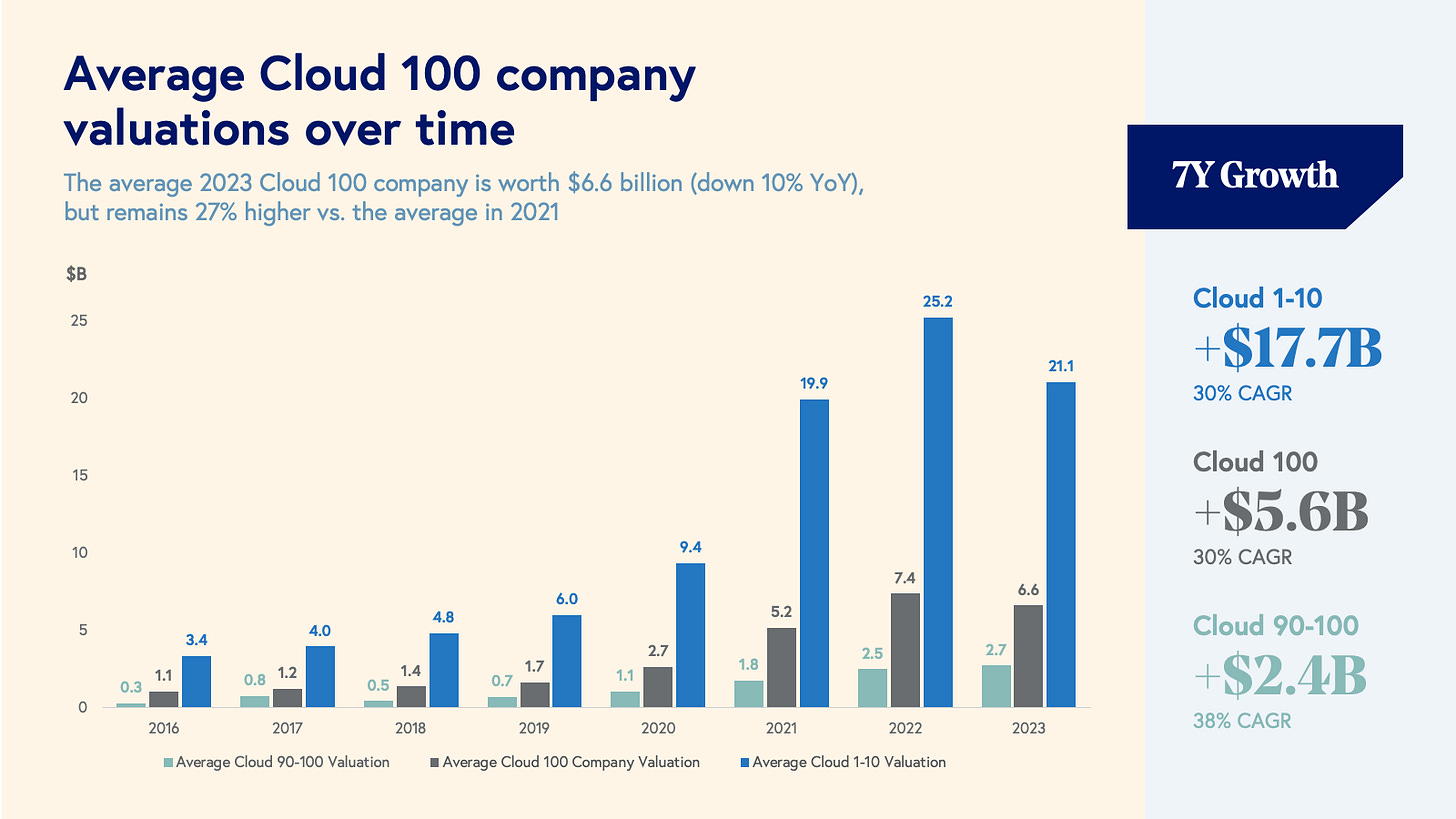

First, for the first time ever, the aggregate Cloud 100 list value actually contracted in value year-over-year. Last year, the bar for inclusion in the Cloud 100 was incredibly high: not only did all the 2022 Cloud 100 honorees reach the $1 billion valuation milestone, but also the average Cloud 100 valuation skyrocketed to $7.4 billion. However, 2022 was one of the most challenging years in recent history for the cloud economy as companies dealt with macroeconomic uncertainty, tightened IT budgets, elongated sales cycles, layoffs, and valuation multiple compression. These headwinds combined and made 2023 the first year in which the aggregate value of the Cloud 100 contracted year-over-year to $654 billion, down 11% versus the 2022 list value.

