The Fed is bringing the punch bowl back… what happens to SaaS and AI multiples now?

We’re at a major turning point in monetary policy which is cause for celebration, but recent observations suggest that software investors shouldn’t pop the champagne just yet.

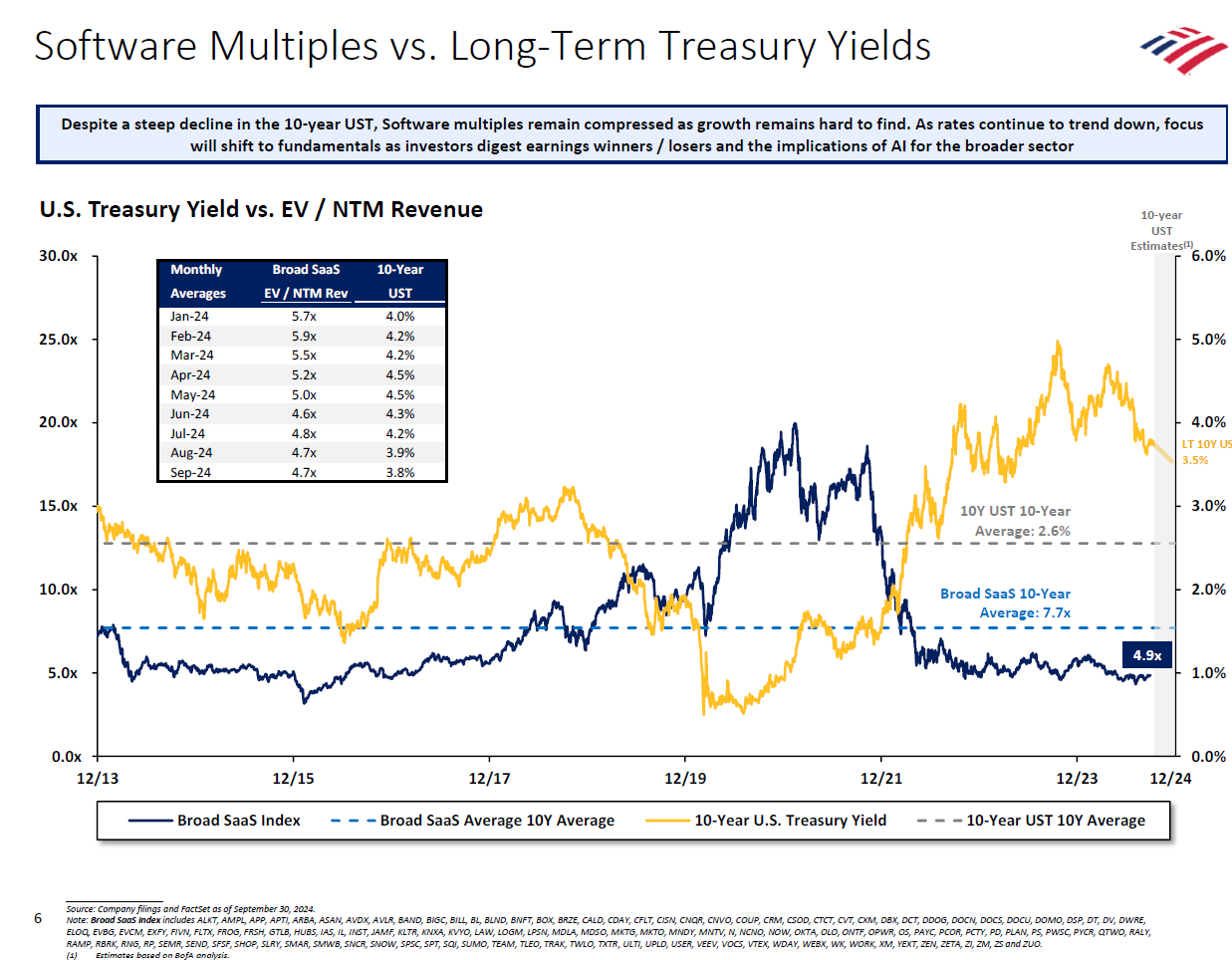

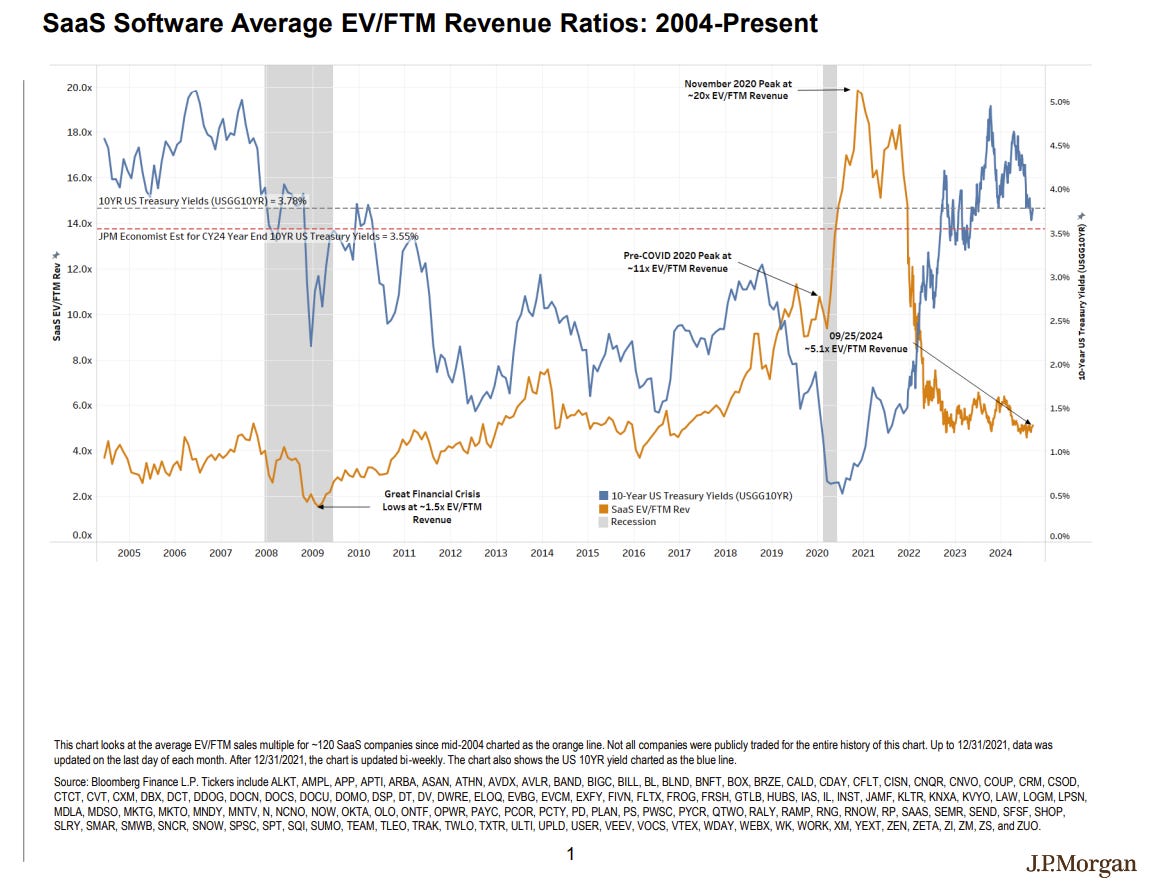

I’ve posited multiple times before that interest rates are inversely related to software multiples (chart below). This relationship is especially pronounced for high-growth software companies that derive a greater portion of their value from longer-term future earnings, since the present value of their future cash flows tends to be considerably discounted in a rising interest rate environment.

