American vs European Startup Dynamism

Recent data indicates a glaring disparity between the vibrancy of the US vs EU startup landscape, leading many to question – how do we make the EU startup ecosystem great again?

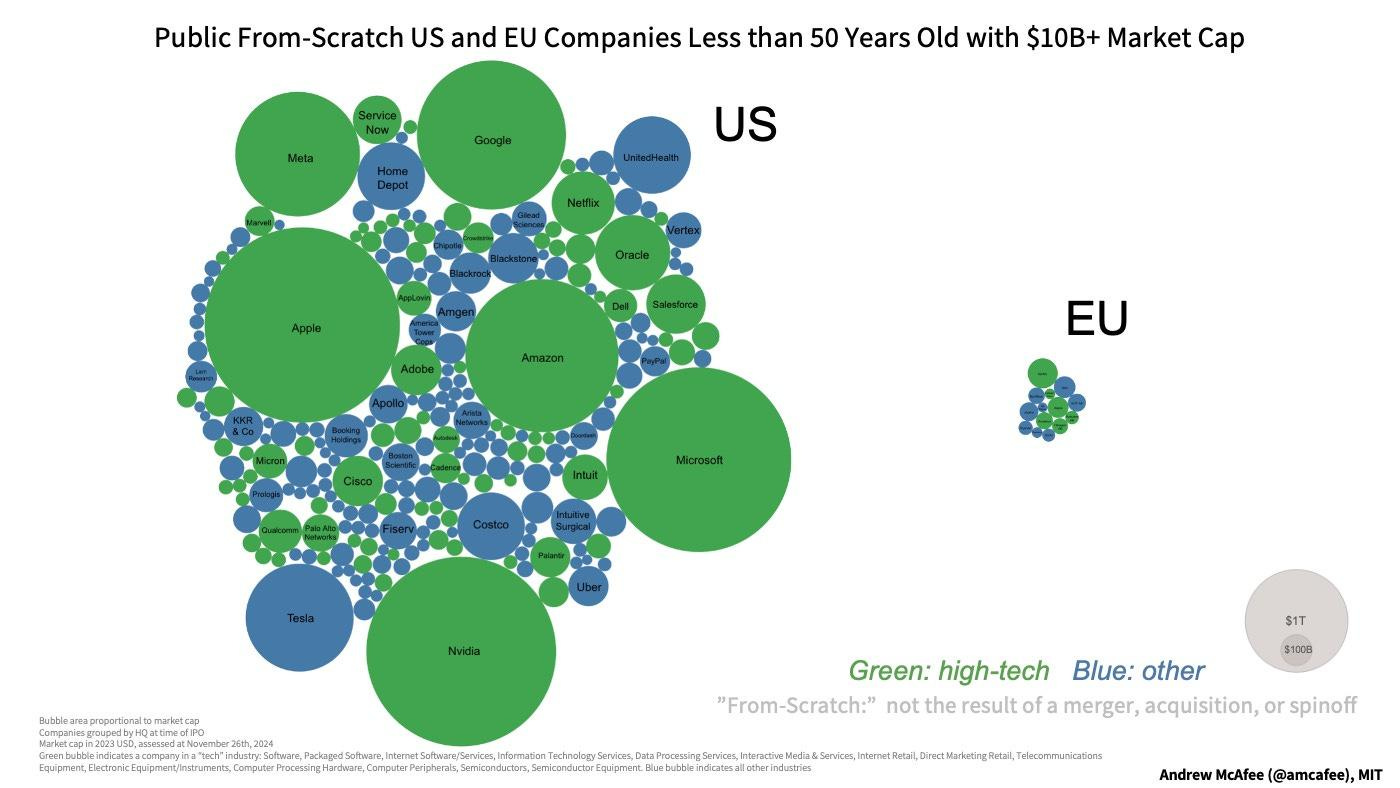

The chart below from MIT researcher Andrew McAfee went viral last month, showing a stark contrast between the US and EU startup ecosystems. The US has significantly outperformed the EU in creating highly valued companies “from scratch” (i.e. not through M&A or spinoffs) within the last 50 years — McAfee found that the US cohort of “from scratch” companies with market cap over $10Bn was ~70x the EU cohort in terms of valuation and ~5x the EU cohort in terms of number of companies. These observations led some industry observers to harshly quip that Europe is “a museum as a continent and a museum as a stock market”.

Notably, some American companies created during this time period, such as Apple, Nvidia, and Tesla, are individually worth more than the entire EU cohort. In fact, Mario Draghi’s report on “The Future of European Competitiveness” highlights that there has been no EU company with market cap over EUR 100Bn created from scratch in the last 50 years, while 6 US companies with valuation above EUR 1Tn have emerged during the same period.

