Tech IPO Winter is Here: Who survived the frosty conditions and how "frozen" is the window?

Following last year's boom, global Tech IPO activity has lost momentum. 2021 US Tech IPOs have taken a blow, but several have endured through the turbulence. Read on for benchmarks and observations.

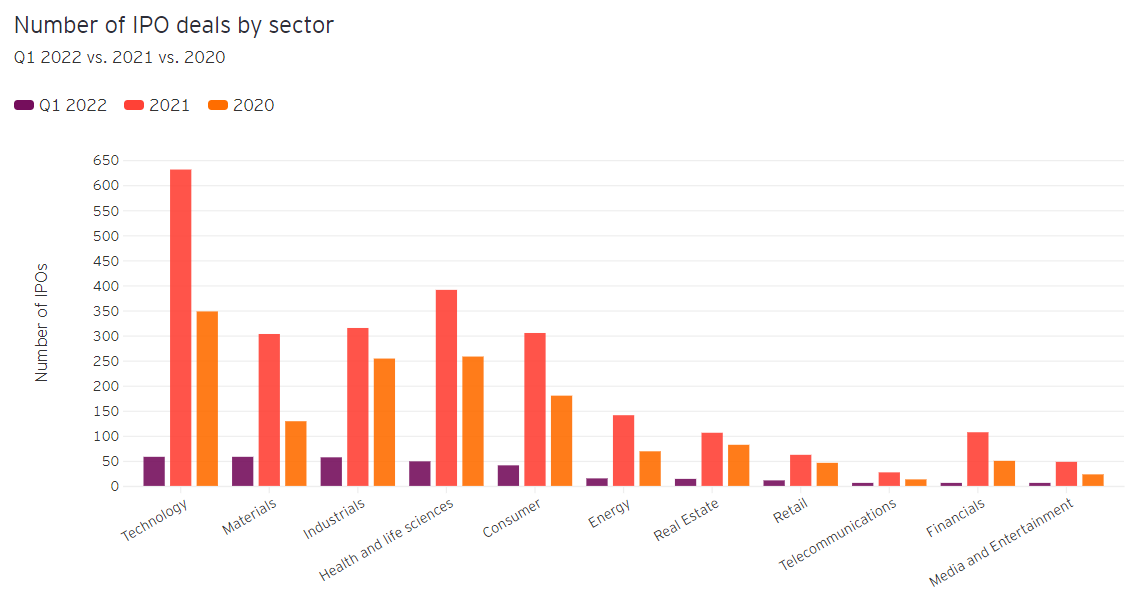

Source: https://www.ey.com/en_gl/ipo/trends

“You’re hot then you’re cold” pretty much sums up investor sentiment in the Tech IPO market over the past few quarters. As seen in the chart above from Ernst & Young, 2021 witnessed a record high of 631 IPOs1 (not including SPACs) globally within the Tech sector, which marked an impressive 81% increase from 2020.

Underscoring the immense level of excitement in the Tech IPO market, only 22% of tech companies that IPO’ed in 2021 were profitable. This percentage was at one of its lowest levels outside of the dot-com years2:

Graph created using data from: https://site.warrington.ufl.edu/ritter/ipo-data/

But after an unprecedented 2021, the tide has turned quickly. Aligned with a wider slowdown in global IPO activity experienced across all sectors, there were only 58 Tech IPOs in Q1 2022, marking a ~70% decline in deal activity QoQ.

Beyond decelerating deal activity, there was also a slight shift in 2022 in terms of sector dominance by proceeds. Tech IPOs raised a staggering $149.1Bn in proceeds (+67% YoY) last year, which was the highest quantum across all sectors. But Tech’s streak of seven consecutive quarters (since Q2 2020) raising the highest IPO proceeds across all sectors was broken in Q1 2022. While the Tech sector ranked highest by IPO deal count in Q1 2022, it came in second by proceeds to the Energy sector. Energy IPOs raised US$12.2Bn in Q1 2022, in large part driven by LG Energy Solution’s mega IPO on the Korea Exchange, compared to US$9.9Bn from Tech IPOs.

