2Q22 Cloud Earnings Recap

Earnings remained strong but revenue beats are getting harder & significantly less companies are guiding above consensus. Is this conservatism at play or an early signal of weakening fundamentals?

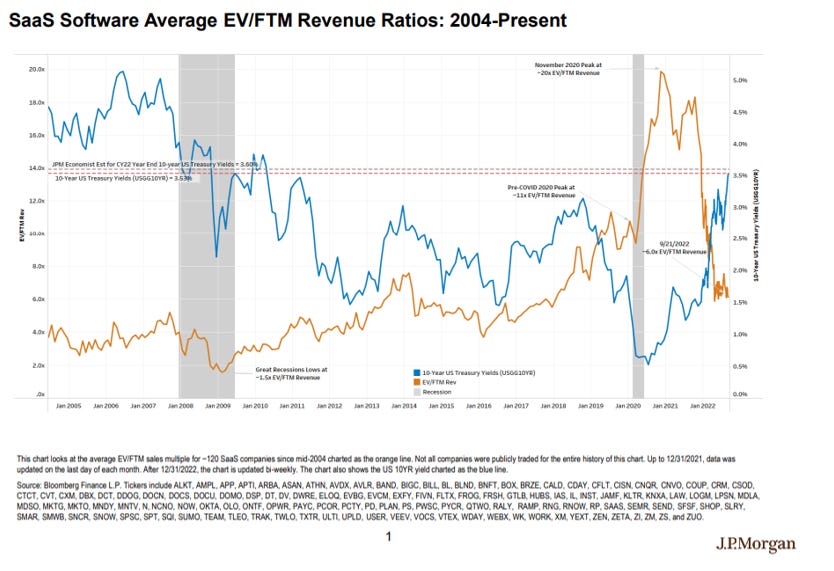

FYQ2 earnings season for BVP Nasdaq Emerging Cloud Index (EMCLOUD) companies just wrapped up. Following earnings season and the Fed's additional 75bps rate hike last week, the average EMCLOUD forward revenue multiple is currently at ~5.7x (median ~4.7x). This is below the historical long-term average, which mirrors the trend seen in wider software comps (shown below on a growth-adjusted basis):

Source: Valuation Views: Hitting A New Valuation Low, Morgan Stanley (9.26.22)

Earlier in the year, the average EMCLOUD growth rate exceeded 40% and the average EMCLOUD efficiency score was above the Rule of 40. Today, fundamentals still have weakened slightly but still remain solid:

average EMCLOUD growth rate is 35.2%

average EMCLOUD efficiency score is 37.5%

and average EMCLOUD gross margin is 70.6%

To uncover what had been happening to cloud fundamentals recently, I reviewed the Q2 earnings of all EMCLOUD members to distill 5 key takeaways from this season and identify signals of what might lie ahead:

Cloud earnings remained strong, but beats are getting more difficult and significantly less companies are guiding above next quarter’s consensus

Compared to the previous quarter, there is now a narrative shift from normalization of multiples to recessionary impact

Macro headwinds leading to elongated sales cycles and pockets of softening demand are common explanations for muted guidance

Macro impact was not all bad… companies with strong platform plays experienced some unexpected benefit from vendor consolidation

Articulating a path to profitability or commitment to efficient growth was top of mind this season

I. Cloud earnings remained strong, but beats are getting more difficult and significantly less companies are guiding above next quarter’s consensus

