When the valuation hangover finally hits

Drunk on ZIRP, many investors viewed every startup as a 10... (x, even 100x). Now that recent watershed IPOs have ushered in a sobering reality, what are key lessons & fundraising implications?

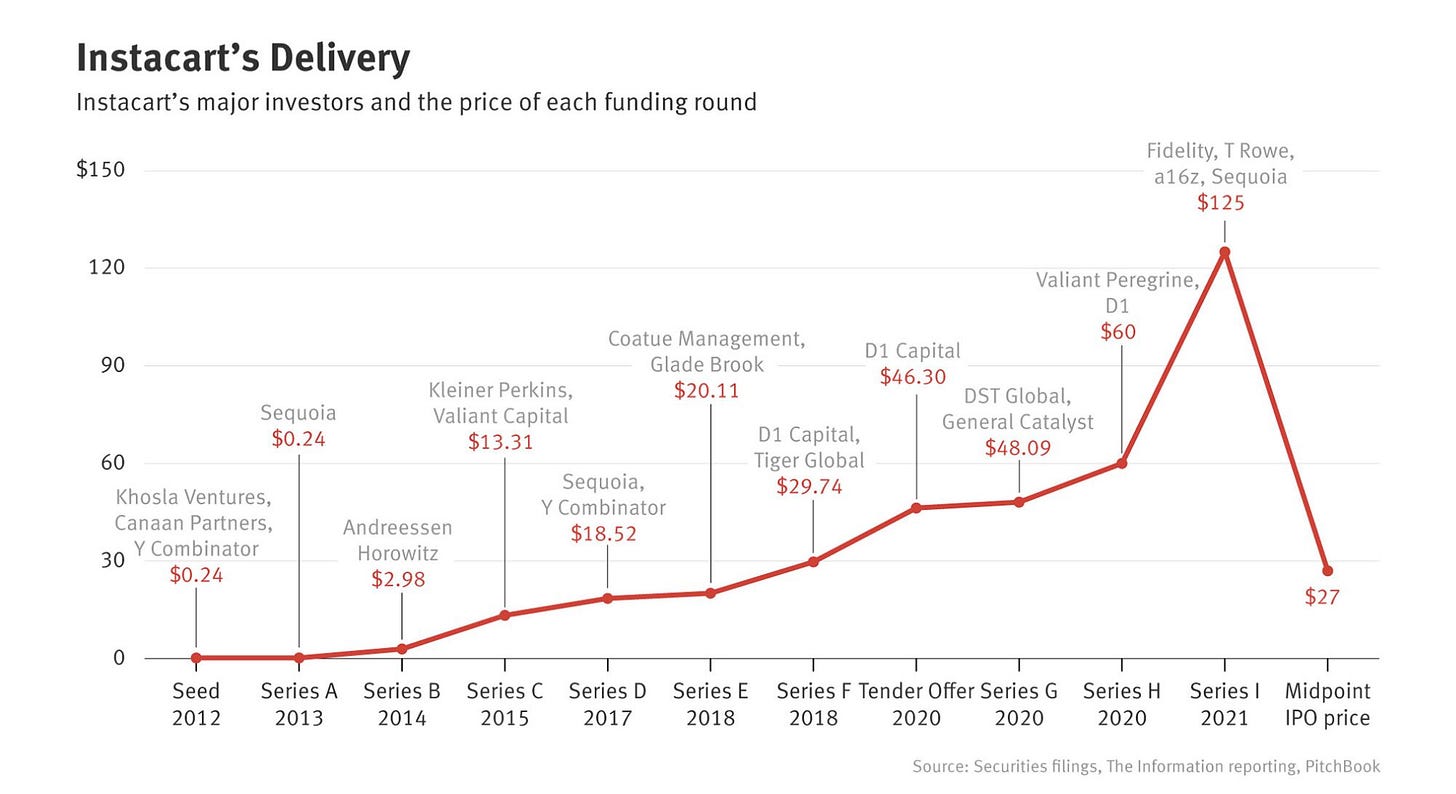

Last month, I wrote about the ripples of optimism pulsing through the VC community following the news of ARM, Instacart, and Klaviyo, filing to go public. These public debuts were highly anticipated not simply because they would mark an inflection point in the Tech IPO window, but also because they would set a precedent for public market demand and valuation sentiment. Many in the startup community have been anxiously awaiting this appetite gauge following a very disconnected private market valuation environment that has not yet fully recalibrated to today’s interest rate paradigm:

ARM, Instacart, and Klavio’s undertaking to test the public markets is a bold move given the significant number of startups stuck in pre-IPO trepidation. Pitchbook estimates the current IPO backlog (i.e. companies at a stage where they are ready and waiting in the wings to IPO) to exceed 200 companies in the US alone (chart below). From a dollars perspective, Bank of America estimates that the IPO pipeline has swelled to ~$60bn.

