Land vs. Expand: Growth formula shifts during downturns

In 1Q23, new logo acquisition as well as expansion levers continued to be impinged. As it gets increasingly harder to drive net new ARR, how has the growth formula changed for cloud companies?

1Q23 earnings season wrapped up last month, and while it likely came as no surprise that the climate for software spend remained downcast, it was eye-opening to observe the increasingly harsh demand conditions that cloud companies are dealing with. Using net new ARR (NNARR) added within the quarter as an indicator revealed that 1Q23 was perhaps one of the toughest in recent periods for cloud companies to attain incremental growth.

As illustrated in the chart above, 22% of BVP Cloud Index Companies reported negative NNARR (i.e. saw declining ARR) in 1Q23, which was a marked increase from 3% in 4Q22 and 9% a year ago in 1Q22. Of the 78% that reported positive NNARR, most companies added less NNARR this quarter compared to 1Q22 a year ago, with the median YoY change in NNARR of the cohort landing at -22%. This was the lowest level in recent years:

The two essential inputs into NNARR are 1) new logo acquisition and 2) existing customer expansion. Companies rely on a mix of these drivers; not every company’s growth formula is the same. Some, such as single product companies, may rely more on landing new customers to drive growth. Others, such as consumption-based companies, tend to lean more on expansion of the existing customer base for incremental gains:

With 1Q23 being such a challenging quarter for incremental growth, several companies noted facing “double whammy” headwinds impacting both land AND expand drivers, as well as a change in their growth formula amidst this difficult macro backdrop:

“We're seeing increased macro headwinds on our business, most notably with new business across SMB and enterprise… Similar to Q4, customers are requesting shorter contract term lengths, and our overall business was weighted more towards upsells versus new business… Given the current macro environment, customers are not expanding seats at the rate they have in recent years, and we believe this trend will persist in this environment.” - OKTA 1Q24 Earnings Call

In this post, I dig in further to discuss:

How has new logo acquisition as a growth driver been impacted?

How has expansion as a growth driver been impacted?

How has the overall growth formula changed?

I. How has new logo acquisition as a growth driver been impacted?

In my 2Q22 earnings recap last year, I noted how a majority of public cloud companies had reported seeing added friction to new customer acquisition (especially new enterprise customers) following the downturn, including pressures such as:

Lengthening sales cycles as new deals get pushed back

Increased scrutiny such as requiring C-suite sponsor sign off or additional justification for new procurements

