Don't get IPObliterated: Preparing for the SaaS IPO window inflection

What do previous cycles indicate about when 2022's SaaS IPO winter might end? What can we learn from 2021's "IPObliteration"? Read on for ensuing catalysts, valuation disconnects, & landscape changes.

Early last year, I wrote about how “Tech IPO Winter” was upon us. That post was prescient as tech IPO activity, especially within SaaS, froze in 2022 due to deteriorating macro conditions:

While several tech companies such as Justworks and Chime formally delayed their plans to go public, Credo Semiconductor and Mobileye stayed the course in 2022 and performed relatively well in an otherwise bleak landscape — both stocks are currently trading at a premium to issue price and have experienced multiple expansion from time of IPO. Notably, there was a 272-day gap between these two major Tech IPOs of 2022, which is the longest break since 1990. Another interesting observation is that no pure-play SaaS company has dared to test the waters yet. Unsurprisingly, gaps in issuance are correlated with spikes in volatility (graph below) and, as I’ve discussed previously, 2022 has certainly been a year defined by unprecedented uncertainty for cloud companies across a multitude of secular and idiosyncratic indicators.

As the IPO candidate pipeline continues to swell, there has been a lot of discourse recently in the cloud world around when the IPO window might re-open. There was a surge in such banter last week following the news that fintech darling Stripe (the #1 company on The Cloud 100) had set a one year timeline to explore a public listing or private-market transaction involving liquidity for employees.

As the buzz grows, I share some notes on these topics which are top of mind for many of the founders I partner with as a growth-stage cloud investor:

What do previous cycles indicate about IPO window re-opening?

What does the “2021 IPObliteration” signal to future cohorts?

How different will the SaaS IPO landscape look in the future?

I. What do previous cycles indicate about IPO window re-opening?

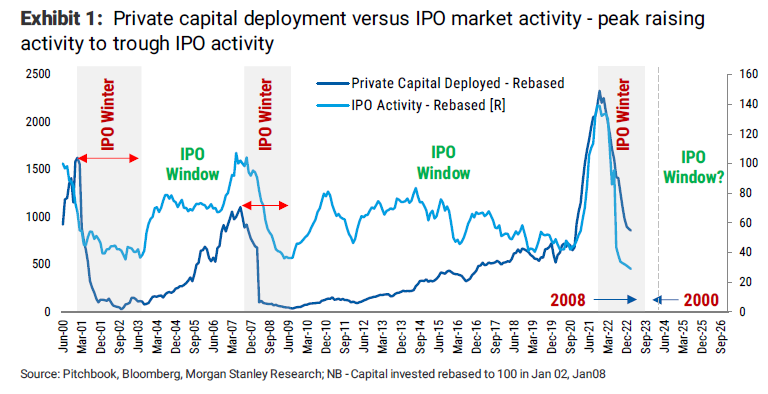

One heuristic to frame a hypothesis around when the IPO window might re-open is to use history as a guide and map this cycle to previous rebounds. Morgan Stanley conducted this analysis and found that:

If this cycle resembles 2008, the window could inflect as soon as Q3 of 2023

If this cycle resembles 2000, the window is more likely to inflect in Q1 of 2024

A big caveat is that while historical precedence could provide directional signals, there are many unique factors that drive divergence. One significant variable at play is monetary policy:

In the 2000 cycle, Fed cut rates 480bps from 6.5% to 1.7%

In the 2008 cycle, Fed cut rates 510bps from 5.25% to effectively zero

Today, we are in a disconcertingly different environment where the Fed has raised rates 400bps from effectively zero to over 4%

A rising/higher rate environment is likely to be a headwind to a robust rebound. Furthermore, a first order condition that likely needs to be fulfilled before a full window re-opening is a Fed pivot. Any discussion around full recovery of SaaS IPO activity is likely pre-mature until then, since growing visibility around steady-state conditions is a key catalyst to curbing volatility and “unfreezing” hesitant behavior from market participants.

