2026 Predictions

Big deals, big innovation, and even bigger AI battles.

My 2025 year-end wrap-up explored AI debates that defined the year, from a deepening power-law trend in capital markets to mounting questions about an AI bubble. This week, I turn from looking back to looking forward, with four predictions for the year ahead:

Accelerated momentum for IPOs and M&As

Defense Tech prints more than one mega IPO

Continual learning at the center of AI Infra’s 2nd wave

The embodied AI wars will eclipse the LLM wars

I. Accelerated momentum for IPOs and M&As

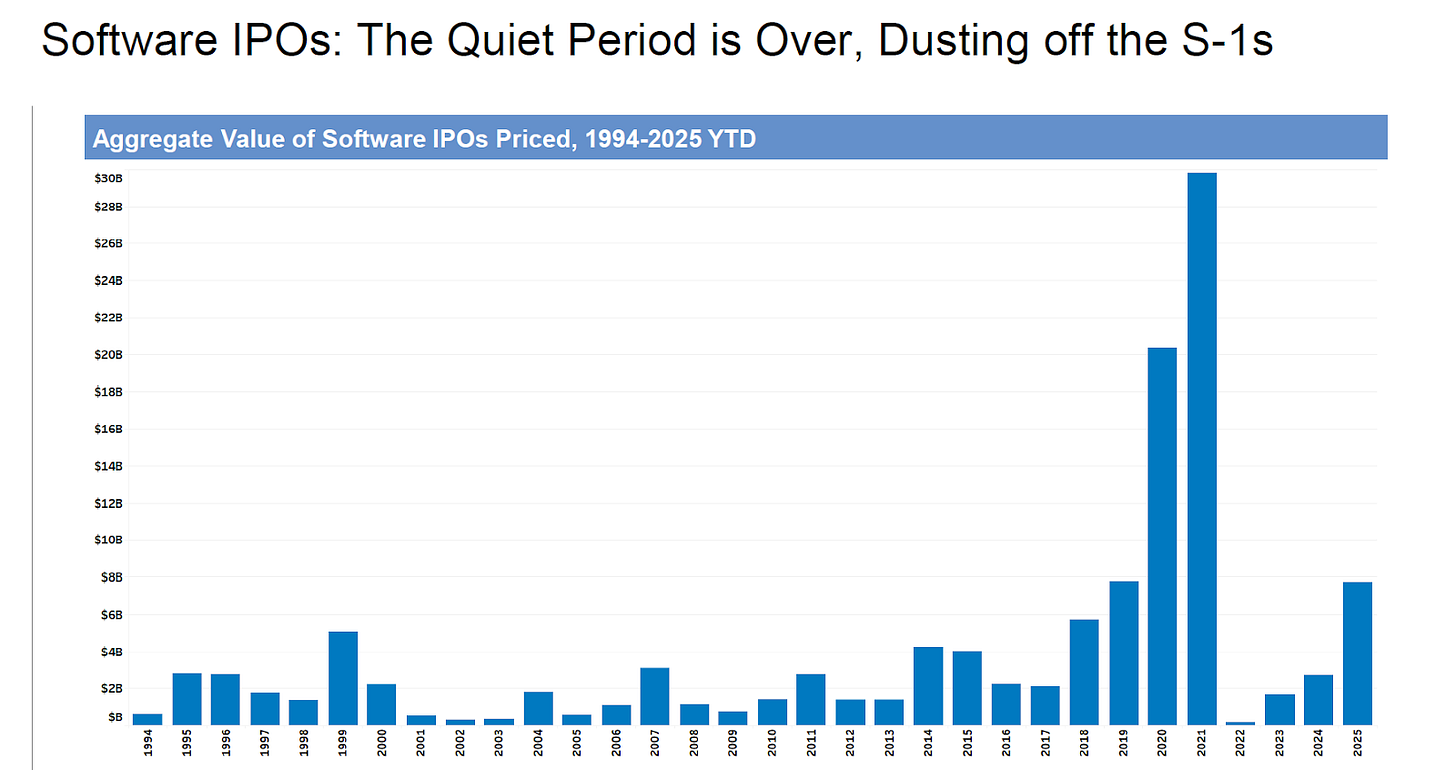

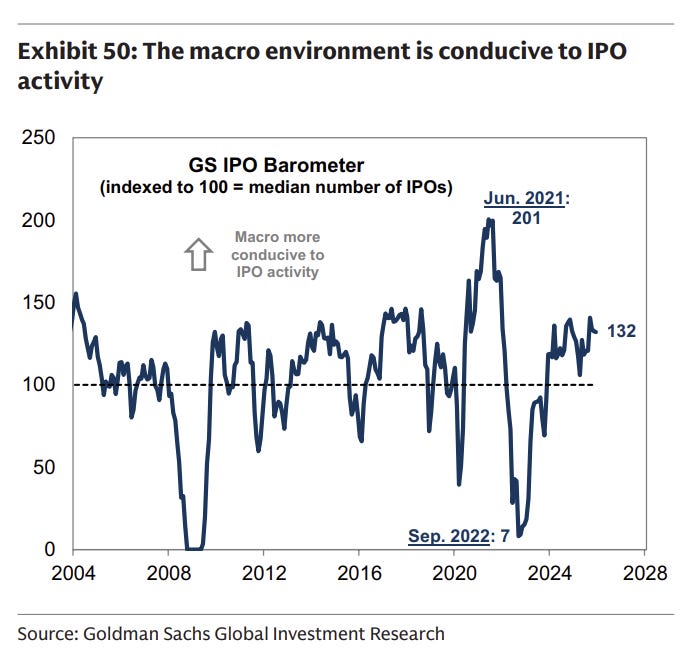

After a quieter stretch in tech IPOs and M&A, 2025 hinted at a rebound, and I expect to see this momentum grow in the new year.