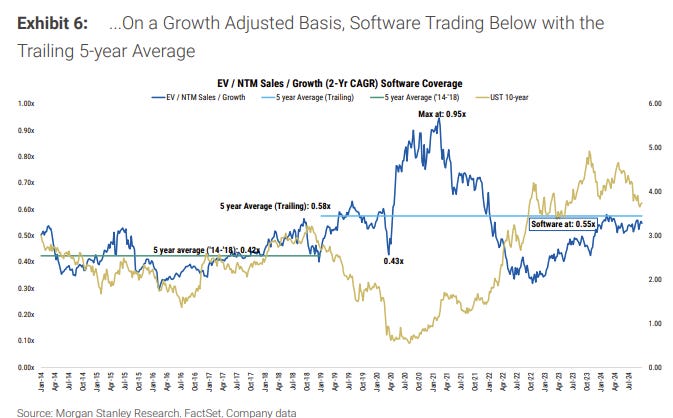

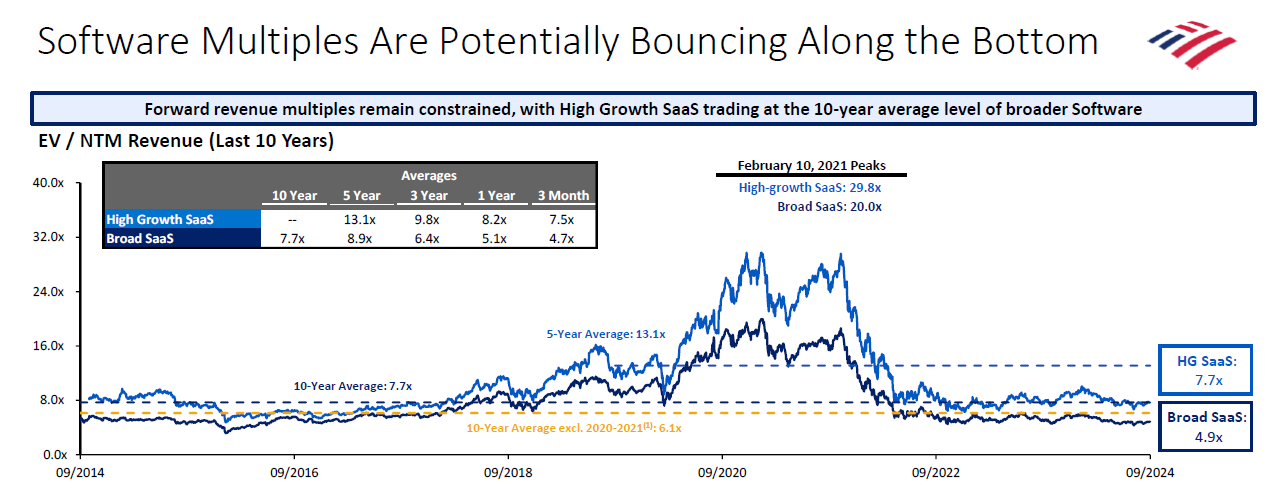

Unsurprisingly, last month’s rate cut announcement by the Fed was welcome news to SaaS investors, particularly since software stocks have been trading below trailing 5-year averages on both an absolute and growth-adjusted basis:

While this major turning point in monetary policy is cause for celebration, I caution software investors from fully rejoicing just yet. Diving deeper into the most recent period indicates that despite declining 10-yr US Treasury yields (falling to under 4% in August 2024), SaaS multiples have remained somewhat flat, which is an unexpected observation based on the conventional wisdom described earlier:

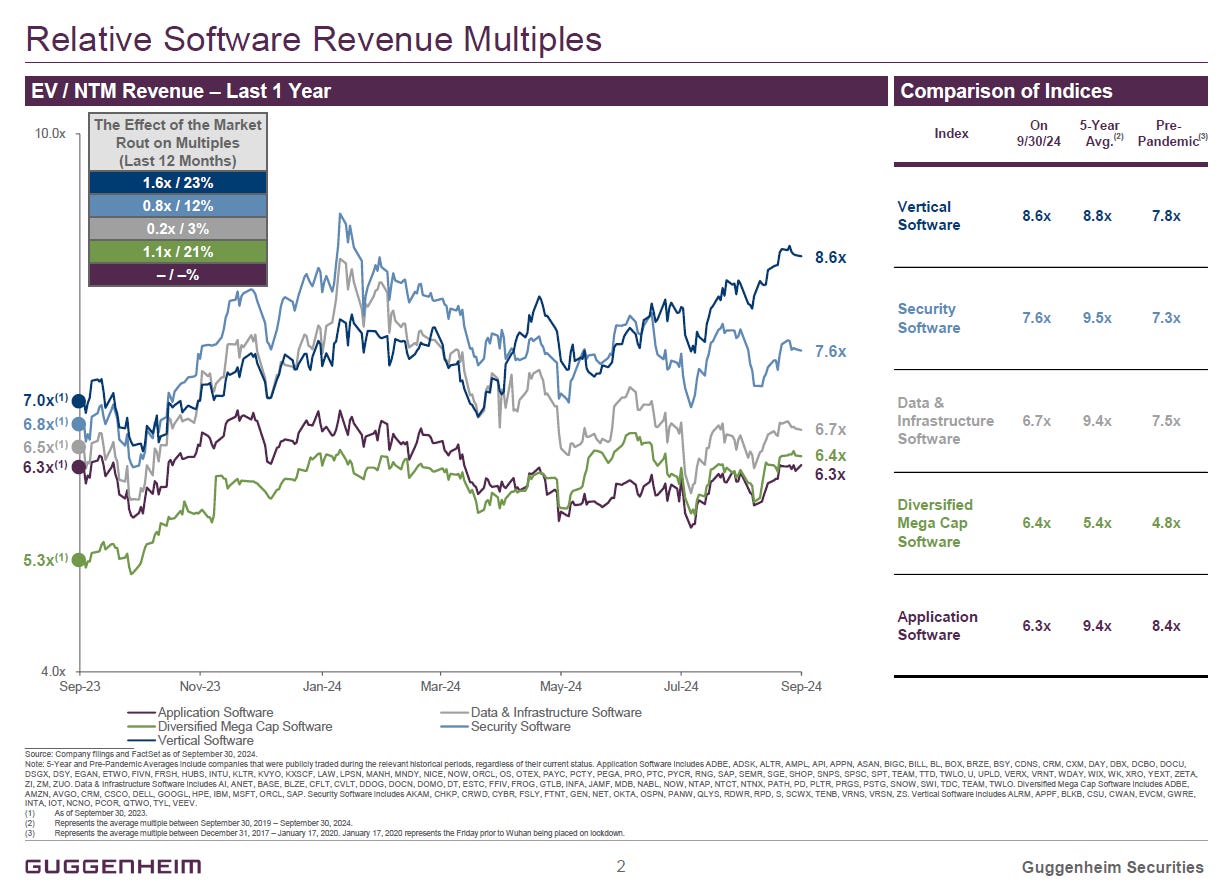

Indeed, software multiples did not massively move following September’s rate cut announcement (chart below). This response is perhaps not too shocking given markets across different asset classes had priced in rate cut expectations prior to the September announcement, but as the data below shows, software multiples (particularly for small/mid-cap infra and app cohorts) still appear somewhat muted.

I’ve written previously about how to think about multiples in stable state. The impact of interest rates on multiples is just one component of the valuation equation. Fundamentals are another key defining factor which drives market demand and provides a basis to explain why different types of business — say a software business versus a services business versus a manufacturing business — trade at different absolute multiples and on different valuation heuristics.

