SaaSacre 2nd wave: Macro double squeeze

Several public cloud stocks slid to new 52-week lows last week. How is this SaaS stock slash different from what we experienced in Q1? Two graphs explain the ensuing chaos & what might lie ahead

Cloud carnage continued in the public markets last week as the Fed announced another 75bp rate hike. BVP Nasdaq Emerging Cloud Index (EMCLOUD) closed out Friday with one of its worst weekly declines (-14.74%) on record. Several marquee names shed over a quarter of their market cap in a single day. A similar somber mood reverberated through the private markets as various cloud startups announced layoffs, the most notable of which being Stripe (the world’s highest valued cloud company).

When I first wrote about the SaaSacre in April 2022, the average EMCLOUD forward revenue multiple was ~10.5x, already down 62% from record highs in early 2021. Following this brutal week, the average EMCLOUD company is now trading at ~4.8x EV/NTM revenue.

What is driving the continued SaaSacre/is this wave different? How should we think about multiples in stable state? What does this mean for growth-stage cloud startups? I posit that these two graphs hold the explanation to many questions about the past, present, and future state of the cloud cohort

I. What is driving the continued SaaSacre/is this wave different?

I note two distinct sources of macro pressure causing this second wave of SaaSacre:

1. Macro squeeze on multiple compression: Earlier in the year, I wrote about how the Fed raising interest rates in March 2022 (for the first time since 2018) to curb inflation catalyzed a fierce SaaS sell-off. I explained that growth stocks tend to be disproportionately impacted by such hikes as they derive a greater portion of their value from longer-term future earnings. Put another way: the present value of future cash flows is more significantly discounted in a setting of rising interest rates.