Second, despite this bleak backdrop, AI emerged as a shining light for the cloud ecosystem. The AI revolution propelled many of the movers and shakers on the 2023 Cloud 100 list. OpenAI not only made the list for the first time, but it also replaced Stripe in earning the top spot as #1 on the list. Databricks, another company making big investments into AI, also moved to the #2 spot. Embedded AI catalyzed growth in the highest-valued cloud category, “Design, Collaboration, and Productivity”, and AI-Native was by far the most highly valued category of new entrants to the list. These shake-ups make this year’s Cloud 100 list one of the most dynamic in history, and we believe the cloud economy will continue evolving as we enter the Age of AI.

With eight years of Cloud 100 data behind us, in this year’s Benchmarks Report we reveal Bessemer’s analysis and insights into the 2023 Cloud 100 cohort and what it tells us about the exciting future ahead for the cloud economy.

Top highlights:

The 2023 Cloud 100 is worth an aggregate $654 billion vs. $738 billion in 2022, representing an 11% decrease year-over-year. Nonetheless, the top 10 Cloud 100 companies still represent an astounding $211 billion of equity value (32% of list value) and the average Cloud 100 company is worth $6.6 billion.

This year, Design, Collaboration, and Productivity is the highest valued category at $110 billion (17% of list value), followed by Fintech at $103 billion (16% of list value), the highest category last year. (We evaluate Cloud 100 entrants in 12 different categories of cloud computing: AI; Data and Infrastructure; Fintech; Design, Collaboration, and Productivity; Sales, Marketing, and CX; Security; Finance and Legal; Automation; HR; Developer; and Vertical Software.)

We introduced AI as a new standalone category this year, with all 5 AI-native companies in the category making their debut on the Cloud 100 list this year. While the core AI category represents $36 billion in total equity value, we’ve seen the impacts of AI across almost every category; in particular, nearly every company in this year’s leading Design, Collaboration, and Productivity category has openly embraced integrating AI into their product capabilities.