On the IPO front, listing activity ticked up in 2025 (chart above). And while AI names like CoreWeave and Figma made splashy debuts, as I noted in my Fast Company interview, fintech/crypto stole the show with IPOs from Bullish, eToro, Gemini, Wealthfront, Figure, Circle, Klarna, and Chime.

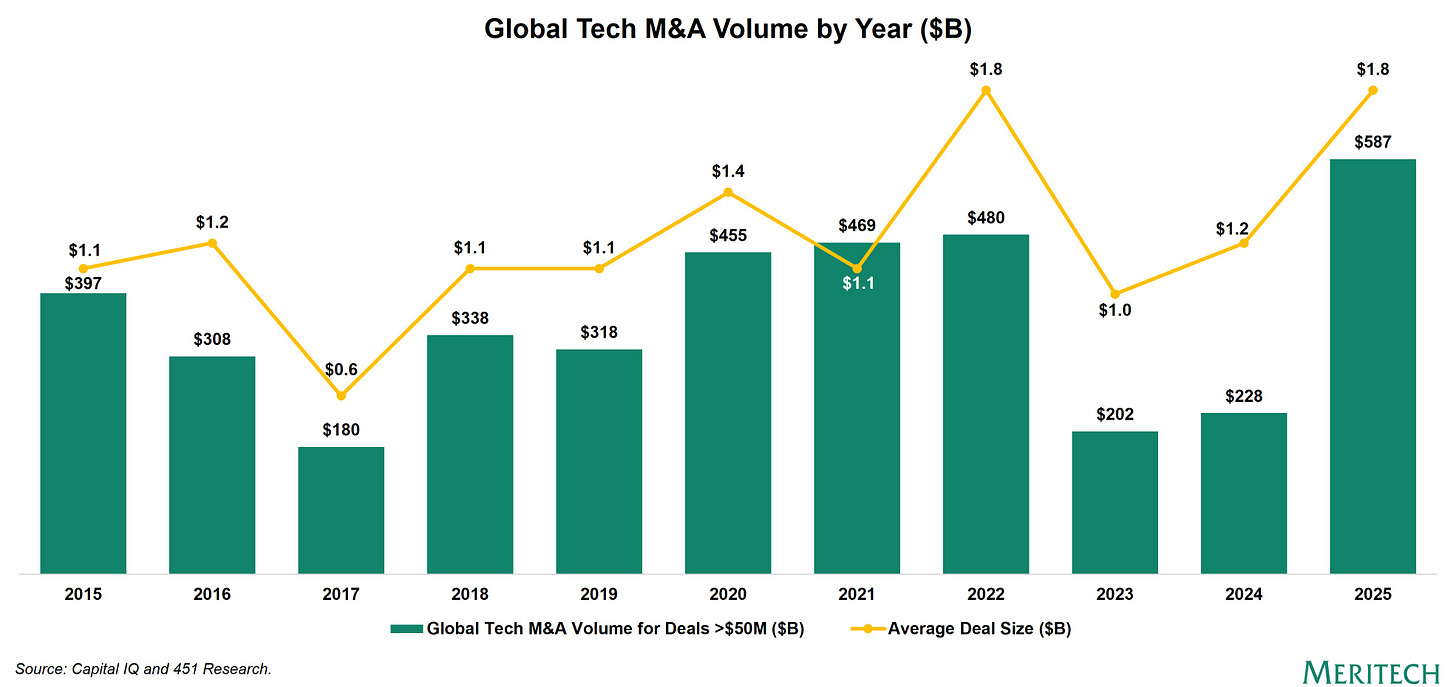

M&A activity followed a similar pattern (chart above), with several key observations:

Strategic mega deals ($5B+) are back, which marked a shift from previous years dominated by take-privates. Notable mega deals in 2025 included Meta’s acquisition of Scale AI, IBM’s purchase of Confluent, and Salesforce buying Informatica. The year closed with a bang: news of NVIDIA’s $20B acquisition of Grok, ServiceNow’s $7.75B Armis deal, and Meta’s $2B Manus acquisition all hit within the last week of the year.

