Contextualizing the growth vs. profitability trade-off for cloud companies

Balancing growth with profitability is top of mind for many growth-stage SaaS companies. Is there an "ideal" Rule of 40 profile? What is a heuristic for the optimal frontier?

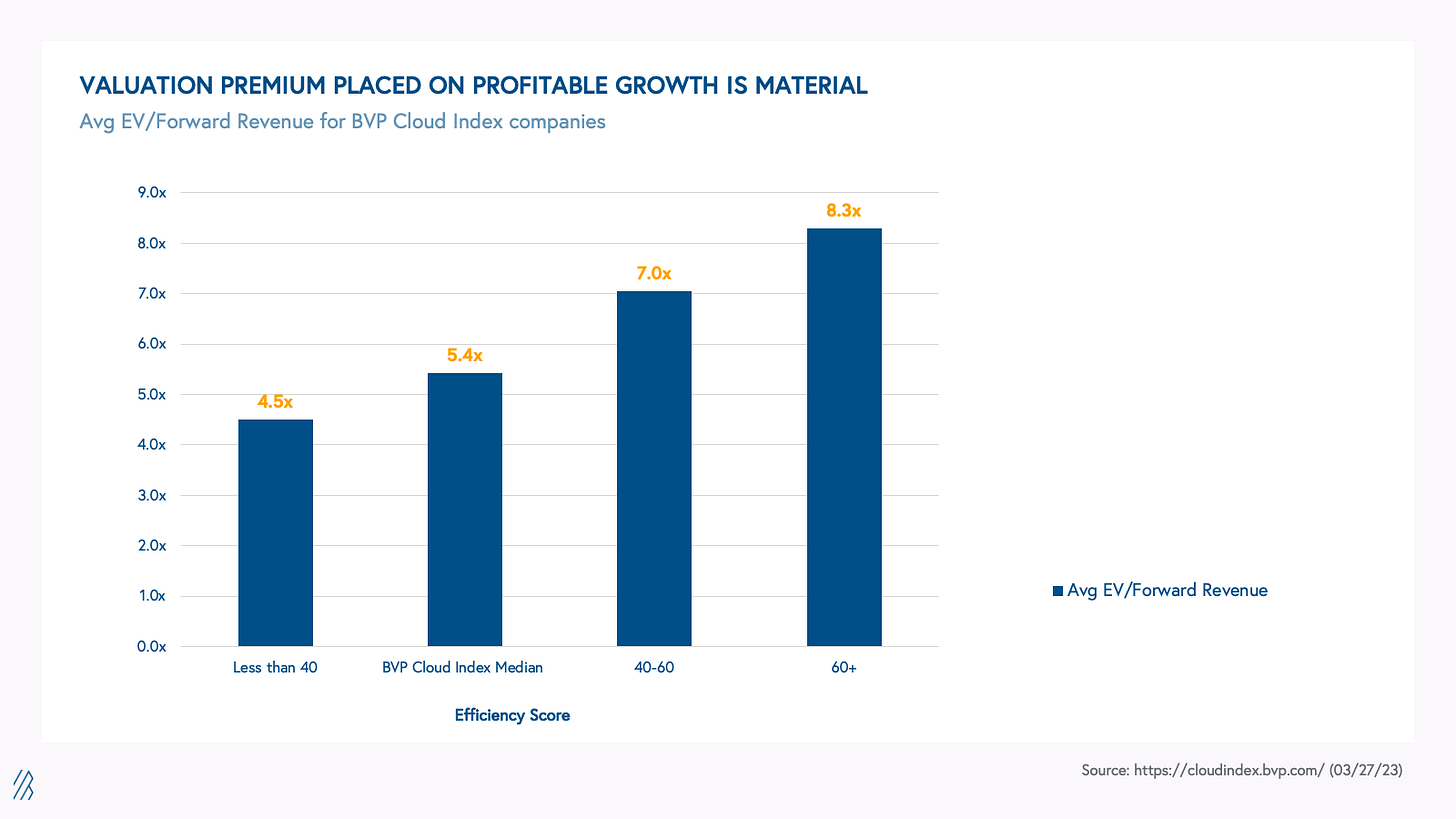

It is now a well-understood rhetoric within the cloud world that growth at all costs is no longer rewarded, and cloud valuations are currently more tightly coupled to efficiency (ARR growth rate + Free-Cash-Flow margin) than growth alone. And this valuation premium is material — in our recent piece on driving profitable growth, my colleagues and I discussed how BVP Cloud Index companies that achieve the Rule of 40+ (i.e. an efficiency score of 40 or higher) traded 1.56-1.84x higher than less efficient peers:

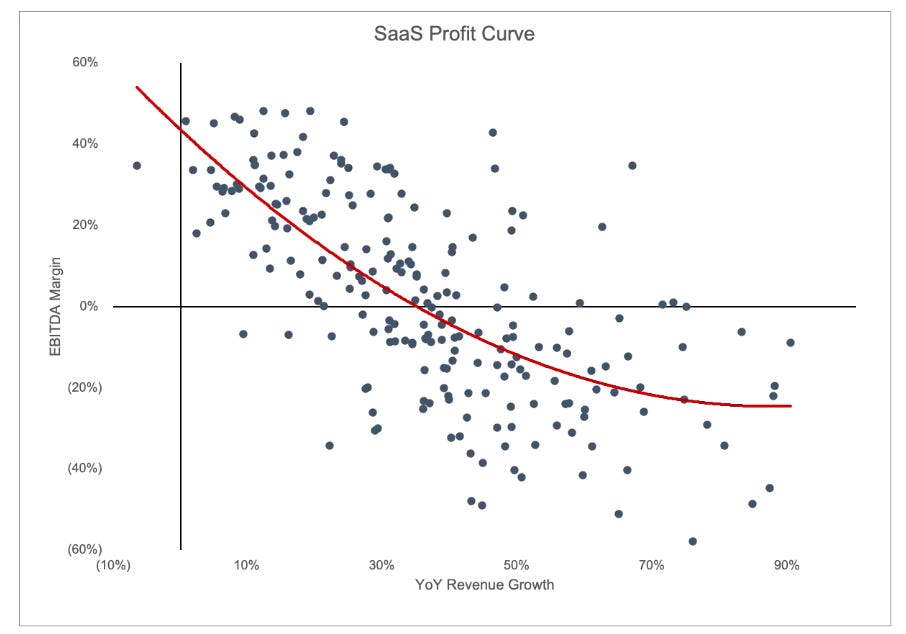

This trend seems to apply broadly to other categories of software beyond just the BVP Cloud Index:

However, not all Rule of 40 profiles are the same — a 100% grower with -60% FCF margin looks like a very different business from a 30% grower with 10% FCF margin despite both being “Rule of 40” companies. As I’ve written previously, Rule of 40 involves a multi-variable equation with a growth component taken in relation to a profitability component, and it is important to peel back the layers since each individual component drives a relative valuation impact.

The chart below visualizes this point. These are all BVP Cloud Index companies that outperform the Rule of 40 (arranged in descending order) with their efficiency score components, and one can see that the corresponding valuation multiples do not follow the same ordinality:

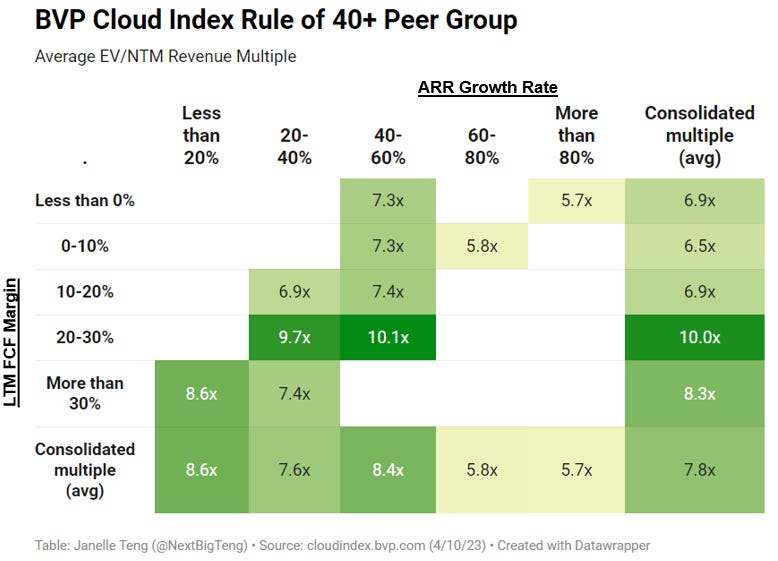

A second order question might then follow: is there an specific efficiency score profile that is particularly favored by investors since it is not just about attaining the highest absolute score? This question is especially top of mind for many growth-stage companies that are carefully balancing investing in growth with driving profitability in order to achieve “efficient growth” at the optimal frontier for their companies. From the heat map below, it appears that a profile of 40-60% growth paired with 20-30% FCF margin attracts the highest valuations within the peer group:

However, as my colleagues and I noted in our State of the Cloud 2023 report from last week, it has not always been consistently the case that a ~2:1 ratio of growth to profitability was the most attractive to investors, as sentiment seems to be tied to market conditions. As visualized in the graph below, at the height of bull market exuberance in 2021, growth was more favored than profitability by a factor of 6x. Then, after the market turned in 2022, this ratio moved closer to ~1:1 and at times even tipped slightly in favor of profitability. Currently, with more macro stabilization, the ratio stands at ~2:1 in favor of growth which maps to our heat map discussion above.

As a general heuristic, in bull times, it seems that the market solves for a growth to profitability ratio above 2:1, and this ratio moves toward a more “goldilocks” 1:1 stance when sentiment is bearish.

One note about this heuristic is that the underlying data set involves BVP Nasdaq Emerging Cloud Index companies which are “emerging public companies” (i.e. earlier in their S-curve compared to large cap software players). To give a sense of the business profile of these companies — median ARR growth rate of the cohort is 23.5%, median gross margin is 74.2%, median LTM FCF margin is 3.0%, , and median market cap is ~$5.1Bn. This heuristic is likely to look different for other sets of comps within the cloud universe, so it is important to benchmark business fundamentals and maturity stage when coming up with a businesses’ “aspirational” Rule of 40 profile. Additionally, this heuristic is pegged to valuation impact but that is not always the end goal. (On a related note, here is a discussion on the current “ideal” growth vs profitability profile sentiment in the private markets where fundability might be considered an important goal).

In a recent interview with Silicon Valley Business Journal, I discussed how public cloud companies are adapting quickly to market sentiment by turning on the switch toward profitability. The chart above is a powerful visualization of this inflection. The recent wave of activist investors putting pressure on cloud companies to cut costs has also served to accelerate this paradigm shift. Today, the 10 highest valued BVP Cloud Index companies (by forward revenue) are driving an average of ~18% FCF margin, versus ~7% from the Top 10 cohort a year ago. Additionally, negative FCF software companies account for ~13% of the public cohort, down from a recent local maxima of ~24% (chart below). In the private markets, I’m seeing startups internalize this same outlook as they implement many creative and effective tactics to drive efficient growth.

The optimism that software companies can drive profitability effectively when they choose to focus on this vector is underpinned by the power of the SaaS business model. This is one mental framework leveraging a structural perspective: SaaS gross margins for scaled companies are generally in the range of 70-80% due to low marginal cost of distribution. This sets the potential for operating margins to reach the 20%-30% range at maturity for high-quality companies that attain operating leverage. And assuming strong retention dynamics, this should stay relatively stable since recurring revenues are akin to inherent annuity streams. Large cap software companies routinely maintain 20%+ operating margins and this is the ultimate aspirational landing for high-growth SaaS companies.

Another framework would be to refer to the “SaaS profit curve” (chart above). This scatterplot of revenue growth vs EBITDA margin of various software businesses over their respective history indicates that a 0% growth business should attain ~40% EBITDA margin, which sets an attractive profitability watermark for mature SaaS companies.

But even if they welcome this paradigm shift, is it really that easy for all cloud companies to inflect toward profitability so quickly? Arda Capital published a thought-provoking piece in

last week that segmented SaaS companies into four buckets, and proposed that companies in the “messy middle” (chart above) may need to maintain levels of austerity for longer than expected (even though they have reached the mature portion of their S-curve) in order to hit the Rule of 40. This could be due to challenges such as increased competition. Others that struggle with an efficient path to profitability could get opportunistically acquired by private equity sponsors to instill more discipline.For the longest time, valuation metrics for many public software names (including mature companies) have been pegged to topline (such as multiple of sales) versus a more bottom-line focused rhetoric (such as GAAP P/E). Along with bull market exuberance, this standard was perhaps an additional impetus driving the mentality of companies choosing to prioritize topline growth over bottom-line margins. But following the change in market conditions, there is now increased dialogue around a repositioning of valuation lens (chart above), which could further reinforce the zeitgeist of efficient growth and fortify the renewed religion of operating discipline within the cloud ecosystem.

Thanks! Would you be able to share the Gugg'n report?