While market cap is just a proxy metric, the disparity between geographies is alarming. I was recently discussing some key factors driving this phenomenon with a European VC peer:

Market fragmentation

Regulatory environment

Risk-capital ecosystem

Cultural and mindset differences

“Brain drain”

I. Market fragmentation

Both the US and EU represent large markets by sheer number of consumers — the current estimated total population of the EU is ~450MM which is larger than the US (~335MM). However, unlike the US which is a large market that is unified, the EU market is more fragmented and heterogenous since the region is comprised of multiple countries with different languages, tax and stock option rules, legal systems, regulation, etc. Despite strong progress made to unite the region as a “single market”, EU startups often have to grapple with cross-border complexity when scaling, which can add frictions to growth.

II. Regulatory environment

Not only is the regulatory environment of the EU more fragmented, the EU is also known for more stringent regulation. From GDPR to the Digital Services Act to the Digital Markets Act to the AI Act, the EU has pioneered many major pieces of tech regulation within the last decade. While it is commendable that the EU has been a global leader in setting strong regulatory standards, such restrictions seem to have had unintended consequences on startup innovation.

Industry observers thus point to regulation as being a primary factor for lagging startup activity in the EU. For instance, Draghi highlighted in his report that:

“The problem is not that Europe lacks ideas or ambition. We have many talented researchers and entrepreneurs filing patents. But innovation is blocked at the next stage: we are failing to translate innovation into commercialisation, and innovative companies that want to scale up in Europe are hindered at every stage by inconsistent and restrictive regulations.”

EU’s regulatory constraints have been likened to “weight vests, blindfolds, and clown shoes”, and have also become the subject of memes:

III. Risk-capital ecosystem

At the New York Times DealBook Summit last month, Jeff Bezos emphasized “better risk capital” as the biggest reason for America’s outsized entrepreneurial success. I agree that this is a critical factor. The US VC ecosystem is more developed compared to the EU ecosystem. Consequently, US startups receive significantly more capital than their EU counterparts:

The sources of risk capital are also quite different across geographies which may impact investing style, priorities, and duration:

Unsurprisingly, a relative funding gap exists between US and EU startups, especially in later-stage and/or larger quantum rounds (chart below). It’s estimated that Europe is underfunding its growth stage companies by a staggering $375Bn!

IV. Cultural and mindset differences

Several founders point to a more risk-averse and conservative “European mindset” as another plausible reason driving the US vs EU startup disparity:

Industry observers have also noted the impact of such culture differences on startup activity. As a report from McKinsey highlights:

“European start-ups face much greater pressure to perform, and to do so earlier, than start-ups in the United States, where having a failure in one’s past is typically seen as a badge of honor… this lack of a “risk culture” in Europe can also drive some founders to take other, more conservative approaches that sacrifice growth potential. For example, they might narrow ambitions to merely building a sustainable business and regional disruptor. This could partially be driven by the stigmatization of start-up bankruptcy in several European countries, incentivizing founders to be more risk-averse in pursuing growth opportunities. This would put European start-ups at a stark disadvantage to their US peers, which more often aim for global dominance.”

V. “Brain drain”

Fundamentally, availability of top talent should not be an issue for the EU since the region boasts an incredibly highly educated populous, and is home to world-class universities and research institutions.

However, talent retention seems to be an emerging issue. While many iconic startups have elected to keep their headquarters in the region (exhibit above), perhaps due to a confluence of the factors highlighted in the prior sections, there has been a recent trend of “brain drain” in the region where European companies are choosing to move their headquarters overseas — between 2008 and 2021, close to 30% of European-founded “unicorns” relocated their headquarters abroad, with the vast majority moving to the US.

A wake up call

While I’m based in California and thus invest primarily in the North American region, I strongly believe that innovation is borderless. Category-defining startups can be founded and scaled globally as long as fundamental building blocks are in place to support entrepreneurs and promote agglomeration effects. As my partner Alex Ferrara from Bessemer’s London office has noted, the EU has incredibly sound foundations to foster a vibrant startup ecosystem. There are thus reasons to be optimistic that the region can turn things around if the structural factors detailed above are addressed.

Things are already trending in a positive direction. For instance, the volume of risk-capital flowing into the EU has been steadily increasing over time (chart above) and is growing at a faster rate compared to the US.

Addressing all of these factors will not be an overnight endeavor and will require buy-in from a multitude of stakeholders. There is a lot of work to be done, but I believe that the EU community will heed this wake-up call and take swift action such that the region can unlock its full potential (exhibit above) within the next few years.

MEGA!!!

I totally agree! I'm from Spain, living in London. Our Fintech Startup is registered in London, and soon, our Subsidiary will be in Texas, US.

🇺🇸🇺🇸🇺🇸 has always been the place