AI isn’t the only story. While AI-related acquisition continues to drive headlines, strategics are pushing into adjacent markets to broaden platforms and deepen vertical integration. Notable examples include OpenAI’s acquisition of io, Palo Alto’s Chronosphere deal, and ServiceNow’s purchase of Veza.

Creative deal structures persist. Meta’s $14.3B Scale AI deal and Google’s $2.4B Windsurf transaction underscore the continued use of “reverse acquihire” structures.

Several factors point to continued momentum for IPOs and M&A in 2026. These include a favorable macro environment, policies like the “One Big Beautiful Bill” impacting the economy, and ongoing interest in AI-related assets:

II. Defense Tech prints more than one mega IPO

Building on Prediction #1, 2025’s IPO headlines weren’t just about AI or fintech/crypto, it was also a notable year for the aerospace and defense sector. As I wrote in “New Frontlines, New Primes”, companies like Karman Holdings, AIRO Group Holdings, Firefly Aerospace, and Voyager went public in 2025, signaling a meaningful shift in the sector’s capital markets profile.

The broader signal was hard to miss. Palantir, now trading ~65x NTM revenue, still commands the highest forward multiple in the software universe, roughly 10x the EMCLOUD average.

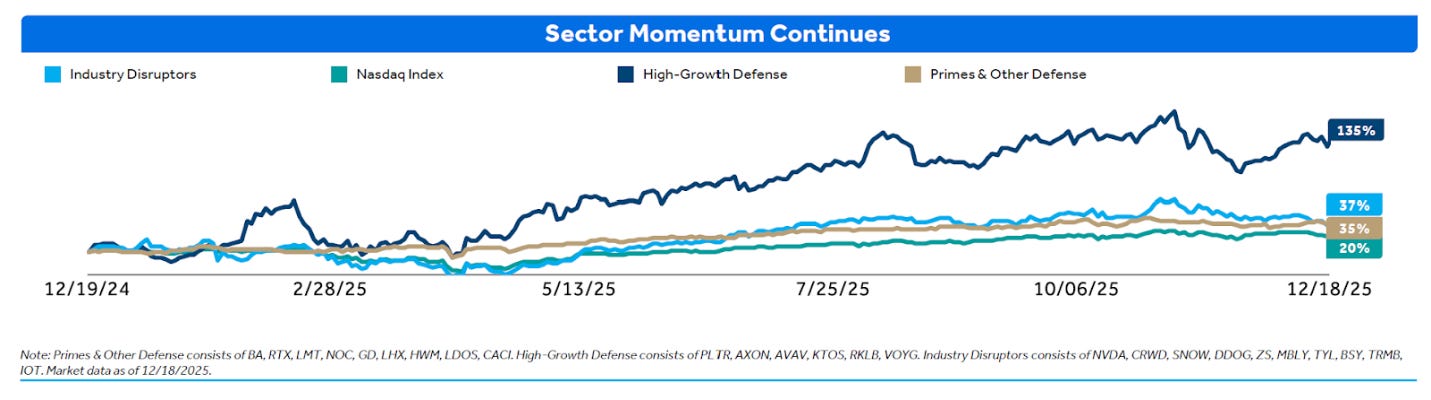

More importantly, this new generation of defense innovators has proven that scaled businesses can be built alongside the legacy primes. In fact, not only did defense as a sector significantly outperform the broader markets in 2025, high-growth defense names were responsible for a big portion of this outperformance:

This momentum should carry decisively into 2026 as expanding budgets and rapid modernization continue to sweep through the landscape. While speculation around a SpaceX IPO remains the obvious headline, the sector’s new growth depth could unlock multiple mega IPOs spanning more than just one domain.

III. Continual learning at the center of AI Infra’s 2nd wave

As I highlighted in “AI Infrastructure’s Second Act”, the AI infra landscape is entering a new phase of innovation. As AI is increasingly deployed in production, new infrastructure tools around frontiers such as environments, evals, and systems are required for AI to embed real-world operational context and understanding.

I believe that 2026 will be the year of continual learning (which I loosely define as an AI system’s ability to keep learning new tasks or information over time without catastrophic forgetting) as researchers and practitioners alike attempt to solve this frontier in an efficient manner. This push is catalyzing innovation across new architectures and novel techniques, which could set the stage for a fundamental breakthrough before the end of the year.

IV. The embodied AI wars will eclipse the LLM wars

The LLM wars have produced a generation of foundation model companies now valued as potential multi-trillion-dollar platforms. But there’s a new frontier emerging, one that plays out not on screens, but in the physical world, where AI perceives, decides, and acts.