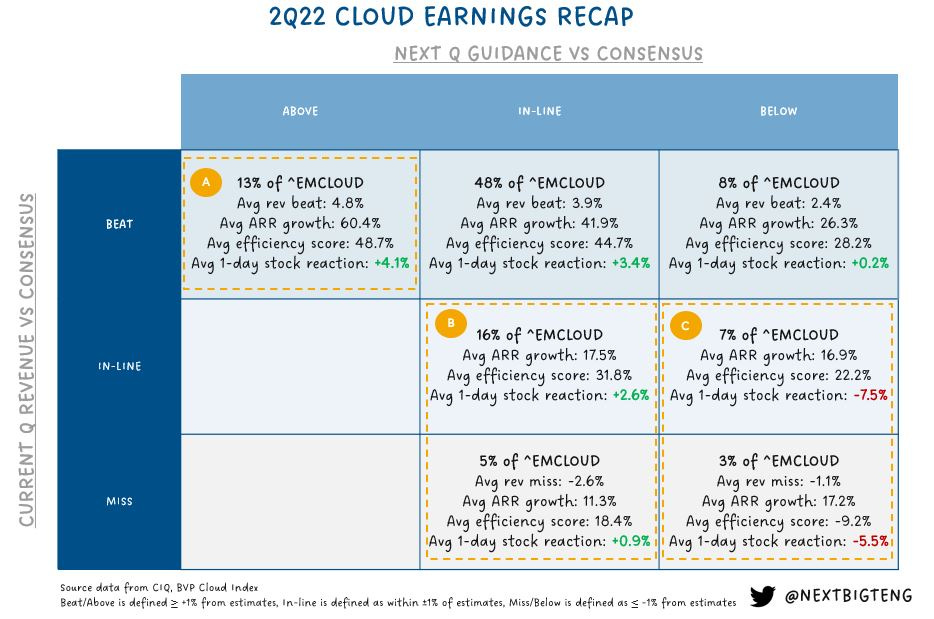

The matrix below gives a view of Q2 results and next quarter’s guidance versus consensus estimates across the EMCLOUD cohort. Key learnings:

Overall, Q2 earnings performance was solid although revenue estimate beats are now getting harder and slimmer:

69% of EMCLOUD companies beat Q2 revenue estimates, with an average beat of 3.9%. This is in contrast to the prior quarter where 79% of EMCLOUD beat Q1 revenue estimates with an average beat of 4.2%.

23% of EMCLOUD performed in-line with Q2 revenue estimates.

8% of EMCLOUD companies missed Q2 revenue estimates, with the average miss at -2.1%. While still only a very small portion of the cohort, this is a marked increase from the prior quarter where only 3% of EMCLOUD missed Q1 revenue estimates with an average miss of -3.7%.

It is also becoming rarer for companies to guide above next quarter’s consensus expectations. As Box A in the matrix shows:

Only 13% of EMCLOUD companies are guiding above next quarter’s consensus, with an average guide of 2.9% over Q3 expectations. This is in contrast to Q1 where 83% of EMCLOUD were guiding above next quarter’s consensus, with an average guide of 7.4% over Q2 expectations.

Notably, all of the companies in the Box A subset beat revenue estimates in Q2 and also have the highest efficiency scores across the cohort, so they likely represent the best-of-the-best in EMCLOUD.

Moving forward, a large majority (69%) of EMCLOUD companies are keeping in-line with Q3 guidance expectations. Surprisingly, as Box B in the matrix shows, companies that did not beat Q2 revenue estimates but kept in line with guidance expectations still saw small 1-day stock price boosts. This perhaps indicates that the market had over-corrected negatively and previous pessimism prior to earnings about future outlook may have been overblown.

Unsurprisingly, the 10% of companies that did not beat Q2 revenue estimates and also guided below Q3 expectations saw the biggest 1-day stock declines (Box C in matrix). Notably, this subset of EMCLOUD companies have the weakest efficiency scores across the entire cohort and are performing below the Rule of 40 which could be an additional factor to the 1-day stock reaction (we’ll explore this further in Section V).