Source: https://www.ey.com/en_gl/ipo/trends

Amidst this slowdown and a backdrop of deteriorating macro conditions, several tech companies, such as Justworks and Chime, have formally delayed their IPOs, while others such as Reddit have been in a bit of a holding pattern. I spend most of my time in the growth-stage cloud world, where many companies have near term IPO aspirations and are closely monitoring window openings. Several are also curious about how their sector peers who went public recently have fared. In this piece, I look at:

How has the latest cohort of US-listed Tech IPOs performed?

What can we learn from the experience of the 2021 US-listed Tech IPO cohort?

What are the implications for cloud teams thinking about an IPO in the near term?

I. How has the latest cohort of US-listed Tech IPOs performed?

As I outlined in my previous article on the recent SaaSacre, I believe that the evolving macro environment and changing investor risk preferences are the main drivers for the marked reversal in investor sentiment toward growth stocks (including Tech IPOs). It is thus not unexpected that we witnessed a Tech IPO slowdown in Q1 2022, but what did the evolving market dynamics mean for tech companies that IPO’ed recently?

To this end, and since I partner most closely with companies looking to list in the US, I chose to examine the performance of the 2021 class of US-listed Tech IPOs. For this set of data, I looked at the 124 names curated and covered by Morgan Stanley in their weekly Tech IPO benchmarking deck3.

At a high level, the overall score card was disappointing. As of mid April 2022:

86% of cohort are currently trading under IPO price

97% of cohort have fallen under IPO price at some point after going public

-36.3% average gain/loss from IPO price

-61.9% average gain/loss from 52-week high

In my SaaSacre deep dive, I discussed how valuation lenses have shifted to focus more on growth + profitability and not just growth alone. I also proposed how companies with the strongest fundamentals in terms of efficiency score (as defined by revenue growth plus free cash flow margin) were the most resilient through the recent pull-back. While it was clear that the entire class of 2021 US Tech IPOs had taken a battering this year in a similar fashion to high-growth cloud stocks, I wanted to test if my hypothesis around efficiency score resilience held true amongst this cohort.

Segmenting the cohort into efficiency score quartiles (with the median current efficiency score at ~45%), I found that newly-IPO’ed tech companies with the lowest efficiency scores proved to be the least resilient through the pull-back. As visualized in the chart above, the weakest 2 quartiles of companies are currently priced on average at 39-61% below IPO price, and experienced 58-74% compression from peak prices. This is in contrast to the top 2 quartiles currently priced on average at 22-24% below IPO price, having had less severe compression of 55-60% from 52-week highs. Notably, the impact was most pronounced for the bottom quartile in particular, and only 1 company in that quartile is trading above IPO price.