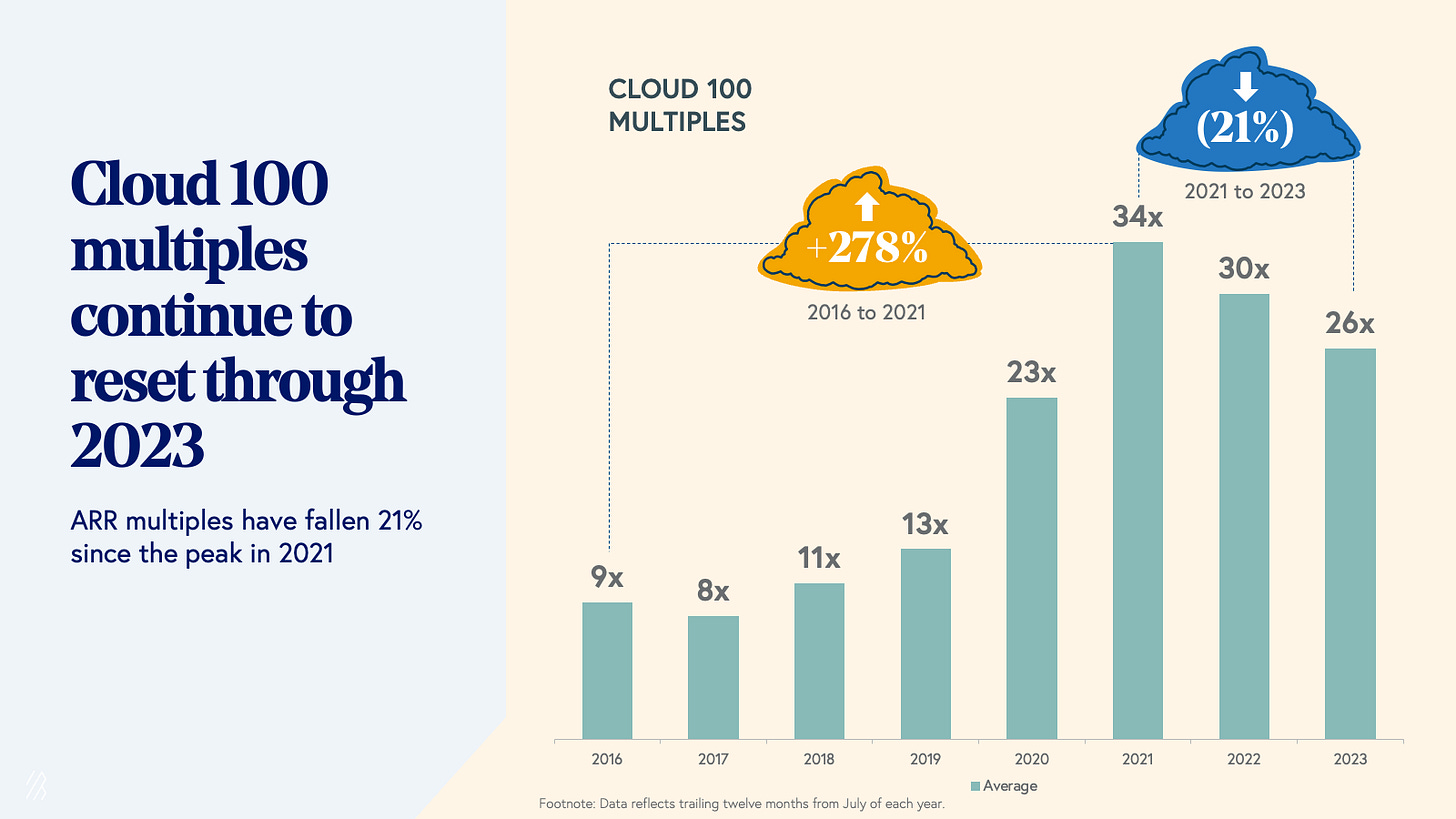

Private cloud multiples are now reflecting the impact of the public market reset that began at the start of 2022. The average Cloud 100 multiple decreased for the second year in a row, down to 26x from 30x last year, representing a 21% decline since the 2021 peak of 34x.

Last year, we introduced the “Centaur,” a $100 million+ ARR business. In 2022, ~80% of companies on the Cloud 100 list were forecasted to become Centaurs by the end of the year; this year’s list of honorees has raised the bar, with ~95% of honorees forecasted to reach $100 million of ARR by the end of the year.

The 2023 Cloud 100 at a glance: a year with major changes and shake-ups

The 2023 Cloud 100 list represents an astonishing $654 billion of equity value, with an average company valuation of $6.6 billion. Still, this is the first year in which the cumulative Cloud 100 list value contracted year-over-year, largely due to down rounds. (Note that the total list value of The Cloud 100 excludes Midjourney's valuation, as it has not conducted a publicly reported financing.)

Despite this backdrop, 2023 was one of the most competitive years in history for honorees to make the Cloud 100 list, since there was only one graduate off of the 2022 list, design software company Figma. Adobe announced its $20 billion acquisition of Figma in September 2022, though the acquisition is still in process. Adobe’s proposed price valued the company at 50x current ARR, representing one of the highest acquisition multiples in history. While the deal has not yet closed, it exemplifies that best-in-class cloud companies can command a valuation premium even in tough economic conditions.

20 newcomers and returners nonetheless earned their spots on the 2023 Cloud 100 list, largely fueled by the AI revolution. In a testament to the rise of AI, the highest-ranked new entrant was OpenAI, which earned the #1 spot on this year’s list. Stripe has had a stronghold on the top spot for four of the last five years, having briefly been replaced by Snowflake until its IPO in 2020. Alongside OpenAI, other newcomers and returners include Dialpad (#25), Appsflyer (#27), Zoho (#41), Druva (#49), Komodo Health (#56), Browserstack (#58), Retool (#64), ContentSquare (#66), Anthropic (#73), Abnormal (#80), Vanta (#82), Midjourney (#85), Brightwheel (#86), Tekion (#87), Moveworks (#92), Orca Security (#95), Cribl (#96), Hugging Face (#98), and DeepL (#100).

The biggest mover title for 2023 went to cloud security company Wiz, which moved up +67 spots to #15 on the Cloud 100 list. Wiz closed its latest $300 million financing in February 2023, valuing the company at $10 billion. The strength of this financing is notable given the overall decline in list value as well as the backdrop of muted VC fundraising activity, especially at the growth stage. Months before that, Wiz announced that it had reached Centaur status—$100 million of ARR—in a record-breaking speed of just 18 months!