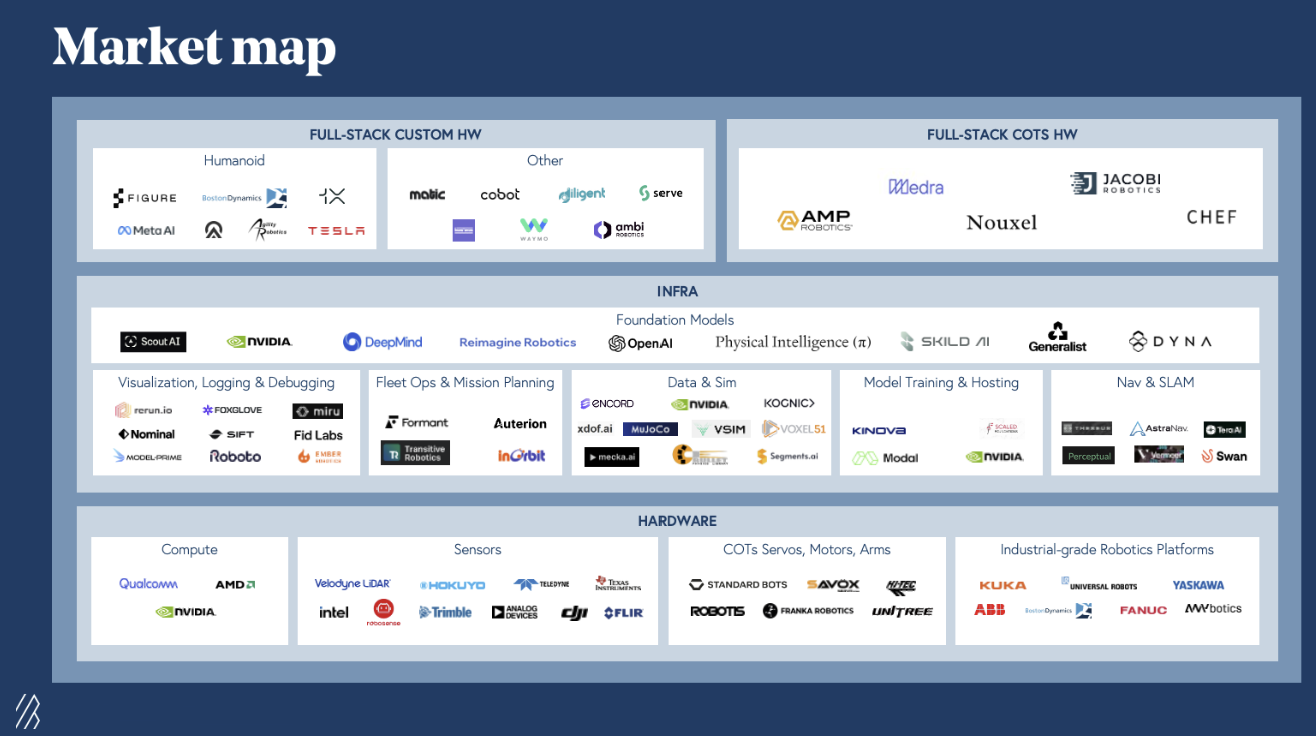

Earlier robotics waves were defined by narrow, pre-programmed machines built for limited (often single) tasks in controlled environments. Today’s AI breakthroughs are enabling general-purpose robots across multiple form factors, capable of learning, adapting, and performing a wide range of real-world tasks in diverse environments. This transition is catalyzing a full rewrite of the robotics stack: from physical AI foundation models that can serve as robotic “brains”, to new data and training paradigms, to novel infra and deployment models for on-device AI, to orchestration software for control and coordination, and even to tightly integrated hardware designed to deliver embodied intelligence at scale:

Investors still carry scar tissue from past robotics cycles, but as AI gets physical, I foresee an embodied AI race that could prove more intense and consequential than the LLM wars. For one, Big Tech, frontier labs, verticalized startups, and hardware incumbents are all racing to define the new physical AI stack. Furthermore, beyond different verticals such as manufacturing or defense, there are multiple form factors, ranging from humanoids to self-driving vehicles, which expands the surface area for intensifying competition. Lastly, the battlefield is global, with rival ecosystems forming across geographies.

Leave a comment below with your thoughts on what 2026 will have in store for us!

Hi Janelle! Interesting read. I think one another prediction I would add to this is that memory is increasingly becoming an important feature in the enterprise space. Enterprises don't just want generic AI tools. They want tools that can understand their preferences, writing style and firm-specfic playbook. I've been tracking this trend in the LegalTech sector. Harvey has announced the launch of a memory tool that can remember a partner's drafting style and strategy. The tool has context to build firm-specific strategies and insights. Would love to know your views!