II. Compared to the previous quarter, there is now a narrative shift from normalization of multiples to recessionary impact

In Q1, cooling investor sentiment mainly revolved around a macroeconomic story around markets and discount rates, rather than trepidations about health of the economy and fundamentals. The narrative then was that persistently low interest rates (2020-2021 average of 1.13% vs. 10-year average of 2.02%) and cheap capital had exacerbated multiple expansion, pushing cloud valuations to historical highs. This was unsustainable, and as the FED raised interest rates to curb rising inflation, the SassSacre occurred and cloud valuations began to reset back to long-term averages despite EMCLOUD companies still demonstrating strong fundamentals:

Source: J.P. Morgan Enterprise Software Mid-Week SaaS Valuations vs. US 10YR US Treasury Yield Charts (09/22/22)

This season, we started to see more rhetoric around recessionary fears impacting fundamentals and added conservatism in anticipation of weakening economic outlook (which we’ll further discuss in later sections):

Source: Preparing for Earnings and 2H22, Morgan Stanley Tech ECM (July 2022)

III. Macro headwinds leading to elongated sales cycles and pockets of softening demand are common explanations for muted guidance

A majority of cloud companies reported elongated sales cycles due to more scrutiny as a recurring trend impacting logo acquisition, especially for large enterprise deals:

At JFrog, “During the second quarter, we started seeing elongated sales cycles for large new business deals compared to trends we have seen in the past”… “What we also see is some kind of slowdown on life cycles of big deal approval, especially when it comes to major deals, big deals, and a slowdown on some of the regions.”

Hubspot’s CEO noted “First off, deal cycles are lengthening and more decision-makers, specifically CFOs and CEOs are getting pulled into deals for approval. Now, in early May, we were one of the first companies to transparently share that we saw deals taking longer in Europe. And in June, we saw these trends become more broad-based across our segments and the geos that we serve.”

Braze commented “Like many of our software peers, we saw elongated deal cycles and greater scrutiny on customer spend as some prospective and existing customers took a wait-and-see approach to the economy before committing to new investments.”

At ZoomInfo, “We have seen sales cycles that are somewhat extended relative to sales cycles in Q1, driven by incremental finance and procurement review”… “there is just more scrutiny, especially as deals get larger and on international deals, where the cycle is elongating.”

Salesforce observed that “Sales cycles can get stretched. Deals are inspected by higher levels of management, and all of this, we began to start to see in July. Nearly everyone I've talked to is taking a more measured approach to their business. We expect these trends to continue in the near term, and we reflected this in our guidance.”

Additionally, several companies reported areas of consumption and aggregate demand pull-back, especially in regions such as Europe, which is impacting both pipeline as well as retention. Some examples:

At Coupa, “In Europe, we continue to see a softer demand environment with lengthening sales cycles, which is factored into our guidance. Consistent with Q1, our Q2 performance in North America was strong. However, we recognize the global macro environment is uncertain. So, we have factored the potential for additional macro headwinds into our guidance to derisk the outlook for the back half.”

Similarly, MongoDB reported “As in Q1, we had not seen an impact on consumption but we expected a modest impact to manifest itself in Q2. Here, consumption growth was above our expectations in North America, while in Europe, we experienced greater-than-expected macroeconomic headwinds. The slowdown in Europe was evidenced across all subregions and industries.”

HashiCorp noted “The continued scrutiny on spend may have some impact on the timing of when we can close our contracts. While it is difficult to predict the impact of macro on our close rates, we have estimated an approximate $4 million to $6 million headwind impact to our revenue in FY 2023, which we have incorporated into our guidance.”

IV. Macro impact was not all bad… companies with strong platform plays experienced some unexpected benefit from vendor consolidation

As customers sought to do more with less when faced with macro pressures, a common theme that arose this season was around customers consolidating fragmented or discretionary point solutions to improve operational or cost efficiencies. This trend bode well for platform solutions. For example:

Gitlab reiterated this observation multiple times — “People are moving away from the point solutions into a platform. And so we saw a lot of that this quarter and really happy with the results that we delivered.”… “We are certainly seeing that with customers that say, ‘Look, we need to consolidate, and we want to move to fewer tools, and that's why we're considering GitLab.’ So this is a tailwind”… “People are wanting to get rid of point solutions and move on a platform to develop software better, faster, more secure, and that's what our platform does.”