The top 10 Cloud 100 companies represent $211 billion of equity value alone, accounting for 32% of the list’s aggregate value. New entrant OpenAI earned the #1 spot with its multi-billion megaround led by Microsoft earlier this year at a $29 billion valuation. Another big move within the Top 10 was Databricks, which moved ahead of Stripe, last year’s #1. Databricks is another company that has embraced AI over the last year, having recently announced its acquisition of MosaicML, its launch of its own large language model (Dolly 2.0), and its launch of the Lakehouse AI platform. Last year’s #1, Stripe, rounds out the Top 3. Joining them in the top ten are Canva, ServiceTitan, Klaviyo, Grammarly, Talkdesk, Rubrik, and Miro. The top 10 average a $21 billion valuation individually, up +$18 billion from the inaugural 2016 list.

While the IPO window has been frozen over the last year-and-a-half, there are signs of life. Companies are beginning to test the waters—non-cloud companies like restaurant chain Cava have gone public over the last two months, and there are indications that shoemaker Birkenstock and chip maker Arm will go public as early as September. Combined with slowing inflation and the market’s indication that it has priced in the impact of recent interest rate hikes, the capital markets have become more predictable. We anticipate that this will lead to many Top 10 Cloud 100 companies soon making public exits and paving the way for others. It has been reported that companies such as Stripe, Klaviyo, Talkdesk, and Rubrik, have been ramping up IPO discussions and preparations.

At $110 billion of aggregate value, the Design, Collaboration, and Productivity category has now overtaken Fintech as the most valuable Cloud 100 category, largely because these companies have recently supercharged their business models and revenues by leveraging AI. As brief examples, Canva released a suite of AI-powered image design and text capabilities, Grammarly launched GrammarlyGO, its enterprise-grade AI text generator and editor, and ClickUp released an AI-powered productivity assistant. Fintech, last year’s leading category, was the second most valuable category this year at $103 billion. It felt downwards pressure from high-profile write-downs from companies—for instance, Stripe’s March 2023 Series I funding round valued the company at $50 billion (down from its prior Series H valuation of $95 billion), and Checkout.com reportedly lowered its internal valuation from $40 billion to $11 billion in December 2022.

Sales, Marketing, and Customer Experience software continues to be the category with the most Cloud 100 companies, at an impressive 18. This category includes the likes of Yotpo, Attentive, and Intercom. The most represented category for newcomers to the Cloud 100 was AI, including OpenAI, Anthropic, Midjourney, Hugging Face, and DeepL, with an estimated combined valuation of $36 billion.

AI takes center stage

The impact of AI on the 2023 Cloud 100 list cannot be understated: 55 Cloud 100 honorees have announced a generative AI product or feature in the last eight months, and 70 are using AI or ML (generative and otherwise) in their products today. Of the 70 companies using AI or ML, 65 honorees have embedded AI, meaning they have added AI tooling and capabilities to enhance their core applications, while five are AI-native, meaning they were designed from the ground up to incorporate generative AI as a core component of their product architecture.

Many of this year’s honorees have embedded generative AI to enhance and streamline workflows in their flagship applications, improving both user productivity and experience. Some have taken the “AI assistant” product approach, using large language models (LLMs) to auto-generate everything from email and SMS content to marketing copy to code suggestions. Others are launching entirely new product lines built from generative AI, like Intercom’s Fin, a GPT-4 powered chatbot, and Zapier’s AI-powered natural language actions API, which allows customers to use natural language prompts to link information and build workflows between applications.

Embedding AI isn’t the only way to capture value—companies are also acquiring these capabilities via M&A, and others are building AI-native apps from the ground up. Cloud 100 honorees like OpenAI, Anthropic, Midjourney, Hugging Face, and DeepL have built their products with a generative AI-first architecture and rely on AI-driven products and research to drive their business strategy.

In this deep dive section, we look at how Cloud 100 honorees Cloudinary, Databricks, and DeepL have taken embedded AI, acquired AI, and AI-native approaches, respectively, to enhance their product offerings and deliver more value to their customers.

Case Study: How Cloudinary is embedding generative AI

Founded in 2012, Cloudinary (#81 on the 2023 Cloud 100) is a cloud solution for managing digital media assets — whether a furniture brand wants to offer a 360° view of its latest sofa, or a large corporation wants to optimize its high-quality images for faster website load speeds on smartphones, the Cloudinary platform helps businesses improve their visual media experiences and workflows.

