SaaS IPO window inflection

Don’t fret, this isn’t another VC breakdown of Klaviyo’s S-1! Rather, here’s a perspective on shared characteristics of trailblazing companies that reopened previous software IPO windows…

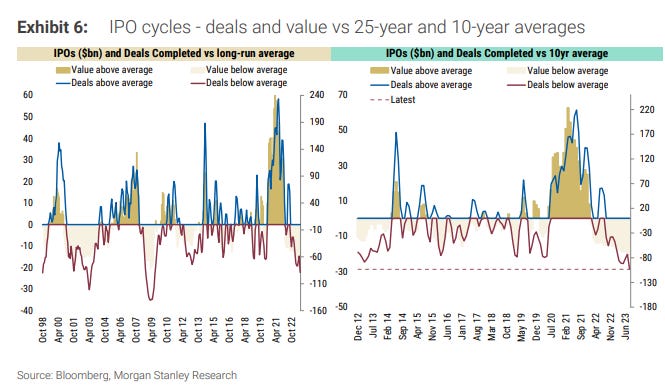

Following a frozen IPO window for venture-backed tech companies where we’ve witnessed one of the largest peak to trough IPO swings in history (chart below), the first signs of a thaw have emerged! ARM, Instacart, and Klaviyo, filed their respective F-1/S-1s last week. The announcement from marketing automation behemoth Klaviyo was met with much fanfare from the cloud community in particular since this represents the first pure-play SaaS company to file to go public after an almost two-year drought of SaaS IPOs.

In January this year, I wrote about the catalysts for a potential reopening of the SaaS IPO window. I pointed to visibility around the steady-state macro equilibrium as a core prerequisite. Conventional wisdom would suggest that increasing stability in macro-backdrop can serve to curb volatility. Lower volatility in turn “unfreezes'' hesitant behavior from market participants. This condition has somewhat come to bear in 2023. For instance, indicators such as cooling inflation and more consensus around future FED actions have helped to promote more stability:

Consequently, the CBOE VIX that tracks volatility has fallen from an average of 25.6 in 2022 to an average of 17.7 in 2023 YTD (chart below). This is more in-line with previous historical averages, paving the path for a more conducive market environment.

Benchmarking previous IPO reopenings

Given all the excitement, many VCs have comprehensively summarized Klaviyo’s S-1 (check out coverage from Jamin Ball, Tomasz Tunguz, Matt Turck, and Meritech Ventures). Instead of providing another S-1 breakdown, I thought I would offer some commentary on profiles of candidates that reopened previous SaaS IPO windows, and how Klaviyo stacks up to these trailblazers.

Bank of America identified that there were several shared characteristics amongst candidates that reopened the previous software IPO windows following crises such as the Dot Com Bust, Great Financial Crisis (GFC), and Pandemic Onset. These key characteristics included category leadership, attractive growth profiles, and strong scale with profitability:

Notably, across the three cohorts:

The post Dot Com Bust reopeners demonstrated the strongest growth profile on average, which may be indicative of the early days of software penetration at the time.

The post GFC reopeners demonstrated the strongest profitability profile on average, with a somewhat balanced growth to profitability ratio. This was likely aligned with the market mood following one of the most serious global financial crises since the Great Depression.

The post Pandemic Onset reopeners demonstrated the strongest scale profile on average, which may be representative of the progression and maturity of the software adoption curve nearly two decades after the advent of cloud computing.

From a metrics perspective, Klaviyo does indeed meet many of the key criteria embodied by previous SaaS IPO window reopeners, including:

Strong scale at $585MM LTM revenue vs. previous SaaS IPO window reopening candidate comps in the $66MM-$428MM range

Attractive growth profile with YoY revenue growth rate of 57% (keeping in mind that last year was a very challenging year for cloud companies) vs. previous SaaS IPO window reopeners falling in the 32%-128% range. For context, the current average revenue growth rate for the BVP Cloud Index cohort is ~21%.

Profitability with 8% free-cash-flow (FCF) margin. Previous IPO reopening candidates ranged from (14%) to 38%. Klaviyo revealed that it turned profitable in the first half of the year so this is a somewhat new development (at least since its bootstrapped years). While only at single digit FCF margin, Klaviyo has demonstrated a stronger profitability profile compared to other peers in the marketing automation space at time of IPO.

Impressive efficiency score of 65% which outperforms the Rule of 40 and is above the current BVP Cloud Index average efficiency score of 29%. Klaviyo has only utilized $15MM of the $455MM it had raised in primary capital throughout its lifetime, and the company stated proudly in its S-1 that “efficiency is part of our DNA”.

Fundamentals aside, perhaps more attention will be focused on where Klaviyo’s IPO will price since this could set a precedent for other SaaS candidates waiting in the wings. As seen in the exhibit below, during peak market frenzy in 2021, software IPOs priced at an average of 14.5x forward revenue. To bring things back to a sobering reality, the average forward trading multiple of the BVP Cloud Index is currently at 5.9x. TechCrunch reported that Klaviyo’s last private valuation was $9.5Bn as of May 2021. This would represent ~16x the company’s reported LTM revenue of $585MM, which is seemingly closer to the public comps from the exuberant times rather than today’s sentiments.

Regardless, Klaviyo’s strong fundamentals have set a high bar and checks many of the boxes of an ideal candidate to be testing the SaaS IPO waters. Congratulations to the team!

Great summary, Janelle!