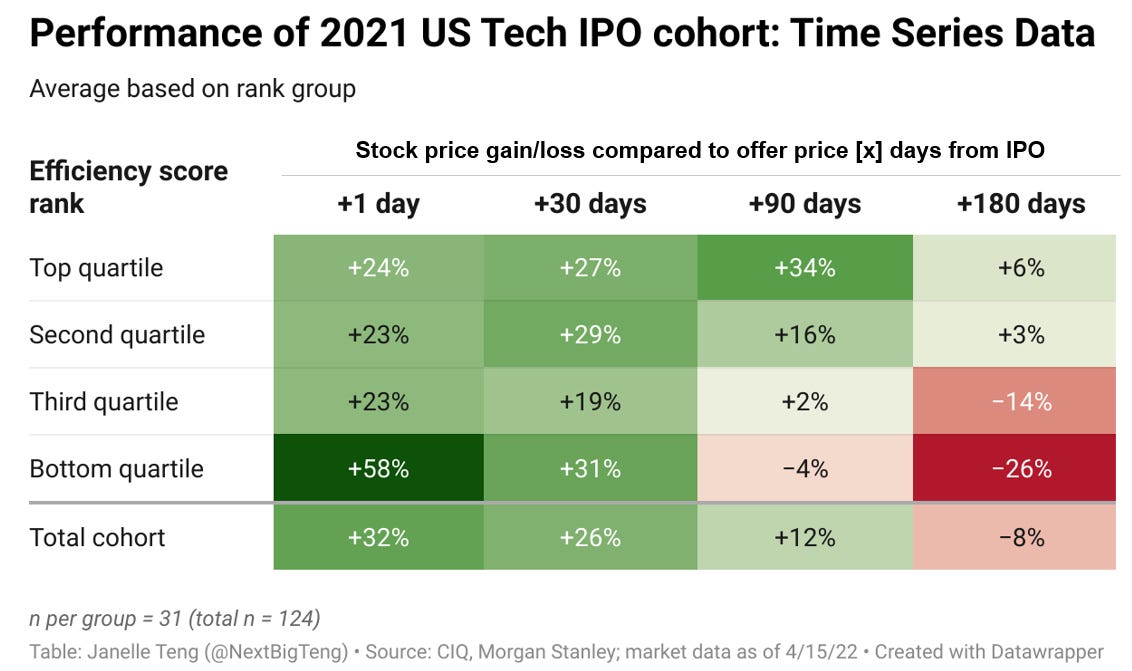

The trends were even more interesting when looking at a time series of performance data:

On average, companies from all quartiles saw a first-day “pop” on IPO price (+32% across the cohort). Surprisingly, the least efficient companies saw the biggest pop! The bottom quartile popped 58% while other quartiles saw gains closer to 25%. In fact, several companies that experienced the largest first-day gains across the entire cohort fall into the bottom quartile of efficiency scores. I examine some of these case studies in the next section.

While the least efficient companies received outsized attention initially, investors were quick to correct. The bottom quartile of companies experienced the most accelerated price declines over time compared to other quartiles. As I discuss in the next section, stock prices ultimately tend to regress to fundamentals and business performance.

Around the time of the first quarterly earnings report, companies in the bottom quartile were on average already trading below IPO price despite posting the largest first-day gains. In contrast, the top quartile of companies not only managed to sustain first-day gains but even slightly exceeded them at the 90 day mark.

Although all quartiles eventually took a hit from their initial gains, by Day 180, companies in the bottom 2 quartiles were on average trading significantly below IPO price while companies in the top 2 quartiles were still in the green.

II. What can we learn from the experience of the 2021 US-listed Tech IPO cohort?

From the findings above, I note a few observations —

1. Declining tolerance for weak efficiency scores: In a bull market or low interest rate environment, investors may be less discerning — ignoring fundamental weaknesses, pricing to perfection, or factoring in too much optimism — as they seek to deploy capital at the most attractive risk premium. This blind spot is further compounded by the inherently risky and challenging nature of evaluating newly-listed companies which tend to lack trading history, research coverage, and a substantial track record of earnings reports.

But as the patriarch of value investing Benjamin Graham forewarned:

“The market is a pendulum that forever swings between unsustainable optimism and unjustified pessimism” and “in the short run, the market is a voting machine, but in the long-run, it is a weighting machine”.

Clarity regarding the business performance of a newly-public company emerges over time which reduces speculation. And with macro conditions evolving, the market is moving faster than ever to re-assess each company’s fair value based on core fundamentals, with a lowered tolerance for companies not growing efficiently. As shown in Section I, newly-listed companies in the bottom quartile of efficiency scores have been penalized the most during the pull-back. Some examples:

Motorsports Games saw an impressive +75% “pop” at IPO, only to disappoint optimistic forecasters by not only failing to meet growth expectations, but also significantly increasing losses over the year. It is the worst performing company (as defined by current price as a % of offer price) of the cohort and is currently at ~5.0% of its IPO price.