With the help of generative AI and LLMs, Cloudinary recently introduced new generative AI features that enhance the capabilities of its Programmable Media image and video APIs. Generative Fill, for instance, makes it possible for users to expand images with matching content, and Generative Remove and Replace features enable users to remove and replace unwanted objects from images without the need for reshooting. New natural language features, like AI-Powered Image Captioning and Conversational Transformation Builder, help technical and non-technical users quickly caption images and make transformations via ChatGPT—for example, instead of coding, users can type conversational language commands, like “remove the dog using AI,” to prompt Cloudinary to remove a dog from an image without disturbing the existing background.

The above image depicts Cloudinary’s new Generative Replace feature, which uses natural language prompts to detect and replace objects in photos. In this case, AI identifies and transforms the subject’s black sweatshirt to a white designer suit using the following prompt: “gen_replace:from-shirt;to_designer_suit.”

These AI-embedded features not only facilitate productivity gains for users, but also expand Cloudinary’s total addressable market (TAM) and drive customer growth. By making it possible for non-technical professionals to make what used to be developer-grade media modifications, and by hastening the creative process, Cloudinary’s AI strategy will help the company reach new user personas, like marketers. And selling additional seats to adjacent customers will enable Cloudinary to increase the account value of its customers, a move that increases net dollar retention and revenue growth over time.

Case Study: How Databricks is cementing its AI leadership through acquisitions

In the AI era when moving fast is rewarded, acquiring capabilities is another way that Cloud 100 winners are maintaining an edge. Databricks (#2 on the 2023 Cloud 100) acquired MosaicML, a pioneer in large language model operations (LLMOps), for $1.3 billion, adding to its strong, internally-developed AI capabilities.

Founded in 2013, Databricks makes software that helps organizations store and transform massive datasets, while MosaicML enables companies to train and deploy their own generative AI models. Concurrent with the MosaicML acquisition, Databricks unveiled Lakehouse AI, a suite of tools for building and governing generative AI models, including LLMs within the Databricks platform. Earlier in the year, Databricks had released Dolly, an LLM trained for less than $30 to exhibit ChatGPT-like human interactivity (aka instruction-following), as well as Dolly 2.0 which it touted as “the World's First Truly Open Instruction-Tuned LLM. ”

Now with MosaicML onboard, Databricks customers have access to a cost-effective, unified platform to manage and analyze their data at scale. By making it simpler than ever for companies to deploy proprietary machine learning models—helping them with everything from fraud detection and drug discovery to modernizing their business intelligence processes—Databricks’ acquisition of MosaicML expands the capabilities of their infrastructure offers, enhancing current customers and bringing on new businesses that are hindered by their existing data architecture setup and costs.

Case Study: How AI-native DeepL is breaking language barriers

Lastly, DeepL (#100 on the 2023 Cloud 100) is transforming the $60 billion language services provider market with its AI-native architecture. DeepL generates real-time language translations that capture cultural context and resonate with native speakers. Unlike traditional translation options that often fall short in providing accurate and culturally aware results, DeepL uses neural machine translation (NMT) and deep learning to provide high-quality translations. By utilizing NMT models, DeepL captures context and nuances of language more accurately, making it the platform of choice particularly for business users who are seeking to translate contracts, corporate communications, and other key business documents in which translation errors might be deleterious.

Deep learning is a way to train computers to process new information just like the human brain does. At DeepL, this approach ensures that the company’s models learn complex language patterns, making them adaptable to linguistic nuances and continuously improving over time. Deep learning with NMT is helping DeepL sell to different markets and use cases, ranging from consumers and small teams to full API access plans. DeepL’s Translator product helps enterprise customers sharpen their customer support chatbots, communicate internally across geographies, and securely translate sensitive information. And translation is only the beginning for DeepL— the team recently introduced DeepL Write, a generative AI writing assistant that’s built on neural network technology, just like DeepL Translator. Now with a multi-product suite of solutions, DeepL serves a broader customer base of creators, professionals, and teams with writing-heavy workloads. With each new solution, DeepL is set up to cross-sell to a new segment or team, deepening engagement and retention with customers and driving more value for the business.