II. What does the “2021 IPObliteration” signal to future cohorts?

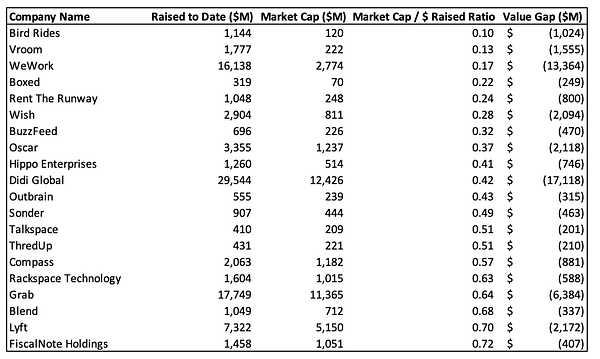

Potential IPO candidates are looking at the performance of the latest class of Tech IPOs for lessons and signals on market reaction. I did a deep dive on this about a year ago for the 2021 US-listed cohort. Bank of America recently refreshed a similar analysis for the software universe and found that the “2021 IPObliteration” still continues with only 3 companies from this cohort trading above issue price:

On a more positive note, ~70% of this cohort is still trading above last reported private valuation. Additionally, unlike other tech categories, SaaS companies do not skew value-destructive (as defined by having a market cap to equity raised ratio <1) and this is phenomenon is similarly reflected in the 2021 SaaS IPO cohort:

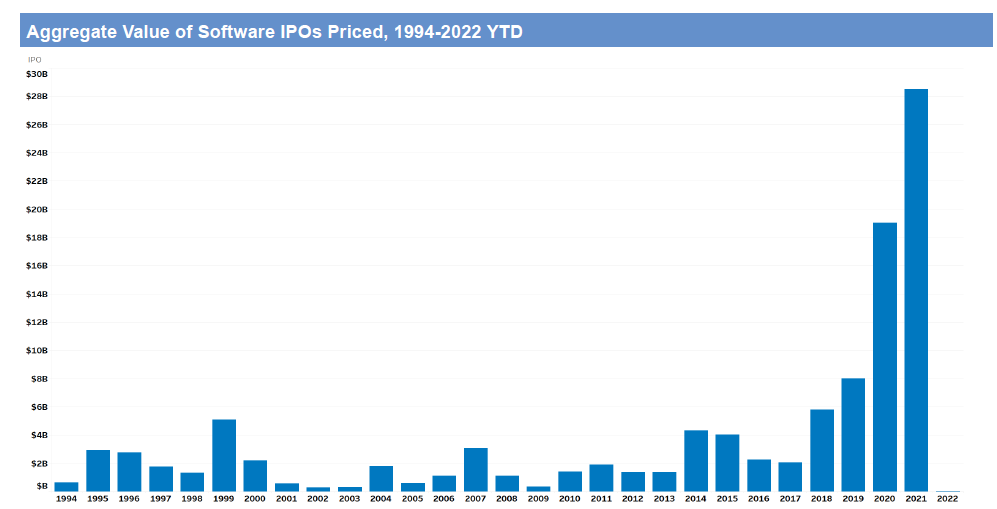

But what makes the current cycle so unique (and worrying) for potential IPO candidates is that 2021 marked historical peaks with the highest recorded levels on an absolute basis for private valuations and investment activity. This might foreshadow a more dramatic recalibration, and the current public market recoil already represents one of the most severe corrections in software downturn history:

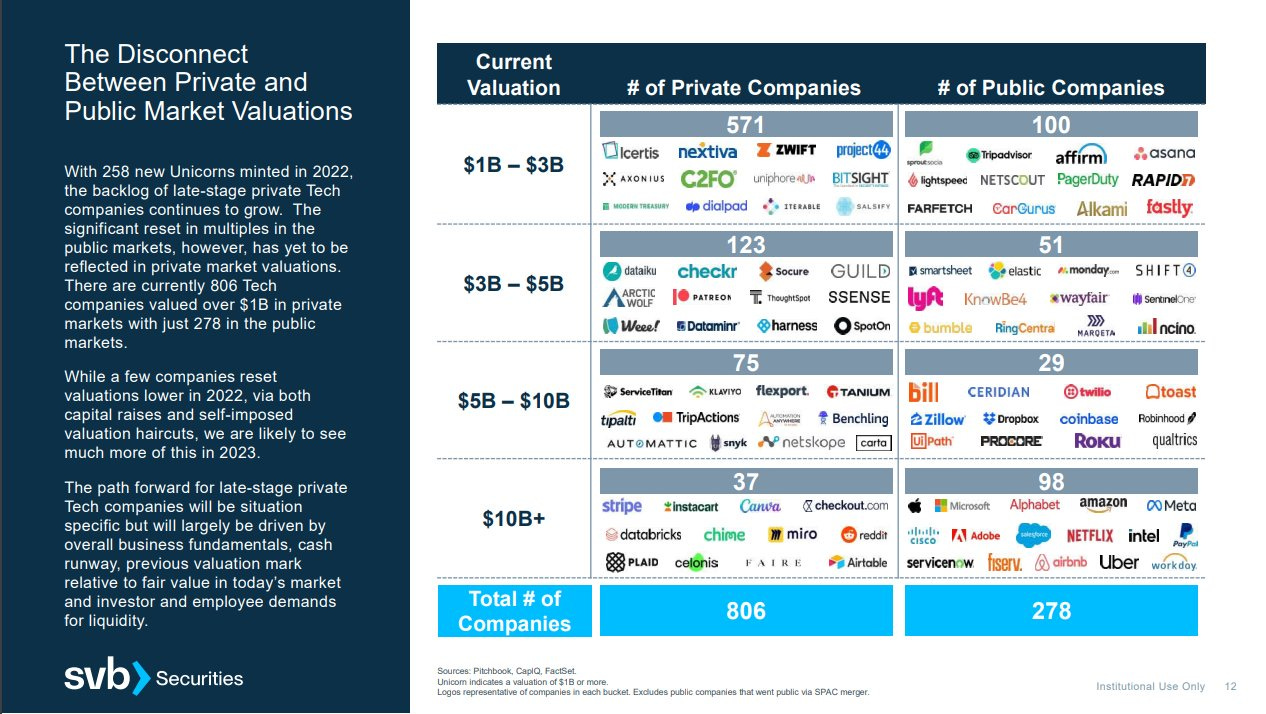

Many private companies have not been marked to market, and the public-private valuation disconnect is consequential — there are currently 806 private tech companies valued >$1Bn… and only 278 of such companies in the public market:

In the SaaS world, only 25 EMCLOUD companies currently have a market cap >$10Bn and the bar to reach this exclusive club is high — the median TTM revenue is over $2Bn and 80% of this group demonstrate positive free-cash-flow margins.

I’ve cautioned previously about impending shockwaves that are likely to ensue, especially amongst pre-IPO startups that raised during peak bubble conditions. Instead of the huge IPO “pops” which we have become accustomed to over recent bull-market years (chart below), we could possibly see more companies going public at a flat/downround to last private valuation when the window re-opens.

III. How different will the SaaS IPO landscape look in the future?

As I’ve noted before, unprofitable companies dominated the IPO landscape in previous years. Only 22% of tech companies that IPO’ed in the peak frenzy period of 2021 were profitable and this percentage was at one of its lowest levels outside of the dot-com years:

With the market shift in 2022, there is now a lower tolerance for weak fundamentals especially as it relates to capital efficiency and public companies are under a higher level of scrutiny to drive profitability. Today, in a complete reversal from the end of 2021, the average FCF margin of the BVP Nasdaq Emerging Cloud Index cohort is positive, and efforts to improve profitability are being recognized and rewarded.

As public cloud companies set a new standard on what it means to be an efficient software business, I believe that successful SaaS IPO candidates of the future are likely to look very different from those of previous years, specifically around positive cash flow margins (not just blended Rule of 40), underlying profit structure (including items such as SBC… more on this in another article) and scale at public debut.

Many pre-IPO companies are coming to terms with the radically changed environment and adapting quickly. Some have already chosen to take a valuation reset while others are reassessing timeline (even if the window re-opens) in order to strengthen profitability. Regardless, pre-IPO companies currently in holding pattern should leverage this preparation period to take stock of fundamentals and return to first principles.

This is amazing