Cloopen Group, which posted an outstanding first-day gain of +200%, is now at ~8.8% of its IPO price. The company had been hyped as “China’s Twilio” despite having weaker margin profile, more entrenched cost dependencies, and less pricing power, compared to competitors.

2. The reinforcing effect of availability bias: Another exacerbating factor beyond favorable macro conditions that may have helped to prop up less efficient IPO assets throughout most of 2021 is the phenomenon of availability bias. To quote Seth Klarman from “Margin of Safety”:

“When the overall market is strong, the rising tide lifts most ships. Profitable investments are easy to come by, mistakes are not costly, and high risks seem to pay off, making them seem reasonable in retrospect.”

The availability bias postulates that people tend to overweight new information or recent events without considering objective probabilities over the long run. In the capital markets, this might manifest in terms of panic selling during crashes and bullish buying into “bubbles” as recent market news is most easily recollected while making these investment decisions.

Source: https://www.renaissancecapital.com/IPO-Center

Using the performance of the Renaissance IPO Index4 (charted above) as a proxy for the broader US IPO market indicates that this asset class has been “booming” since early 2020 up till late 2021. Even through this period where valuations were at all-time highs, there was very much a perception of “things will always go up” as the magnitude of “pops” remained elevated, further reinforcing over-exuberance in an already buoyant market:

Source: https://www.nasdaq.com/articles/a-record-year-for-ipos-in-2021

Going in 2022, with the market sentiment turned, availability bias could likely now have the opposite effect on rebound.

3. Beware of mispricing due to representativeness: I infer from the data that a subset of companies were inaccurately categorized as “tech” companies due to representativeness heuristic. This led to confusion and mispricing early on. If a bird looks/swims/quacks like a duck, is it a duck? Well, not always. Just because a company…

participates in (and even headlines) prominent tech conferences,

was backed by tech-focused venture capital firms,

sells primarily to technology clientele or tech-savvy consumers,

employs a sizeable number of engineers,

derives a portion of its revenue from digital channels,

or states in its S1 that it is “technology-led” or “digitally-native”,

… does not immediately make it a SaaS, online marketplace, consumer internet, or broader tech company. Looking under the hood using financial statements tells a more unambiguous story about a company’s core business model. Reviewing prospectuses and coverage, it was surprising to discover how many companies were perceived to be tech companies despite their revenue quality and margin structure resembling more non-asset-light, non-recurring, or goods/services-oriented businesses.

Some of these companies in question may actually be growing more efficiently than contemporaries in their appropriate peer group due to their “tech-enabled” nature. But in a case of “paying the wrong price for the right company”, several of these companies were guided to/initially commanded multiples closer to premium tech comps instead of those of the proper peer set such as apparel, consumer goods, finance, or retail. Many of these companies experienced multiple compression over time, I believe driven mostly from this paradox, and are now trading closer to the basket of their more relevant counterparts.

4. Tangible impact of geopolitical turmoil: I would be remiss not to address the impact of geopolitical uncertainty on IPO performance in 2021:

The Chinese government took actions over the past year that were acutely felt by US-listed Chinese companies. Additionally, there has been increased oversight around audit practices for US-listed foreign companies which have placed several Chinese ADRs under scrutiny. 7 of the 10 worst performing (as defined by current price as a % of offer price) companies of the 2021 US Tech IPOs cohort are headquartered in Mainland China.

One example is Zhangmen Education which experienced the biggest first-day gain across the entire cohort but is now at less than 1% of its 52-week high price. The company had outlook altered following policy changes affecting specific sectors such as education.

Didi is another example and the company will hold an extraordinary general meeting next month to vote on its delisting plans in the US.

The ongoing and unjustified invasion of Ukraine affected newly-listed companies such as Cian Group, an online real estate marketplace based in Russia, which currently stands as the 13th worst performing company of the cohort.

