SaaS 2H22 forecast: (Still) cloudy with a chance of... recession

In 1H22, cloud valuations were decimated as investors responded to Fed rate hikes. Is there more impact ahead or even a SaaSacre Part 2 from additional macro headwinds and recession fears?

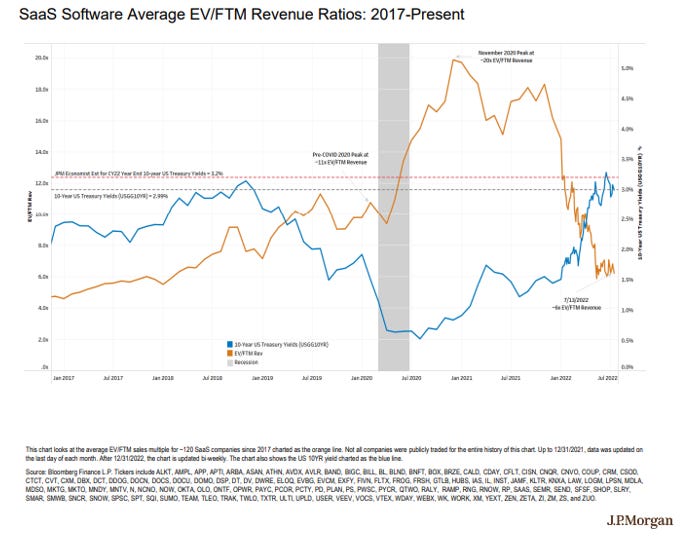

Source: J.P. Morgan Enterprise Software Mid-Week SaaS Valuations vs. US 10YR US Treasury Yield Charts (7/21/22)

When I first wrote about the SaaSacre of 2022 earlier in the year, I noted that the Fed’s interest rate hikes drove underwriting of less favorable discount rates for growth stocks. This macro driver was the main catalyst for sell-offs (see chart above) despite strong fundamentals from cloud companies.

The BVP Nasdaq Emerging Cloud Index (EMCLOUD), as well as other indices, have started to stabilize in recent weeks (chart above). But might another wave of macro impact be brewing? Cooling investor sentiment earlier in the year was linked to a macro story around markets and discount rates, rather than trepidations about health of the economy and fundamentals. However, a new storm is stirring, with cloud leaders starting to take heed of mounting macro headwinds driving recession concerns that could impinge on growth. Dissecting this rhetoric, I look at:

What are the expectations for enterprise software spending?

Why do expectations matter?

What categories might be impacted the most?

Where is the silver lining?

Is this SaaSacre Part II? How can startups respond?

I. What are the expectations for enterprise software spending?

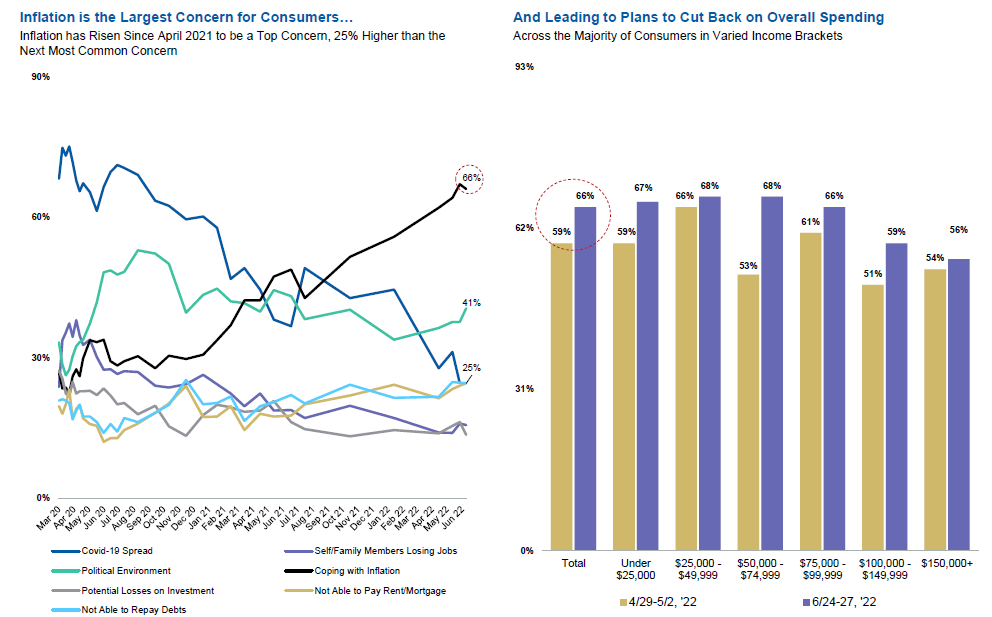

With US inflation skyrocketing to a 40-year high of 9.1% last month, inflation is unsurprisingly a top concern amongst consumers, with a majority of consumers planning to cut back on spending in the near term:

Source: Morgan Stanley Tech ECM: Preparing for Earnings and 2H22 Report (July’22)

Like consumers, companies are feeling pressure from the macro backdrop and enterprise purchasing behaviors are changing. Last month, JP Morgan surveyed 142 CIOs responsible for $114B in annual enterprise IT spending. The survey found that sentiment leaned more toward a slowdown or recession versus normal or robust economic health:

Source: J.P. Morgan CIO Survey 2022 (7/22/22)

How does this apprehension translate into IT spending? Just this month, Morgan Stanley found that CIOs expected annual IT spending growth to decelerate across all IT sectors (left chart below), but with software continuing to be the fastest growing sector.

Source: Morgan Stanley 2Q22 CIO Survey Takeaways (7/13/22)

Enterprise IT budgets are effectively contracting in real terms as budget growth is no longer keeping on pace with inflation. For comparison, from 2016-2019, JP Morgan found that CIOs have set their IT budgets to grow 3-4% when US CPI ran at 1-2%. Additionally, in a marked reversal from previous quarters, more CIOs believe there will be less upward budgetary revisions (right chart above).

II. Why do expectations matter?

A textbook definition of a recession involves two consecutive quarters of real GDP contraction. Real GDP data for 2Q will be released this week, and while the “technical” threshold for a recession is likely to be triggered, most of the GDP decline in 1H22 was attributed to idiosyncratic factors (such as geopolitical impact). The labor market remains strong, and there is reason to believe that inflation will start coming down in July. So one might ask: is this actually a big deal — why should we be worried about these pull-back expectations if they may not actually be realized?

In macroeconomics, expectations can be a powerful force that influences actions which end up shaping a self-fulfilling reality. For instance, if enterprise leaders have a negative outlook on future demand, they might pull-back on spending or conduct layoffs to prepare for bleak conditions. This causes a reduction in aggregate demand. In response to this initial demand drop, other companies and individuals also reduce investment and consumption, and the cycle continues. Following Keynesian theory, there is a reverse effect of investment multiplier, and a downward spiral could ensue, causing the bearish expectations to materialize.

Tech layoffs are already happening. Additionally, CIOs are taking actions to prepare for a worsening economy, which could be the initial catalyst of the aforementioned domino effect that instigates a slowdown. JP Morgan found in its recent survey that a small majority of CIOs indicated that they plan to delay or defer IT purchases in the second half of 2022 (chart below). While not necessarily alarming, this proportion is higher than benchmarks from regular economic conditions.

Source: J.P. Morgan CIO Survey 2022 (6/22/22)

III. What categories might be impacted the most?

McKinsey found that in previous recessionary periods, IT spending tends to fall by a factor of at least two compared to GDP decline. As highlighted in Section I, software is expected to demonstrate resilience compared to other tech sectors. But within software, which categories will be the most insulated?

When CIOs were asked by Morgan Stanley about IT projects least likely to be cut in a worsening economy, security and data warehousing/business intelligence/analytics ranked top as the most defensible categories (chart below). It makes sense that these are “must have” categories as they directly impact an enterprises’ core business and day-to-day operations.

Source: Morgan Stanley 2Q22 CIO Survey Takeaways (7/13/22)

On the other end, on-prem, consulting, and desktop/laptop projects are the most likely to be cut, alongside software categories such as collaboration and blockchain. I note that several of these more discretionary projects tend to involve “nice-to-have” offerings (e.g. consulting), be newer initiatives with unclear return-on-investment (e.g. blockchain), or are categories prone to redundancy (e.g. collaboration).

IV. Where is the silver lining?

But a CIO’s mandate is not just about maintaining projects that keep the lights on. CIOs are also empowered to invest in strategic projects that can drive competitive advantage. This directive becomes increasingly important as economic conditions become more challenging.

When CIOs were asked by Morgan Stanley about key IT priorities in 2022 and where they expected the biggest areas of investment, the top categories primed for growth involved cloud computing, security, digital transformation, and several data infrastructure verticals including data warehousing/business intelligence/analytics as well as AI/ML (chart below). These are all essential categories that directly impact core business functions, efficiency, and/or topline.

Source: Morgan Stanley 2Q22 CIO Survey Takeaways (7/13/22)

The bottom categories involved legacy tooling, on-prem projects, as well as more frontier tech initiatives such as quantum computing. In other words, projects that did not result in immediate efficiencies or direct topline impact were deprioritized.