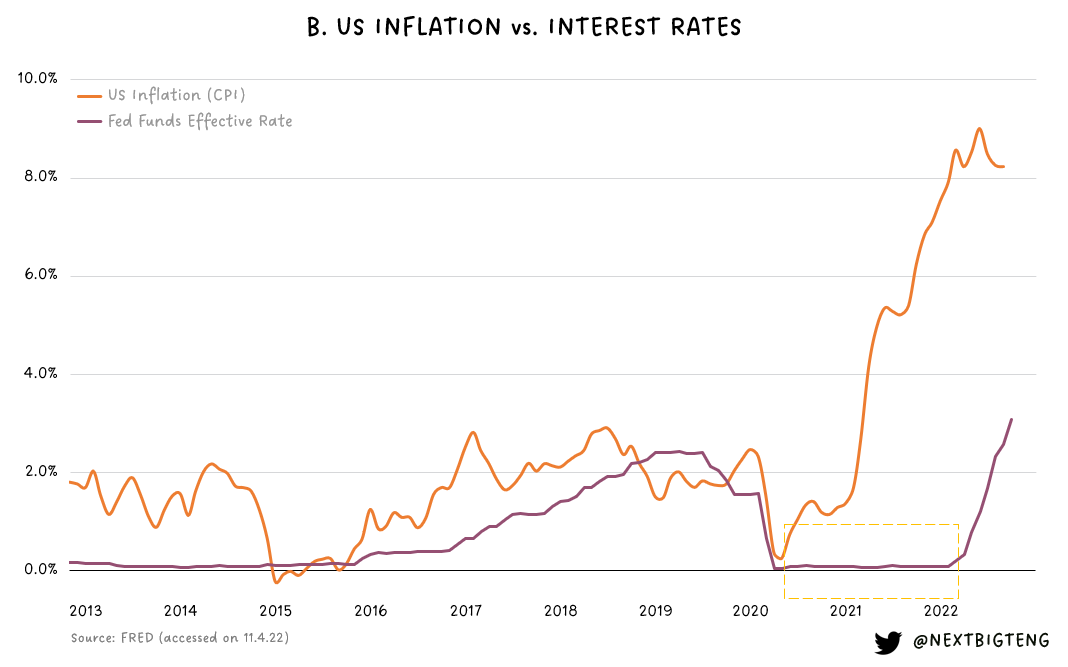

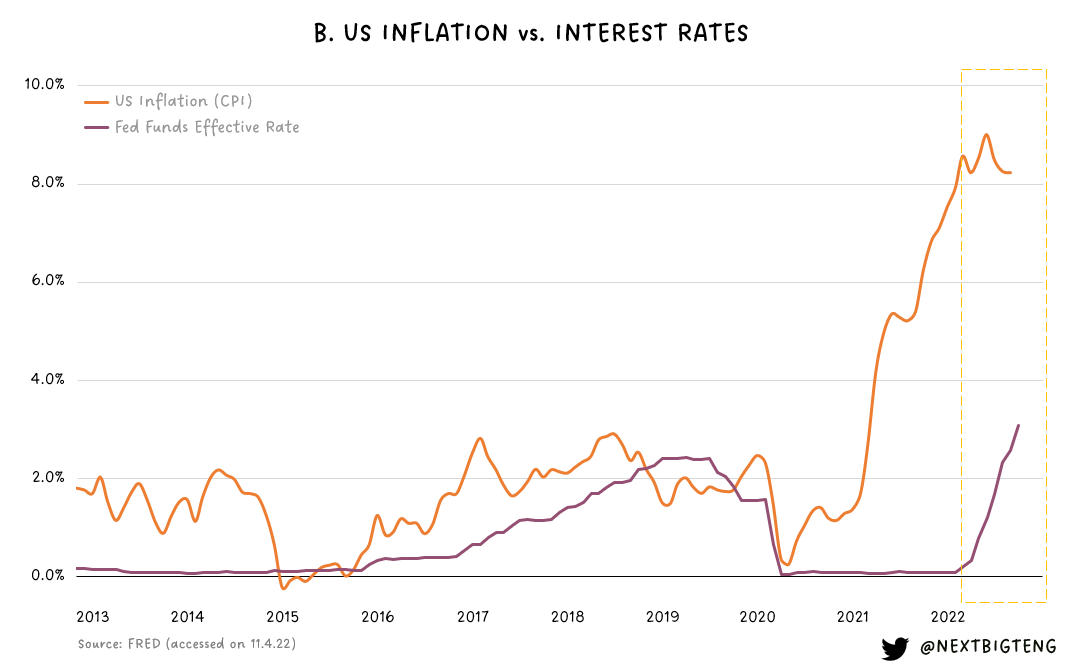

As seen in the highlighted section of key graph B above, since March, despite the Fed’s efforts, inflation is still elevated. As a result, Fed Chairman Jerome Powell said last week that “we still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected” and that the Fed will continue to raise rates to “a level that's sufficiently restrictive to bring inflation to our 2 percent target over time”. Correspondingly, the markets moved in response to these comments. But why did the cloud cohort suffer a more adverse reaction compared to other market indices?

I’ve already put forth that interest rates govern multiples — this is what Brad Gerstner from Altimeter calls the “Iron Law of Investing” — and you can see this pronounced inverse relationship in key graph A above. But unlike earlier in the year, I observe a new perturbing dynamic which (again) exerts a disproportionate impact on cloud stocks: As interest rates (i.e. risk-free rates) keep rising, the conversation increasingly rotates toward a fundamental question about whether cloud stocks offer a sufficient equity risk premium (i.e. the additional return that stocks are expected to earn in excess of the guaranteed return from “riskless” bonds over the long term) to compensate for risk and make this an attractive investment opportunity compared to other assets.

For investors, the trade-off is now not just about growth stocks versus other types of stocks (such as value stocks), but also between “risk-free” Treasury bills and equities. Investors that want tech or SaaS exposure could also consider “moderate-risk” corporate bonds of high-quality cloud companies as a more compelling alternative versus holding the stock.

2. Macro squeeze on fundamentals and earnings: In the first wave of the SaaSacre in 1Q’22, cloud fundamentals were still solid with the average EMCLOUD efficiency score at 45.4% (i.e. above the Rule of 40). Cooling investor sentiment earlier in the year was linked to a macro story around discount rates causing valuations to reset, rather than trepidations about health of the economy and fundamentals.

Midway through this year, I wrote about how cloud leaders were starting to take heed of mounting macro headwinds driving recession concerns that could impinge on fundamentals. We saw some early signals of this which I highlighted in my 2Q’22 Cloud Earnings Recap where companies began noticing elongated sales cycles and pockets of softening demand.

We are now seeing full-blown macro impact on fundamentals which investors are starting to react to. An example is Atlassian which noted in its shareholder letter from last week that “last quarter, we shared that we saw a decrease in the rate of Free instances converting to paid plans. That trend became more pronounced in Q1” and “this quarter, we started to see a slowing in the rate of paid user growth from existing customers.” As Jason Lemkin of SaaStr noted from the examples of Datadog and ZoomInfo that both reported last week, even companies from categories perceived to be “resilient” are seeing real headwinds.

