UNICORN SIGHTINGS: 2021 unicorn highlights and predictions for 2022

2021 was a record year with unicorns being minted at an unprecedented pace. How did the herd evolve and what should we expect for them in 2022?

The term “unicorn” — used to describe a private start-up with at least a $1 billion valuation — was first coined by renowned venture capitalist Aileen Lee in 2013 because such companies were rare and hard to come across.

Fast forward to today, sightings of such unicorns are not quite as mythical. In the first quarter of last year, I examined how 2021 was shaping up to be a record unicorn year as unicorns were being minted at an unprecedented pace. In our State of the Cloud 2021 report published in March 2021, my colleagues and I identified several factors fueling this phenomenon within the cloud industry specifically, including the:

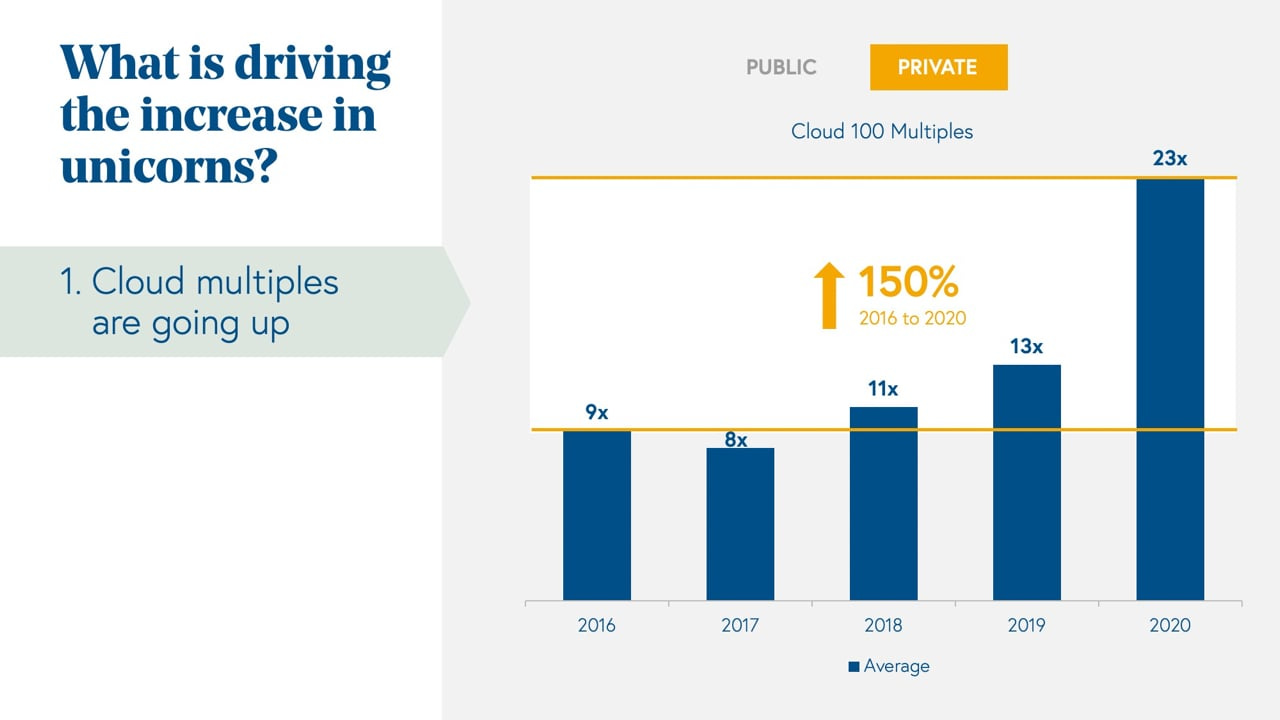

explosion in cloud multiples,

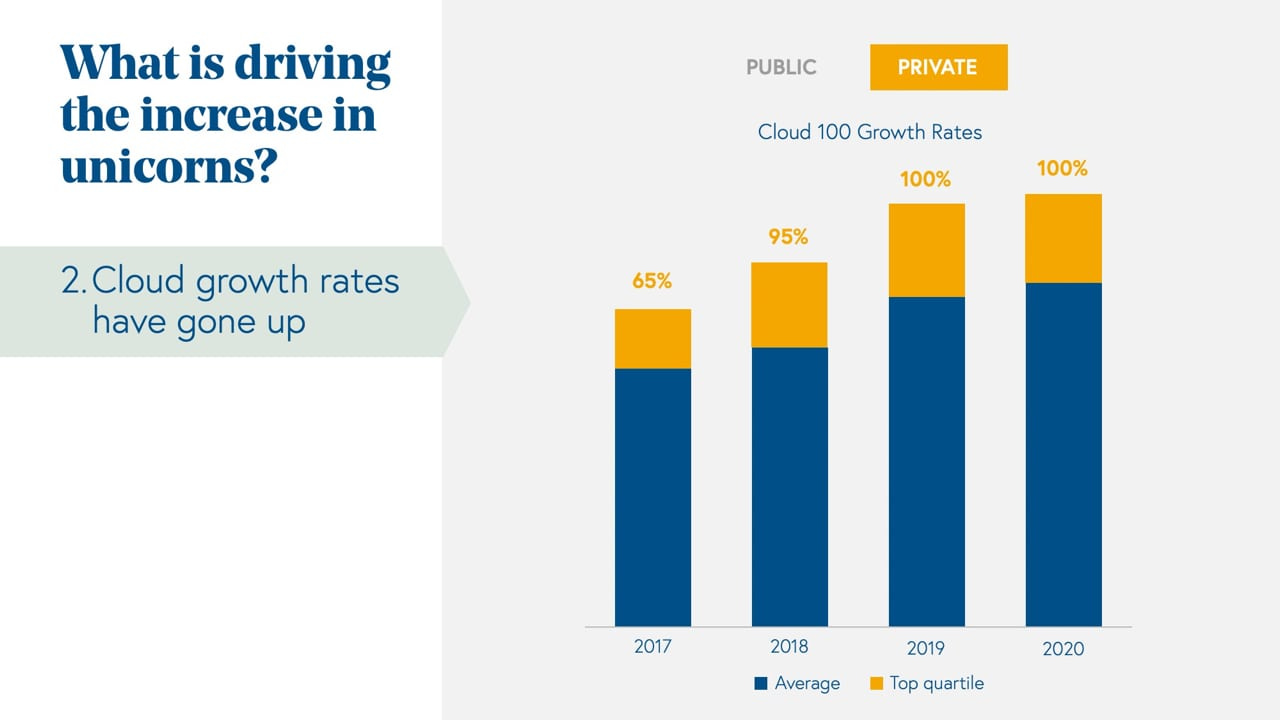

unprecedented growth rates,

and demand and supply dynamics for best-in-class cloud companies.

As 2022 kicks off amidst a background of public market volatility (overall cloud median multiples are currently ~7% below pre-Covid highs, and while 2021 was a record year for IPOs, two-thirds of 2021 IPOs now sit below their offer prices with the average venture-backed company that listed in 2021 returning -45% from first-day close through Jan 14 2022), I was curious to revisit a full year’s worth of 2021 unicorn data to see how the herd evolved throughout the year following my last deep dive, and examine what might be in store for the herd in 2022.

At the end of 2021:

🦄 TOTAL NUMBER OF ACTIVE UNICORNS1: ~960 (+69% from 2020)

💰 TOTAL CUMULATIVE VALUATION: >$3.1 TRILLION

🔟 PERCENTAGE OF DECACORNS2: 5%

Here are some interesting findings when looking at the full year of unicorn data:

Unicorns are still being born at an unprecedented pace… but will this last into 2022? Before 2014, appearances from new unicorns were few and far between in the single digits. In line with the trend emerging at the start of 2021, new unicorns continued to be birthed at an unprecedented speed throughout the year. 510 new unicorns joined the herd in 2021; this represents ~2 new unicorns per business day! 2021 unicorns now outnumber the total number of active unicorns in the herd pre-2021… which means more than 50% of active unicorns first became unicorns in 2021!

Should we expect this trend to continue in 2022? As noted by my colleague Mary D’Onofrio in today’s WSJ report, the recent pull-back in public market multiples is likely to put pressure on private valuations. This is attributed to the fact that venture investors, especially at the growth stage, often track the performance of comparable public companies and factor these into entry prices for VC deals. Based on this logic and assuming no disconnect between private and public markets, we should anticipate the velocity of unicorn birth rates to slow down in 2022 as private market optimism adjusts to the cooling public market conditions.