V. Is this SaaSacre Part II?

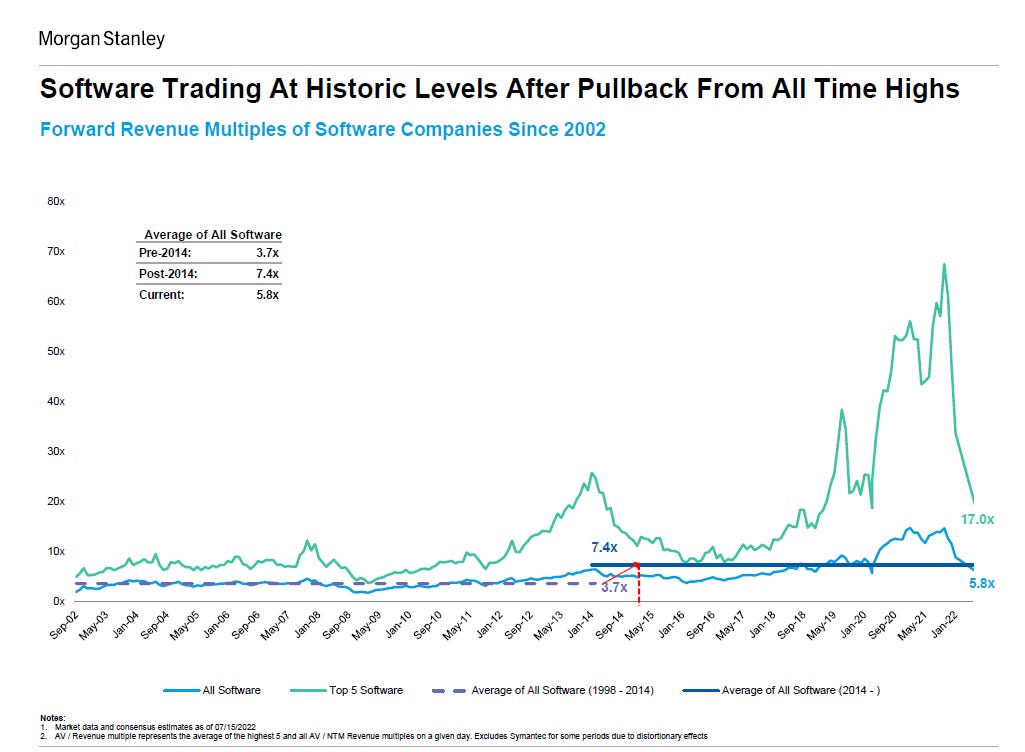

Putting everything into context, concerns of an imminent downturn will likely induce more forward guidance revisions in the coming quarters, which may cause volatility. But given that on average, software multiples are currently already under the long-term trailing mean (see chart below), some of this outlook seems to be baked in. So while there may be compression, it is hard to envision swings in the magnitude of the 60%+ reset across the cohort that we saw during the SaaSacre earlier this year.

Source: Morgan Stanley Weekly Software Data Pack (7/15/22)

Parting note: Defense and offense are equally important for cloud startups mounting a response in this macro backdrop

During the SaaSacre, companies that demonstrated strong efficiency scores emerged resilient. As highlighted, the resilient SaaS companies from this next wave of macro impact will be defined in two ways:

by their defensibility in the face of budget cuts

by their ability to seize opportunities as enterprises invest selectively in key tech priorities to adapt in challenging times

Mature companies can rely on legacy customer bases, brand recognition, and pricing power, for some buffer during downturns. While it may be tempting for startups to default into a defensive position right now (such as preparing and building in conservatism for longer sales cycles, pushed out deals, and pricing pressure), strategic offensive maneuvers are also important to capitalize on opportunities. Some ideas:

Pitch value in terms of top-line (i.e. a “must have” revenue-generator) rather than simply bottom-line (i.e. a “nice-to-have” cost-saver)

Convey ROI very clearly in quantitative terms (e.g. efficiency gains, dollars generated), especially when building new unproven categories or securing POCs

Focus on core use cases or champion personas that are the most sticky, rather than casting a wide net

Leverage organic distribution channels which tend to be more efficient (e.g. product-led growth)

Build thoughtful architecture such that your product is hard to rip-and-replace (e.g. integrate quickly into core workflows)

As I mentioned in a previous article, history has shown that some of the most iconic companies of a generation arise following major crises. Crisis breeds opportunity — while these times will be trying, there is cause to maintain optimism and keep staying the course.

Other ideas? Questions? Thoughts? Reach out to me on twitter @NextBigTeng!