Frozen budgets where no new software purchases are allowed during the period

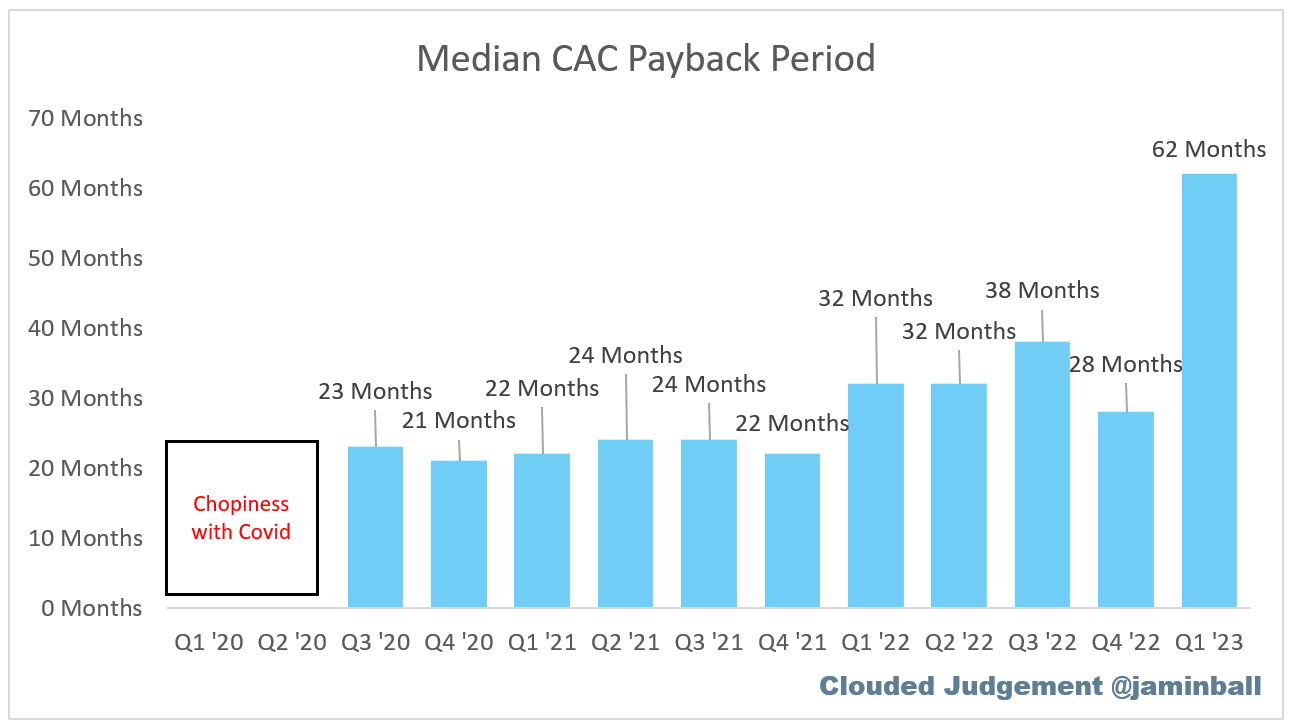

These headwinds have had a tangible and fast-acting sting on sales efficiency. As visualized in the exhibit above, a majority of cloud companies saw customer acquisition costs (CAC) increase meaningfully in 1Q23, both on a QoQ as well as a YoY basis. Consequently, median CAC payback skyrocketed to a shocking 62 months in 1Q23 after having already been on an upward trajectory in previous quarters:

Unsurprisingly, as new logo wins have became harder to come by, software companies witnessed reduced growth (on an absolute basis) from new customer lands over the past several quarters, with the average growth from this driver falling from 28% in 1Q22 to 14% in 1Q23:

II. How has expansion as a growth driver been impacted?

While landing new customers has been challenging, expanding the existing install base has not been immune from impediments either. Expansion motions tend to be quite heterogeneous since there can be many different levers to pull, such as:

upselling tiers, add-ons, or upgrades

cross-selling products

adding more seats or users

increasing volume or consumption

raising prices at renewal

Each of these levers exhibit differing sensitivity to macro conditions. For instance, seat-based expansion dynamics could be more impacted during recessions as customers reduce headcount. But on average, as seen in the exhibit below, software companies have experienced an overall deterioration in net dollar retention (NDR) from 120% in 1Q22 to 115% in 1Q23, demonstrating just how strong expansion headwinds have been in the current demand environment.

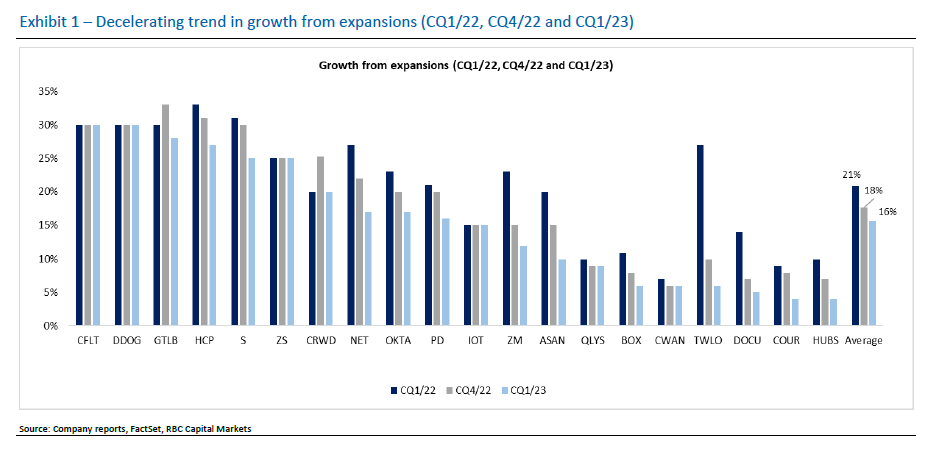

As NDR fundamentals weakened, mirroring the trend seen within new logo acquisition, growth (on an absolute basis) from expansion has been declining over the past several quarters, from 21% in 1Q22 to 16% in 1Q23:

III. How has the overall growth formula changed?

It was clear that headwinds hit from all angles in 1Q23 and companies faced a two-fold squeeze on both land as well as expand growth components — but was one driver relatively more reliable than the other?

Indeed, RBC Capital found that companies relying primarily on new logo acquisition to drive growth faced steeper deceleration during the past year versus counterparts that relied more on expansion (chart above). “Incumbency bias” is one common theory used to explain this trend where customers become less willing to take on the risk of procuring from new vendors during times of economic uncertainty and thus tend to stick with existing providers.