Global unicorn distribution remains enduring. As we saw in Q1 2021, unicorns are a global phenomenon, driven by thriving entrepreneur communities and ecosystems across the world. This trend held up throughout the year, with a special mention to India for rising to become the third largest active unicorn market behind the U.S. and China. India experienced a record number of unicorn births in 2021, including newly-minted unicorns such as Bessemer portfolio company MyGlamm joining this distinguished, multi-national herd.

During the global pandemic, entrepreneurs, operators, and investors have increasingly recognized the power of the distributed workforce model. Pairing this with the overarching philosophy that entrepreneurship is borderless and that outstanding innovation happens in many different parts of the world, I believe that we will continue to see more global unicorn births as valuable companies are increasingly being built away from locations that are perceived to be “traditional” entrepreneurship hubs. In fact, international representation on our Cloud 100 list (the definitive ranking of the top 100 private cloud companies) reached a record high of ~30% this year and I expect this trend to endure for many more years to come.

Fintech unicorns shine brightly! While unicorns can be found across a wide range of categories which mirror wider trends in consumer behavior and enterprise digital transformation, a standout category is fintech which accounts for the largest unicorn representation from both a valuation perspective as well as total company count.

Leading the fintech unicorn charge is Stripe, the most valuable start-up in the US, which returned back to the #1 spot on the Cloud 100 list in 2021 after ceding the top spot to cloud data warehouse company Snowflake in 2020. Additionally, ~25% of current decacorns are fintech companies including the likes of Brex, Checkout.com, Chime, Klarna, Plaid, and Revolut.

The dominance of fintech unicorns over the past year is not surprising. Early in 2021, my colleagues and I had predicted strong momentum for fintech and crypto players going into the year as we witnessed pandemic tailwinds accelerating the rebuilding and redesigning of financial services infrastructure for the modern world. We also anticipated the proliferation of cryptocurrencies, driven by increased adoption and acceptance by companies as well as consumers.

Congratulations to all the founders and teams that have hit the unicorn milestone in 2021 — this is a remarkable feat and you should be proud to be in the company of many incredible peers. 2022 may be off to a turbulent start with more uncertainty up ahead, but I’m excited to see what this year holds in store for this herd of outstanding companies!

The information set forth in this post is provided for informational and discussion purposes only. The views expressed herein are the author’s alone and is not intended to be, and shall not be regarded or construed as, a recommendation for a transaction or investment or financial, tax, investment or other advice of any kind. While certain information contained herein has been obtained from sources believed to be reliable, the author makes no warranty or representation regarding any such information or the data presented in such materials. The author assumes no liability for this information and no obligation to update the information contained herein in the future.

Raw data set from CB Insights: https://www.cbinsights.com/research-unicorn-companies