The SaaSacre of 2022

Public cloud stocks have taken a drubbing in 2022. But not all cloud companies have been impacted equally. Why is this happening, how severe is the compression, & where are the areas of resilience?

Graph created using data from: https://cloudindex.bvp.com/

Skies have been cloudy recently in the SaaS market. Mirroring broader growth stock market trends, public cloud stocks have taken a significant drubbing in 2022. The BVP Nasdaq Emerging Cloud Index (EMCLOUD) is down ~40% since its all time high in early November 2021, despite cloud companies still demonstrating solid fundamentals:

average EMCLOUD growth rate of 41.6%

average EMCLOUD gross margin of 71.1%

and average EMCLOUD efficiency score of 45.4%

In fact, in the latest earnings season, 92% of EMCLOUD companies beat consensus estimates, with several such as Bill.com, Datadog, and GitLab, handily outperforming expectations while providing upbeat outlook forecasts.

Following record venture funding in 2020 and 2021, the recent sell-off and multiple compression in the public markets have been top of mind for many cloud teams as they attempt to put the SaaSacre in context for their own unique circumstances. In this piece, I put together some thoughts on:

What is driving the SaaSacre of 2022?

What is the magnitude of SaaS multiple compression?

Where are the areas of resilience? And why?

Which categories are surviving better than others? And what are the implications/learnings for teams?

I. What is driving the SaaSacre of 2022?

If fundamentals are largely intact (unlike during the dot-com crash), what is then primarily driving the recent sell-off in the cloud world? From recession fears, to pandemic re-opening headwinds affecting particular cloud stocks, to the boredom markets hypothesis, everyone seems to have a theory. I see the macro environment as being a particular driver for the SaaSacre of 2022:

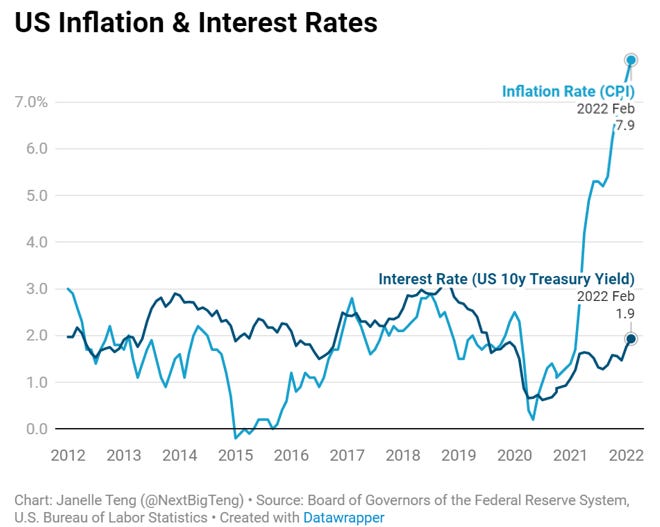

Escalating inflation and rising interest rates: US inflation rate has been accelerating at the fastest annual pace since 1982, and is at 7.9% as of Feb 2022. To curb the upward pressure on inflation, the FED raised interest rates for the first time since 2018 in March 2022, with expectations for several more hikes in the near future (Goldman Sachs expects US inflation to come in below 4% this year).

So why does this affect SaaS stocks disproportionately compared to other types of stocks? When valuing stocks using a discounted cash flow method, higher interest rates tend to impact growth stocks (such as EMCLOUD companies) more negatively, which may lead to investors shifting their attention away from these type of stocks. Growth stocks tend to be fast-growing companies that are working their way up to profitability. They derive a greater portion of their value from longer-term future earnings, and the present value of their future cash flows is more significantly discounted in a setting of rising interest rates. This is in contrast to value stocks that have stronger current cash flows while growing at a slower rate (for context, the average growth rate for the S&P500 is under 20% YoY vs. EMCLOUD’s 42% average).

In fact, there is some historical precedent that SaaS multiples tend to be somewhat inversely correlated to interest rates:

Source: J.P. Morgan Enterprise Software Mid-Week SaaS Valuations vs. US 10YR US Treasury Yield Charts (03/10/22)