At Datadog, “We also had a number of sizable six and seven-figure new logo and expansion wins with companies that have recently experienced business contraction and announced staff reductions. These customers are looking to streamline their operations, save on engineering costs or consolidate multiple vendors on a strategic platform. We believe that software is a deflationary force, and we are confident in our ability to help our customers do more with less should economic conditions worsen.”

Zscaler’s CEO commented that “Number one thing CIOs and CFOs are asking now is, please help me eliminate a lot of point products. Help me save money. So cost reduction by elimination is a big thing, and especially a platform provider like Zscaler, which can eliminate lots of products.”

At ZoomInfo, “We saw it all across our SMB customers. We saw it across our enterprise customers, where they were consolidating either multiple sales intelligence vendors and a conversation intelligence vendor and a sales automation vendor into ZoomInfo's RevOS.”

V. Articulating a path to profitability or commitment to efficient growth was top of mind this season

As investors prepare for a potential recession, it is no secret that the buy-side has shifted its focus toward rewarding profitability and efficient growth. I did a deep dive on this Rule of 40 valuation premium previously.

Source: The Great Normalization, Morgan Stanley (Sep 2022)

In previous recessionary periods, software companies optimized toward profitability due to such changing market sentiment (see visual above). 2022 is shaping up to be no different. Thus, regardless of a company’s earnings performance or guidance this season, a majority of companies made comments about driving toward efficient growth and enforcing renewed discipline around spending. For instance:

At Shopify, “For the remainder of 2022, we expect to reduce spend in lower priority areas and non-core activities that we do not believe would be effective in this environment, focus our sales and marketing spend on activities with shorter payback periods and realign our support teams under a more efficient operating model.”

Twilio’s team commented that “And you probably noted that we've taken some actions with respect to slowing down hiring except for some key areas. We're taking, we guided based on having a real estate charge, which I think reflects our kind of remote-first approach to the way that we're going to work going forward. And I think both of those things will drive profitability into next year.”

At Braze, “Notably, this period of rapid evolution in the sales environment overlapped with the ramp period for a large class of account executives hired earlier this year, resulting in sales productivity landing short of where we expected it to be in the quarter. We are adapting quickly, identifying areas where execution faltered and making appropriate adjustments.”

Parting thoughts: Putting these learnings into context, what archetypes of companies emerged as “winners” this season?

Source: https://cloudindex.bvp.com/companies (9.20.22)

Following the close of Q2 earnings season, the chart above shows the Top 10 EMCLOUD companies ranked by forward revenue multiple. Some observations:

Efficient growth is rewarded: As highlighted in Section IV, valuation lenses have shifted toward a focus on efficient growth. To that end, all of the Top 10 companies outperformed the Rule of 40. Within this set, Snowflake, Datadog, and Bill.com, posted unparalleled efficiency scores above 95%. It is notable that these three companies employ product-led-growth models, and also top the entire BVP Cloud Index in terms of highest efficiency scores.

Developer and cybersecurity categories remain resilient: Of the Top 10, 40% are developer-centric companies (e.g. DevOps/tools and data infrastructure) and 30% are cybersecurity companies. All of these companies are platform plays. Companies within this set such as Gitlab explicitly reported that sales cycles were compressing (rather than lengthening) and demand remained robust, bucking the general headwinds that hit many of their EMCLOUD peers. Developer and cyber categories represent massive market opportunities that are essential to business operations, universally across all geos and industries. I previously wrote about how these two categories are the most resilient during a downturn, so it is unsurprising to see such companies thrive in the face of uncertainty this season.

Special shoutout to my Bessemer teammate and friend Andrew Schmitt (co-author of Parting the Clouds) for being a thought partner to me on this piece.

Note: All quotes pulled from company earnings calls transcripts or public statements