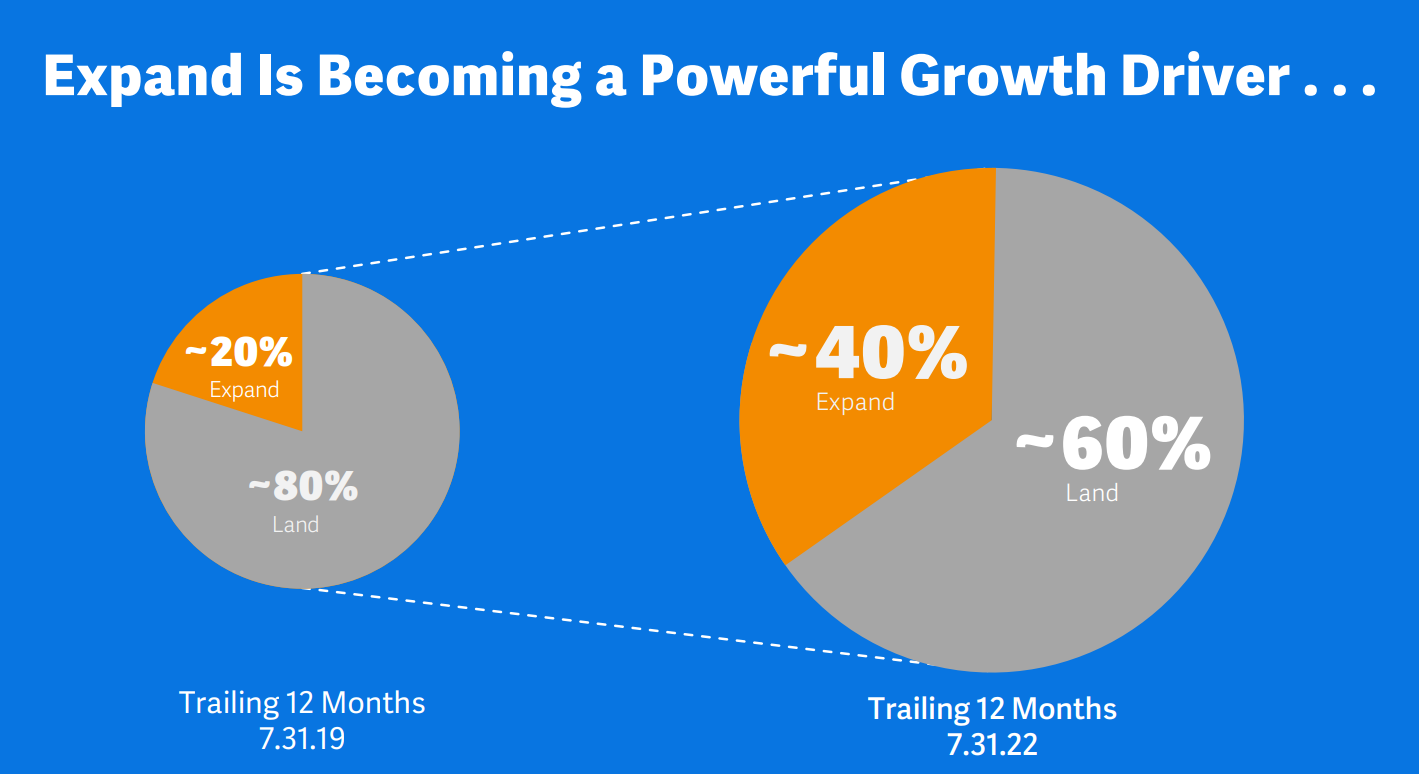

So what has been the cumulative impact of these driver changes on the overall growth formula for cloud companies? Following the downturn, some companies reported an increasing shift toward expansion as a contributor to growth (case study from Workday above). But few companies explicitly disclose this split. To further answer the question above, Bank of America applied a methodology assuming growth from expansion as NDR-1, and similarly found that the growth formula for software companies had shifted more toward expansion contribution in recent quarters. In 1Q23, the split of growth from new logo:expansion was ~40:60 versus closer to a ~50:50 split during less challenging times:

Customer success matters more now than ever

It is imperative for emerging cloud companies to invest in both new logo and expansion efforts. But in difficult times such as these where any marginal gain goes a long way, the recognition that existing customers play an outsized role becomes a critical insight for defensible growth:

Law #7 of Bessemer’s 10 Laws of Cloud is “Customer success is company success”. As expansion from existing customers becomes even more of a core focus during recessionary periods, it may be time to further internalize this tenet as the current install base is now more valuable than ever before!