The take-private takeover of software M&A

Sponsor-backed take-privates have been dominating the software M&A landscape. A supply and demand look at what’s fueling the trend and how the changing macro paradigm might impact momentum.

In my first post of this year, I noted that sponsor-backed take-private deals dominated the software M&A landscape in 2023. I predicted that “with the median BVP Cloud company trading at 6.0x current revenue, which is below the average take-private TTM sales multiple in 2023, we may expect momentum for these transactions to continue into 2024 as sponsors further maximize areas of dislocation.”

Indeed, software take-privates have been the talk of the town over the last few weeks following announcements of Smartsheet’s acquisition by Blackstone and Vista for $8.4Bn, and Zuora’s acquisition by Silver Lake and GIC for $1.7Bn. Other notable PE-backed software take-privates this year have spanned various categories including:

Bain Capital’s acquisition of PowerSchool for $5.6Bn

Bain Capital’s acquisition of Envestnet for $4.5Bn

KKR’s acquisition of Instructure for $4.8Bn

Permira’s acquisition of Squarespace for $7.2Bn

Thoma Bravo’s acquisition of Everbridge for $1.8Bn

Thoma Bravo’s acquisition of Darktrace for $5.3Bn

Vista’s acquisition of Model N for $1.2Bn

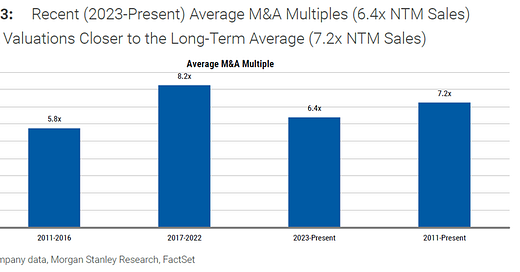

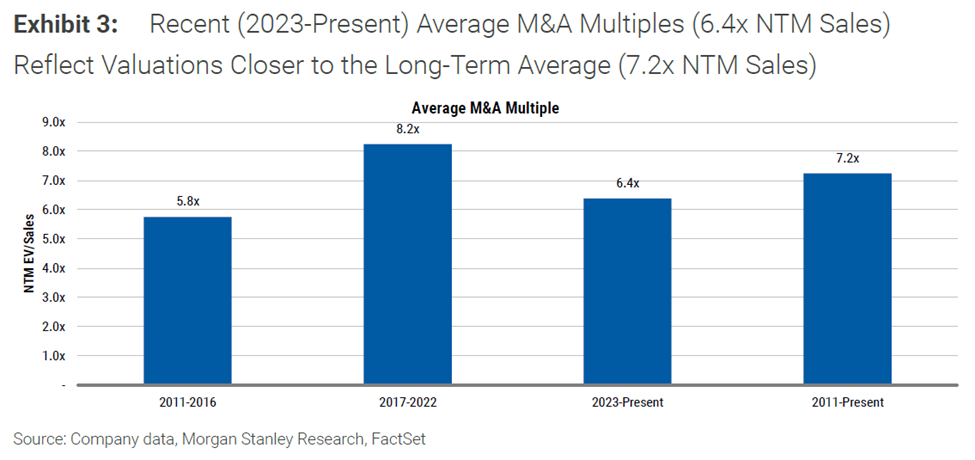

By my count, ~60% of the large (>$1Bn TEV) software M&A deals that have been announced YTD are PE-backed take-private deals. Morgan Stanley pegs the average M&A multiples for recent sponsor-backed transactions at ~6.4x forward. This is lower than the average of such transactions during the 2017-2022 period, and also lower than the long-term historical average of such deals from 2011-present:

Currently, the median forward trading multiple of the EMCLOUD cohort is 5.6x forward, with 68% of the cohort trading below the long-term historical average NTM revenue multiple for large software M&A. Given these dynamics, it is perhaps somewhat unsurprising to see take-private activity be so robust in current market conditions.

Supply side factors involving attractively priced assets are just one part of the equation. Looking at demand, global PE dry powder continues to be at an all-time high. Notably, dry powder is concentrated within a cohort of mega-firms, giving them the ability to write very large checks:

Private companies now outnumber public companies by a significant margin within the cohort of scaled companies with revenue >$100MM (exhibit below). I’ve written previously about how companies are staying private for longer, and it’s interesting to now see the take-private trend fuel the rising tide of privatization albeit from a different angle.

Looking to the future, I’ve been asked about how the changing macro paradigm might impact momentum of the take-private trend. Interest rates ostensibly have an impact on both supply as well as demand factors in opposing directions. On the demand side, take-privates often involve leverage in financing, so lower interest rates should be stimulating for activity. However, one would expect lower interest rates to have the opposite effect on the supply side by driving up valuation multiples which could reduce the number of attractively priced take-private targets.

So to which of those competing forces might the scale tip? I’ve noted previously how software multiples still appear somewhat muted even after September’s Fed rate cut announcement. Multiples for small and mid cap software companies in particular have been slow to bounce back (chart above), and this cohort tends to be a good strike zone for potential M&A takeout. Considering this context, I suspect that the take-private trend may not slow down just yet as sponsors continue to find and maximize pockets of dislocation in the market.

This is a lot to write to say not much in the end….

Insightful as always! I think there is more to the story here. The value creation playbook for software is now very tangible, with a lot of low hanging fruit with AI led levers both for top

-line and ebitda. The macro env. being benign with the start of the rate cutting cycle makes the timing better with valuations still not 2020-21 like. And these companies have better FCF generation now vs earlier too. Everything that PEs would want to see.