This quote from David Sacks of Craft Ventures perhaps best summarizes this second macro squeeze:

“After Q1 board meetings, I would say about 2/3 of portfolio companies were hitting their numbers and 1/3 were missing and it still appeared to be like problems related to those specific companies, not a macro trend. I would say after Q2 board meetings, 2/3 were missing and 1/3 were hitting their numbers and you could start to feel okay maybe there’s like a macro trend here. And I would say after Q3 board meetings now the entire portfolio is reforecasting… even the best companies in our portfolio now are seeing major headwinds and this is just I think an economy-wide slowdown.”

II. How should we think about multiples in stable state?

With the most recent hike, the fed funds target rate range is now 3.75% to 4%. As highlighted earlier, the average EMCLOUD company is now trading at ~4.8x EV/NTM revenue. This is below the 10-year average (trailing), 5-year average (trailing), as well as 5-year average (Nov’12-Oct’17):

When and where will multiples stabilize at? Going back to the “Iron Law of Investing”, your view on where multiples land will largely be defined by your perspective on 1) terminal interest rate (as this will inform your regression) and 2) how long this environment will last (and how that relates to target holding period).

Source: https://twitter.com/SoberLookd

Here is one perspective with data from The Daily Shot: Following Powell’s briefing last week, traders in the futures market were anticipating that the fed funds rate would peak over 5% by May 2023. From the graph above, traders are expecting that rates will remain elevated for longer and stabilize at a higher level compared to previous expectations. Ultimately, when conducting your regression of where multiples will land, it is important to account for the fact that 2020-2021 period was an atypical near 0% rate environment:

III. What does this mean for growth-stage cloud startups?

Semil Shah’s tweet says it all. There is an incredible amount of uncertainty in the current macro environment which is affecting everything from fundraising conditions to when exit conditions (such as IPO window) will stabilize. This is again visualized in the right-most portion of key graph B (below) which gives indication of intractable inflation. Powell himself mentioned during his Wednesday briefing that “there is significant uncertainty” around level of interest rates and pace of future increases.

Many companies have already taken thoughtful steps early on to prepare and recalibrate. As Stripe’s example from last week has shown us, even the best cloud startups are making hard decisions to right-size costs and manage runway. My Bessemer teammates and I have spent months putting together a comprehensive white paper on tactical actions for startups to improve free-cash-flow margins and control burn across every P&L line item. This article will be published in a few weeks (please subscribe if you would like to receive a copy of it once it goes live) so I won’t further belabor this point, but instead will re-emphasize Bill Gurley’s advice below:

Parting note: Margins matter more than ever before

Earlier in the year, my colleagues dove deeply into the resilience of the cloud model. I see ourselves at the precipice of an era where cloud businesses will now demonstrate the full extent of how remarkably operationally efficient this model can be. Over the past several months, we have been harping on how growth at all costs is no longer rewarded and how profitability is en vouge again. As cloud companies set a higher bar on what it means to be successful as an efficient software business, I believe this is where we see the paradigm very palpably shift to focus on multiples being pegged to bottom-line metrics rather than just a top-line driver.

Source: https://www.battery.com/blog/opencloud-report-2022/

This fundamental shift will cause shockwaves and require a lot of introspection and re-evaluation from everyone in the ecosystem, operators and investors alike. This may be painful, especially given the private-public market disconnect that is visualized very powerfully in the chart above. And following the cloud carnage from last week, there are now only 20 EMCLOUD companies with market cap >$10Bn and only 2 with market cap > $100Bn (both above the Rule of 40 and driving significant free-cash-flow margins)… let that sink in.

If you compare the TLT with the WCLD, you'll see that there's significantly more to the history than just rates. (in fact, I'd suggest plotting the price of a bond instead of the yield, because I don't know you, but I have no sensibility of how 70bps increase in the 10y should compare to SaaS stocks)

Of course there's significant amount of companies missing guidances, but the main story here is the market losing patience with software companies lack of profitability. Get RNG, they are public for a decade and aren't expected to turn a profit for years. Which investor would have underwritten RNG in 2012 thought that in the 10th year they would still not have achieved profitability?

On top of that, there's SaaS companies obsession with fake metrics like FCF and Non-GAAP Operating margin. We once hate sold SQSP because of their guidance of a meager 20% fake margin, before taxes and stock-based compensation.

We're seeing some religion. Twilio is now guiding SBC (although it's still awful, but at least they now recognize that it's an expense). Salesforce is now talking about returning 30-40% of FCF to owners (despite 30-40% being SBC). But it's still not enough for investors and still not enough for the expectations that once were baked into prices (there were people talking about 40% margins like it was normal!)

(Not surprisingly, companies like SNOW that talk about SBC since their investor day, still command a mid-teens revenue multiple)