Cloudinary, Databricks, and DeepL exemplify AI’s transformative capacity to increase productivity, expand product use cases, and strengthen cloud software business models. Whether embedded, acquired, or built natively, AI has expanded the product capabilities and improved user experience for customers in a way we’ve never seen before. It enabled our spotlight companies to democratize creative content generation for non-technical users through embedded AI (Cloudinary), empower customers to develop their own proprietary models through acquisitions like MosaicML (Databricks), and deliver higher fidelity translations via AI-native architecture (DeepL). The impact of generative AI on our Cloud 100 honorees list is undeniable, and we expect that it will continue to drive innovation and enhance user experience across software more broadly.

Cloud fundamentals check in: Centaurs, multiples, and efficiency

The average 2023 Cloud 100 company valuation is $6.6 billion—down 10% year-over-year, but still 27% higher than the 2021 average valuation, even as the macro environment has deteriorated over the last 18 months. As we noted last year, however, valuations are not always reflective of a company’s fundamental value, especially when capital is easily accessible and markets are frothy. This golden truth is even more pertinent in today’s challenging environment where the already significant gap between fundamentals and valuations is growing even wider.

This is why we introduced the concept of the Centaur, a $100 million ARR business as a more reflective milestone of performance. Last year, we expected 80% of the 2022 Cloud 100 honorees to reach the Centaur milestone by the end of the year. For the 2023 Cloud 100 cohort, we expect to reach ~95% by the end of the year, strengthening our conviction that the cloud market has a bright future ahead despite all the doom and gloom of the last year. That’s right – ~95% of the Cloud 100 will have $100 million or more of ARR by the end of 2023. This includes companies like Zapier, Canva, Cohesity, and Wiz, which has announced reaching $100 million ARR faster than ever.