IV. What are the implications for cloud teams thinking about an IPO in the near term?

While the next few quarters may not necessarily be the best time to test the window as markets continue to stabilize, cloud founders eyeing a near term IPO should still remain ambitious. Public market investors today understand and recognize the power of proven business models such as SaaS, and have appetite to support such high-quality companies demonstrating viable fundamentals even if a company is not yet profitable.

Still set sights high but take stock of fundamentals and demonstrate credibility toward achieving goals

Putting the findings into context, to increase the chances of not just a successful IPO but also enduring longevity in these volatile market conditions, it is important to do a careful examination of fundamentals as these will come under more scrutiny. In particular, demonstrating that your company can attain efficient growth with strong unit economics (not just growth at all costs), while laying out a credible path to profitability, will be key. This may also require an honest review of an appropriate peer set or re-evaluation of previous private valuations to anchor on the right set of expectations. Companies that are not yet at a level of maturity to put their best foot forward should not feel pressured to rush at any upcoming window, and should ensure adequate runway or prepare with alternative fundraising plans. All of this seems quite obvious to say, but surprisingly, in the peak frenzy of the last year, these were not always the practices followed by Tech IPO candidates.

Questions? Thoughts? Feel free to leave a comment or reach out to me on twitter @NextBigTeng!

The information set forth in this post is provided for informational and discussion purposes only. The views expressed herein are the author’s alone and is not intended to be, and shall not be regarded or construed as, a recommendation for a transaction or investment or financial, tax, investment or other advice of any kind. While certain information contained herein has been obtained from sources believed to be reliable, the author makes no warranty or representation regarding any such information or the data presented in such materials. The author assumes no liability for this information and no obligation to update the information contained herein in the future.

EY’s data focuses only on IPOs of operating companies. EY defines IPO as a “company's offering of equity to the public on a new stock exchange.” Public listings from trusts, funds and special purpose acquisition companies (SPACs), are not included. EY’s definition of “Technology industries” include computers and peripherals, electronics, internet software and services, IT consulting and services, other high technology, semiconductors, as well as software.

Prof Ritter’s data set includes 3,298 tech and 4,781 other (non-tech, non-biotech) IPOs from 1980-2021, after excluding those with an offer price below $5.00 per share, unit offers, ADRs, closed-end funds, partnerships, acquisition companies, REITs, bank and S&L IPOs, and firms not listed on CRSP.

“2021 US Technology IPOs” names curated in Morgan Stanley Tech data pack (as of 4/15/22): 1stdibs.com, Affirm, AiHuiShou, aka Brands, Alkami, Allbirds, Amplitude, AppLovin, AvidXchange, Blend Labs, Bumble, Cian, Cloopen Group, Coinbase, Compass, Coursera, Cricut, DiDi Global, Dingdong, Enfusion, Freshworks, FTC Solar, Full Truck Alliance, HashiCorp, Hepsiburada, Kaltura, LegalZoom, loanDepot, Missfresh, Motorsport Games, Mytheresa, Nerdwallet, On24, Onion Global, Oscar Health, Playtika, Poshmark, Remitly, Rent the Runway, Riskified, Rivian, Robinhood, Roblox, Samsara, Sophia Genetics, Sportsradar, Stronghold Digital Mining, The Honest Company, thredUP, Toast, TuSimple, Tuya, Udemy, UiPath, Viant Technology, VTEX, WalkMe, Weave, Zenvia, Zhangmen Education, Zhihu

This stock market index is designed to capture approximately 80% of the total market capitalization of newly public companies that have gone public within the last three years, and tracks IPOs from all sectors, including tech, healthcare, and industrials.

Thanks Janelle, well done. There is certainly a risk-off mentality at the moment.

One question. What period did you use to calculate efficiency?

Was it at the IPO, or the most recent quarter. If the most recent quarter, you might be capturing underperformance as much as you are capturing a particular profile. Said differently, these may be companies that have stumbled their way into the lower quartiles by missing expectations along the way. Those stocks will get hammered regardless of efficiency.

Either way, it's a good reminder to have your unit economics nailed prior to IPO.