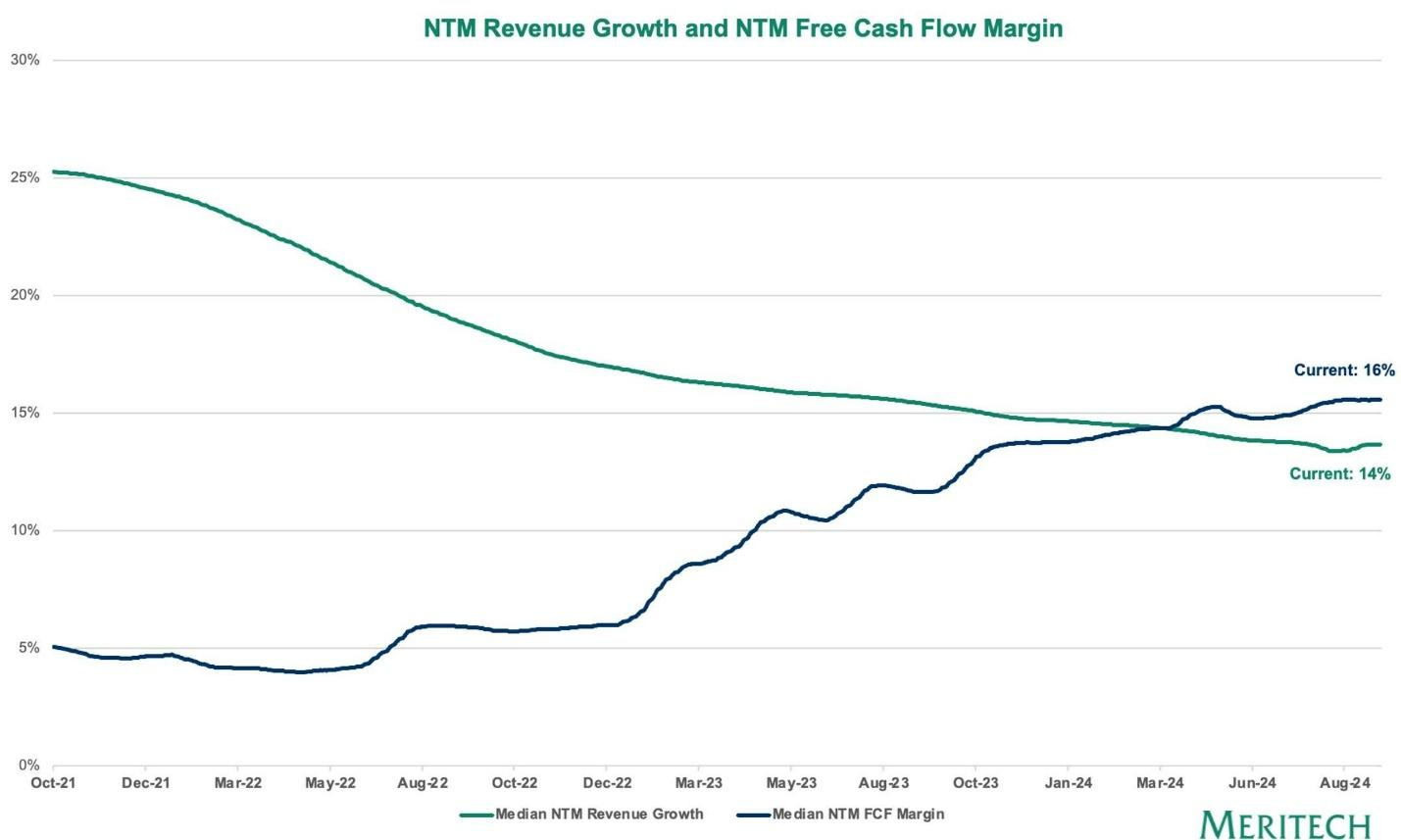

The fundamentals of SaaS businesses have come under great scrutiny in recent years, from debates about growth vs profitability tradeoffs to recent discussion about the potential death of SaaS. Taking a very high level view, the public software cohort is currently showing weakening on growth and plateauing on profitability metrics (chart below). While interest rate policy may now be stimulating, all of this deliberation around fundamentals may have impacted market optimism and dampened the perceived attractiveness of software as an investment category.

As VCs, we make investments in current conditions but need to underwrite assumptions in anticipation of future conditions at exit. So as we enter a new policy paradigm, key questions emerge in this environment for private market SaaS investors:

Even as interest rates drop, if public market investor demand for SaaS stocks continues to be persistently tempered by the perception of weakening fundamentals, where do multiples ultimately normalize?

Will multiples bounce back to historical averages or should we be underwriting to a new normal if high-growth SaaS today is trading at the 10-year average level of broader software (chart below)?

Will dislocations be temporary or permanent in nature?

Macro can have a double impact on multiples as well as fundamentals. How will the new macro environment influence fundamentals for SaaS companies and how idiosyncratic might this impact be?

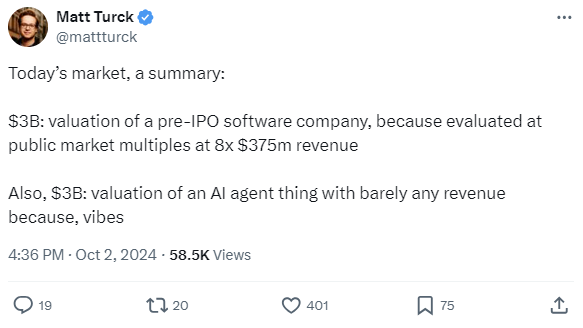

Complicating this discussion further is discourse around AI business and multiples, which as I highlighted in a recent podcast with UX Magazine, has been sucking the air out of the room and contributing to the narrative around the SaaS industry’s decline. Many AI startups are compounding growth at a rapid pace, making this category of companies highly attractive to venture investors. While VC demand is insatiable, it’s still somewhat unclear how these businesses will ultimately end up trading in the public markets due to reasons such as their novel business models, unit economics, etc.

Yet, looking at recent examples highlighting the current investor exuberance for AI companies indicates that AI valuations don’t always make a lot of sense (as Matt Turck from First Mark quips in his tweet above). The trend suggests that some VCs are perhaps underwriting to either unprecedented multiples and/or extraordinary fundamentals and/or lower return hurdles to support these astronomical marks.

In general, I tend to subscribe to the view that it is dangerous for investors to rely primarily on multiple expansion to drive returns, and it is better to be conservative on this front. Investors should focus first and foremost on fundamentals, of which I’m bullish on for AI companies given the massive tailwinds and ability to pull in services spend. But it may take many more years before we see where all of the AI market hype shakes out and discover who is left swimming naked when the tide goes out. Until then, the stakes are perhaps too high to sit on the sidelines in the midst of this paradigm shift, so I suspect we’re likely to see the ebullience driving up AI multiples to continue.