Unicorns are dead. Long live Unicorns!

Despite several recent high-profile unicorn shutdowns, reports of a unicorn mass extinction event may be greatly exaggerated. But the herd certainly needs to get fit fast in order to ensure survival.

It’s no secret that 2023 has been a brutal year for startup shutdowns. On an absolute basis, The New York Times reported that 3200 private VC-backed US companies have gone out of business this year. On a relative basis, Carta’s data indicates that startup shutdowns are up ~50% since last year and up ~300% since 2019. Morgan Stanley reported that startup shutdowns in 3Q23 were 4x higher than typical levels, marking the fastest pace in history at which these causalities were piling up:

Taken in a vacuum, these stats may not seem shocking in startup world where survival rates are already expectedly low; and many in the industry have been prophesying a reckoning of shutdowns following an era of private market overexuberance. Some have even gone so far as to predict an impending “startup mass extinction event”:

However, some additional context makes the current tidal wave of startup shutdowns feel distinctly different from those of previous years. According to The New York Times, companies that wound down this year had raised an eye-watering $27.2Bn in venture funding. Carta estimates that shutdowns amongst startups that have raised at least $10MM has increased by a whopping 2.38x since last year (chart below). This trend has raised eyebrows since it would be logical to assume that later-stage businesses armed with multiple rounds of capital would have a higher chance of survival versus very early-stage businesses that have not yet raised copious amounts of money.

In particular, the high profile shutdowns of unicorns such as Convoy (raised $900MM), Olive AI (raised $852MM), and Veev (raised $647MM), over the past few weeks have sent shockwaves through the ecosystem, since it has been rare to see these ‘mythical’ creatures go out of business in such staggering numbers. One would expect unicorns to have already hit product-market fit before being awarded a $1Bn+ valuation by investors, or be at a sufficiently mature stage from a business perspective to transition into default alive mode. Articulating this sentiment as it profiled a former unicorn darling Evernote, The New York Times wrote in 2019:

“For fledgling companies, taking enough investor money to become one of these magical ungulates was supposed to show customers, employees and the world that they were sure bets — that they were too special and big and valuable to fail.”

Yet, the string of recent unicorn graveyard case studies, as well as the bankruptcies/shutdowns of former unicorns that have recently graduated to the public markets (such as WeWork which raised more than $11Bn as a private company and SmileDirectClub which raised more than $430MM as a private company) provide a stark cautionary tale that no startup, regardless of stage or total amount raised, is immune from this unfortunate fate.

So we’ve observed many unicorn corpses recently and are expecting more; but what’s happening on the other end around unicorn birth rates?

During peak hype in 2021, new unicorns were being born at an unprecedented pace of ~2 new unicorns per business day. 2021 was also a notable year for the herd since the number of new unicorns minted in 2021 outnumbered the total number of active unicorns pre-2021. The speed of unicorn births was so prolific that I ran a weekly “unicorn blotter” internally for my team just to keep track of these announcements.

Unsurprisingly, as we exited a ZIRP environment at the start of 2022, unicorn births quickly saw an inflection point as the VC market reacted quickly in terms of reducing the number and size of new unicorns:

If births are down and deaths are up, does this imply that the herd is headed for a quick extinction?

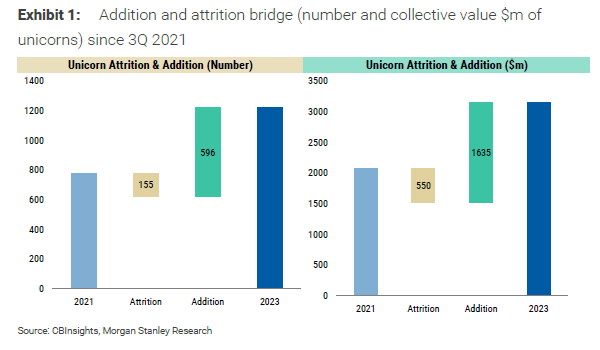

Well, not quite. As Mark Twain once said, “the reports of my death are greatly exaggerated”. In a similar vein, based on current data, the unicorn herd will assert that rumblings of their impending extinction are severely overstated. Post the market shift in early 2022, Morgan Stanley found that unicorn additions still outpaced attrition by almost a factor of 4:

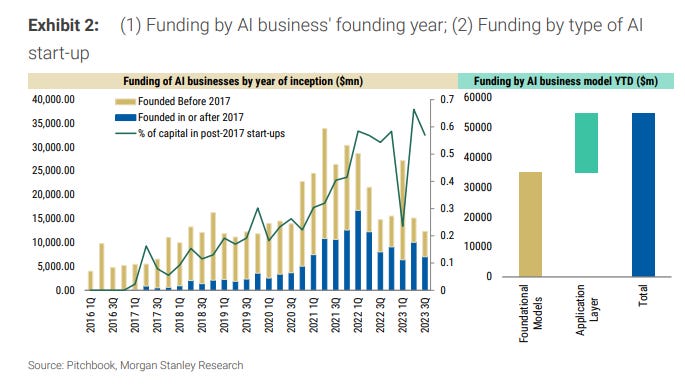

On the addition side of the equation, it should come as no surprise that the current AI revolution has fueled an explosion of a new kind of unicorn species: AI unicorns (graph below). Crunchbase reports that one in five of new unicorns to join the herd this year were AI companies. Observing early signals of this trend, CB Insights reported earlier this year that “generative AI is churning out unicorns like it’s 2021”.

I’ve also written previously about how the most highly-valued GenAI unicorns are foundational model companies, and this cohort has captured the bulk of VC funding this year (exhibit below). As a sign that this trend may not wane any time soon, Mistral AI, a Paris start-up focused dubbed as a European rival to OpenAI, announced a €385 million Series A earlier this week, propelling the company into the unicorn herd less than seven months since it was founded.

On the attrition side of the equation, there are multiple ways for a unicorn to leave the herd such as either by graduation through an exit event such as IPO or M&A, or by falling out of the $1Bn-valuation club through a downround or shutdown. Approximately half of the current US unicorn herd have 2 years or less of cash runway left, so we are yet to see the full impact of unicorn attritions until this reckoning hits:

Darwinian principles apply more than ever before

While it’s been a decade since Aileen Lee first coined the term “unicorn”, I agree with her sentiments in a recent interview that the unicorn legacy is far from over, especially given a resurgence of the herd due to an AI boost. However, the herd needs to get in shape fast. As it currently stands, the median unicorn’s fundamentals do not paint a rosy picture for survival (chart below), particularly if many of them are burning through a limited cash runway in the short term. Even for those unicorns that do survive, the future may not be bright, with investors warning of the emergence of “zombi-cons”, which are unicorns that can run at break-even but are stuck in zombie mode as they are unable to grow and muddle along on this path for years.

Entering the unicorn club is certainly an achievement to be celebrated since this is a significant milestone for any startup to attain. However, the unicorn accolade is ultimately rooted in valuation rather than core business fundamentals. This is why my teammates and I at Bessemer believe that it is important to layer on additional milestones such as Centaur status (companies that have reached $100MM ARR) which focus on the health of the business. In an environment where only the fittest (not the ones who have raised the most money or have the highest valuation marks) will survive, it is perhaps more useful for a startup to orient around a north star grounded in fundamentals rather than vanity metrics.