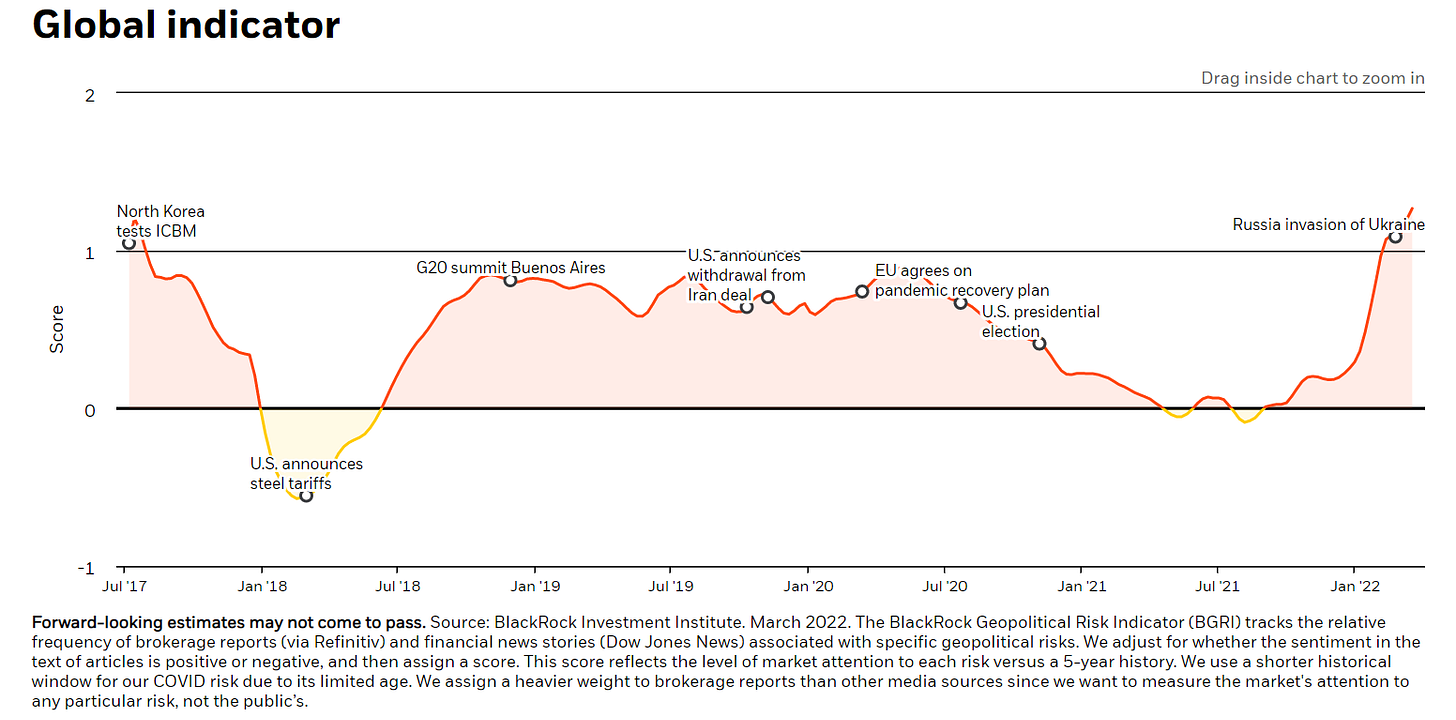

Geopolitical uncertainty: Additionally, the markets continue to be impacted by various geopolitical risks, most notably the ongoing and unjustified invasion of Ukraine. Several SaaS companies, such as Adobe and Atlassian, have voluntarily put international growth in affected regions on hold by curtailing sales and operations in Russia. Some, such as Salesforce, have gone one step further and started to fully exit all relationships with Russia-based customers.

Source: https://www.blackrock.com/corporate/insights/blackrock-investment-institute/interactive-charts/geopolitical-risk-dashboard