While this feat offered some relief from the incredibly gloomy sentiment of 2022, high hopes that the trio would reignite exuberance and burst open the Tech IPO floodgates was quickly brought back to a muted reality:

Pricing was a far cry from the frenzy times of 2020-2021 where software IPOs were being priced in the range of 13.7x-14.5x NTM EV/Revenue on average, offering a wakeup call about the new reality of market clearing prices. For additional context, my colleagues and I at Bessemer presented recently at SaaStr 2023 about normalization of multiples for cloud companies in the public and private markets.

While all companies saw exciting Day 1 IPO pops, this was notably less ebullient compared to previous years. Ultimately, a lot of the momentum that Instacart and ARM saw initially lost steam after a few days, and both of these companies are currently trading at or very close to IPO price. ARM even fell below issue price at one point.

While it’s still early days for these companies as they begin their new chapter in the public markets, their current market caps are all below their peak private valuations. In particular, Instacart has come under great scrutiny given the significant delta between its IPO price and peak private valuation:

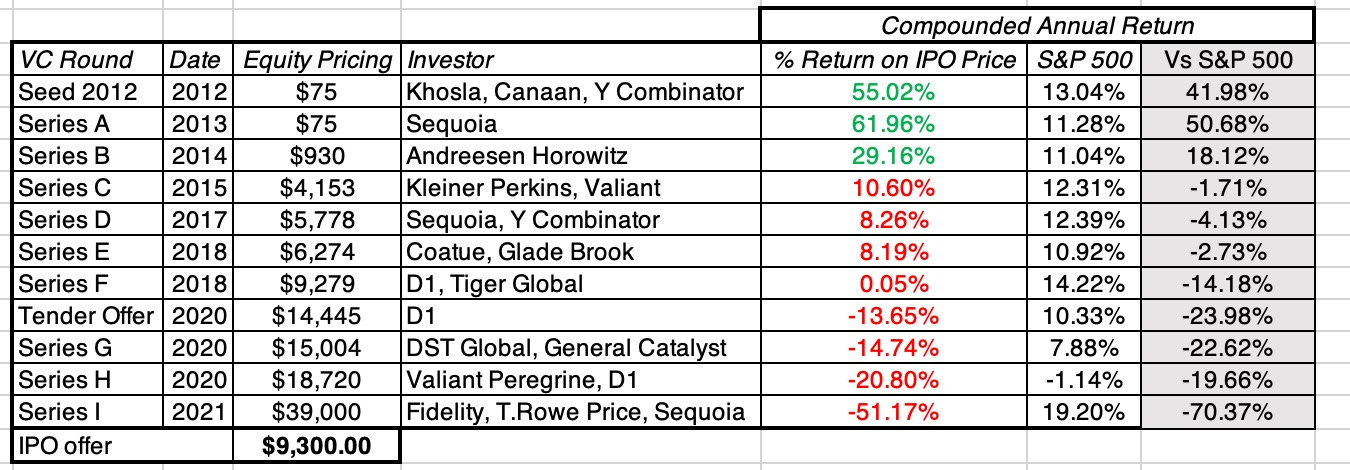

Instacart’s case study has spurred discourse around the winners and losers in IPOs and the risks of growth-stage private investing. Professor Aswath Damodaran recently penned an incredibly insightful post, concluding that only Instacart’s pre-Series F investors were in the black at the IPO price. Of this cohort that made money, only investors that invested at the Series B or earlier made a return that outperformed the S&P500 (chart below). One could also argue that depending on their cost of capital, some of Instacart’s earliest investors may have been disappointed if they did not meet their required return hurdle rate.

Private market implications

Rumblings of this impending reckoning were already brewing in the private markets. One of my predictions for 2023 was an uptick in down rounds. This has indeed come to bear — Carta reported that nearly ~20% of rounds year-to-date have been down rounds and this is meaningfully higher than previous benchmarks (chart below). Valuation overhang shockwaves are likely to reverberate further.

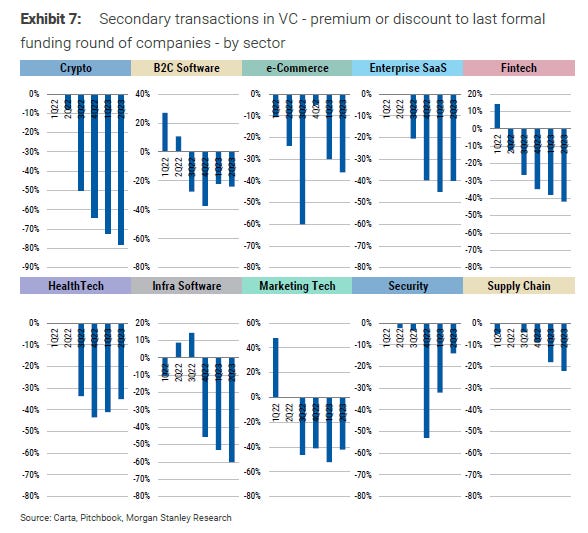

Similarly, within the secondary markets, the average VC secondary transaction is now clearing 40% below previous primary transaction price levels, and this discount has grown sequentially for the past few quarters (although the magnitude of impact is sector-dependent):