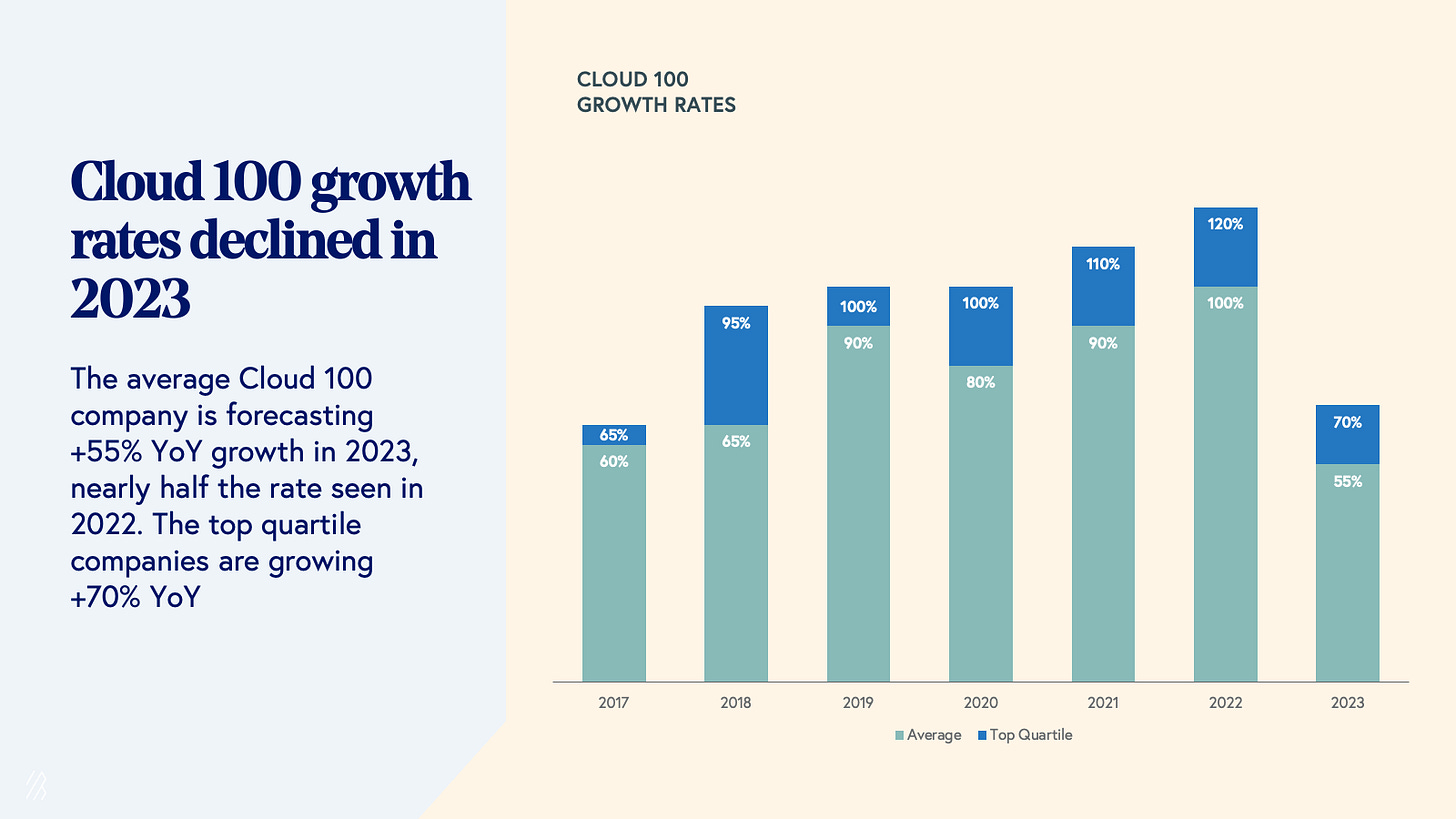

The macro background has nonetheless hurt the average Cloud 100 company. For years we saw growth rates increase, but in 2023, the average growth rate for a Cloud 100 company – the 100 best private companies in the world – has been nearly halved. After years of defying gravity and reaching record highs, headwinds eventually caught up with Cloud 100 fundamentals. The average Cloud 100 revenue growth rate fell significantly to 55% within the year, with the growth rate of the top quartile companies falling to 70%, once again reinforcing the extremely challenging year that the world’s best cloud companies had to deal with.

The private financing markets have responded in turn. For the second year in a row, the average Cloud 100 multiple has decreased, from 30x in 2022 to 26x. Considering that the average public BVP Cloud Index company is trading under 10x, we expect that reported private multiples will continue to compress.

Cloud 100’s year of efficiency

As 2022 saw more tightening in capital markets, IT budgets, and consumer spend, founders faced new challenges in reducing burn and driving efficient growth. 2023 became the year of efficiency in cloud, and profitable growth became more valuable than growth-at-all-costs. At Bessemer, we’ve always been big advocates of growth at optimal costs as a core guiding principle, and this is Law #2 in our 10 Laws of Cloud.

Internalizing this mantra of efficient growth, this year’s Cloud 100 honorees displayed remarkable resilience and adaptability proving the power of the cloud business model. Nearly 25% of Cloud 100 members are already cash flow positive today, and nearly two-thirds of the 2023 Cloud 100 will be cash flow breakeven or profitable by the end of 2024. 94% of Cloud 100 companies will be profitable by the end of 2025.

Further improving on this strong trajectory of efficient growth, over half of 2023’s currently unprofitable Cloud 100 honorees (58%) are meaningfully reducing their burn rate this year. Only a very small portion (7%) of the Cloud 100 intends to accelerate burn in 2023.

Observing the trends in absolute burn numbers also validates the commitment of the Cloud 100 cohort towards cash flow positivity and how these companies took swift action within a short period of time. On an absolute basis, 2023’s Cloud 100 cohort showed meaningful improvement in total burn when comparing their burn numbers from 2022 to 2023.

As the Cloud 100 cohort has shown, efficiency is a core imperative for cloud companies in 2023, especially since balancing the trade offs between growth and profitability not only has a tangible impact on business performance, but also on valuations. At Bessemer, we have seen the tactical steps great cloud companies have taken across our portfolio and compiled them here as a guide for SaaS leaders to drive profitable growth.

The future of the cloud economy will be efficient, and will be AI-driven

In the midst of a highly uncertain and volatile year, we commend all of the 2023 Cloud 100 honorees for demonstrating resilience and executing on efficient growth despite the doom-and-gloom that has impacted cloud fundamentals and valuations. We applaud that ~95% of the Cloud 100 will reach Centaur status by the end of 2023—the highest percentage ever in Cloud 100’s history—with companies hitting this milestone at record-breaking speed and strong efficiency despite the bleak backdrop.

Looking ahead to a brighter future, we recognize that we are in the midst of a defining paradigm shift as AI advancements will no doubt shape our lives and work for generations. We are excited to see so many Cloud 100 honorees at the forefront of this movement and look forward to seeing how the AI revolution will continue to define and transform the cloud industry in the years to come.

See you for the 2024 Cloud 100!