II. What is the magnitude of SaaS multiple compression?

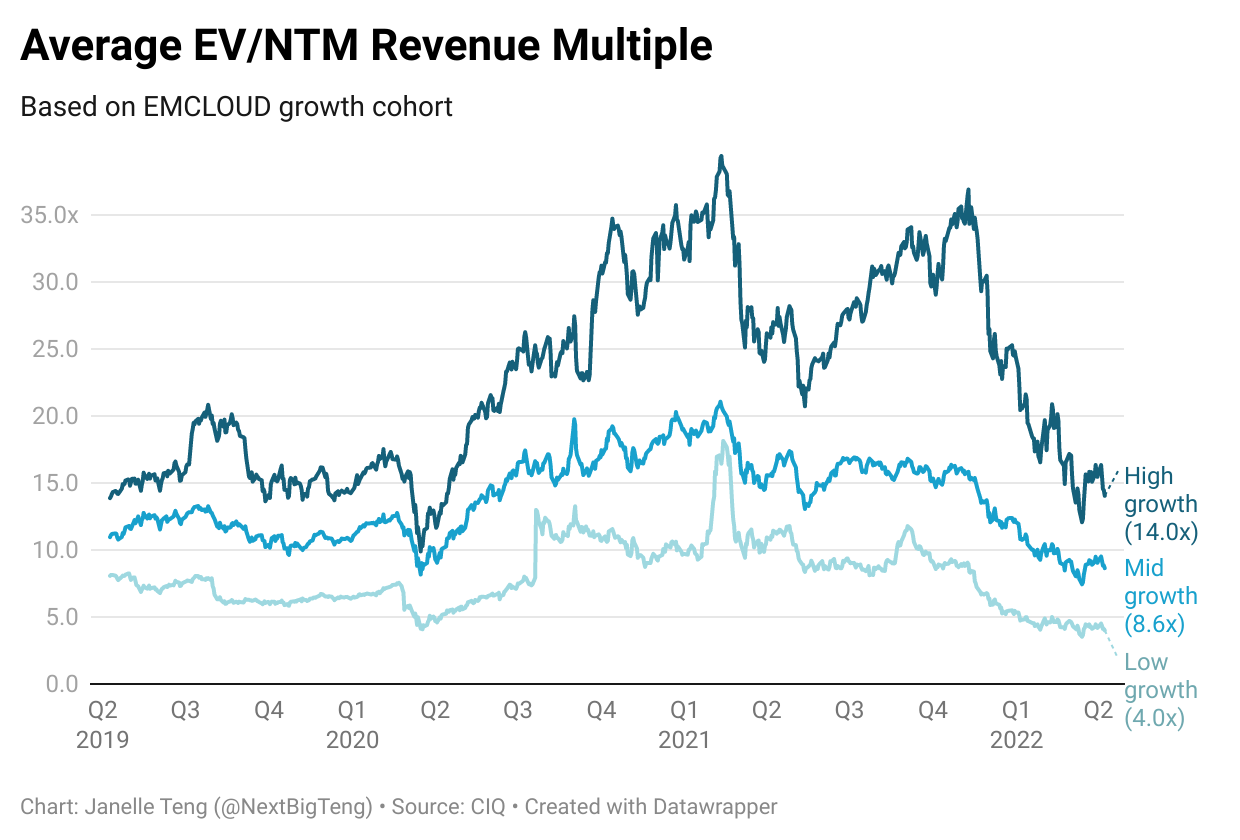

The impact of SaaSacre 2022 is palpable. Cloud companies tend to be valued on a multiple of revenue, and often times this is based on a forward projection (i.e. EV/NTM revenue multiple). When looking at EMCLOUD as a basket, the average forward revenue multiple today is ~10.5x (median ~9.0x) which is down a startling 62% since record highs over 27.5x in early 2021.

Peeling the layers back further, compression is most pronounced for the lowest growing companies in this cohort:

High growth (>30% projected NTM): ~64% down from 2021 peak of ~39.4x

Mid growth (15-30% projected NTM): ~59% down from 2021 peak of ~21.0x

Low growth (<15% projected NTM): ~78% down from 2021 peak of ~18.1x

III. Where are the areas of resilience? And why?

But growth is only one part of the story. While valuations were more correlated to growth (rather than growth + profitability) throughout the last several years, there has been a recent shift toward a stronger correlation between valuations and capital efficient growth rather than just absolute growth rate alone:

Source: Morgan Stanley Weekly Software Datapack (04/08/22)

My team and I at Bessemer Growth understand that many fast-growing startups and companies will start off by being cash consumptive rather than cash generative, but we observe whether growth in topline revenue effectively reflects dollars invested in the business. We define capital efficient growth using efficiency score:

For growth stage startups at less than $30 million ARR, efficiency score is measured by net new ARR over net burn (best-in-class score being >1.5).

Longer term, cloud companies should focus on efficiency scores as defined by ARR growth plus FCF margin of ARR. The average EMCLOUD efficiency score is 45.4% (which is higher than the “Rule of 40” benchmark), anchored up by several product-led growth companies.

Source: https://www.bvp.com/atlas/introducing-enterprise-sales-to-a-product-led-growth-organization

As described in section 1, with the changing macro environment, investors are now increasingly focused on cloud companies not only with sustainable growth in categories with a large total addressable market opportunity, but also with strong fundamentals in terms of robust business models allowing for attractive unit economics and profitability potential.

Indeed, EMCLOUD companies with weak efficiency scores under 40% (i.e. lower than the “Rule of 40”) saw multiple compressions of over 78% versus 58% for companies performing above that benchmark. These less efficient companies are currently trading at 6.6x forward, significantly below their more efficiently growing peers:

IV. Which categories are surviving better than others? And what are the implications/learnings for teams?

Not all categories are impacted equally, and pandemic re-openings have further widened the survival gap in SaaSacre 2022. When looking at 10 major categories within the EMCLOUD basket, cybersecurity leads the charge as the category with the highest average efficiency score. Consequently, this category has the highest average forward revenue trading multiple of all EMCLOUD categories at ~20.7x, despite a ~55% pull-back from peak valuations.

In contrast, EdTech, with the lowest efficiency score by category, is trading at an average forward revenue multiple of ~1.6x (the lowest in absolute terms for all EMCLOUD categories). The category had a ~75% multiple compression from its peak, which was the most pronounced compression experienced across all categories.

Parting note: It’s not just about growth at ALL costs, rather, it should be growth at OPTIMAL costs!

Putting this into context for cloud teams, it is now more important than ever to find the right balance between growth rate and burn rate. This is not just to ensure that your company has enough of a runway to weather upcoming uncertainty, but also because investors are shifting their valuation lens from previous years to focus more on growth + profitability correlation.

Questions? Thoughts? Feel free to leave a comment or reach out to me on twitter @NextBigTeng!

Great work, thank you for sharing! I think what many discovered after Amplitude miss is that there's basically no floor for what an unprofitable cash-burn SaaS co can go after they miss sales (or worse, change LT outlooks). Reflexivity kicks in and you start to read about Zoom and DocuSign changing comp because the stock went too low. It's hard to own stuff that doesn't own its own destinity.