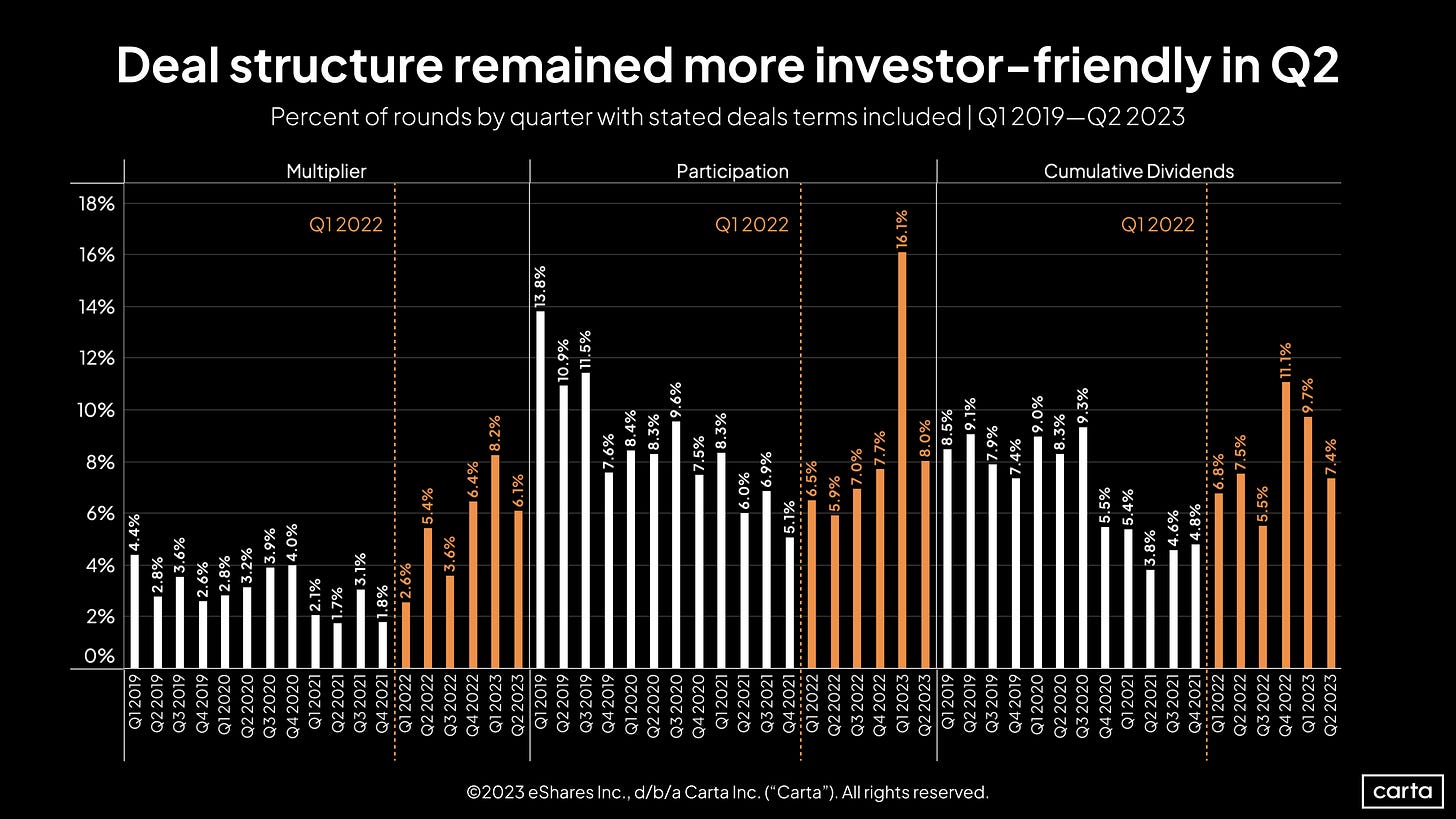

As runway depletes, reality is catching up with many unprofitable growth-stage startups that have previously been reticent to raise following high watermark valuation rounds from 2020-2021. In fact, according to Pitchbook, the need for VC funding now outstrips supply by 2.9x for late-stage startups. Consequently, as David Kellogg predicted, the pendulum has swung across all levers and the private fundraising environment has become the most investor-friendly it has been in years:

With such a backdrop in place, term sheets are getting dirtier (chart below). As founders increasingly encounter structured terms, I have previously cautioned that a dirty term sheet is not always the silver bullet it appears to be to avoid a down round since there are significant risks and trade-offs. (Side note: I’ve previously developed a framework for my founder friends to leverage as they evaluate non-standard term sheets; please leave a comment if you think it’ll be helpful to publish a post on this.)

In this new dawn of a changed financing environment, it is important for investors and founders alike to sober up quickly and remember a golden truth that has perhaps been grossly overlooked in the intoxicating haze of a ZIRP environment: fundraising should be a means to an end (the end being building a profitable business with strong fundamentals) and NOT an end goal in and of itself.

Excellent analysis. Thank you for sharing!

A great read! Very insightful.