Five Software M&A Observations for 2024

And we're off! Software M&A is already active in 2024 with news of several notable deals breaking within the first few days of the new year. Here are my 5 M&A observations on what to expect in 2024.

Software M&A is off to a quick start in 2024! News of Airtable acquiring (and sunsetting) Airplane, along with SentinelOne’s PingSafe acquisition announcement, broke just within the first week of the new year. Following these developments, I received several requests to do a software M&A wrap-up for 2023 (similar to the review I did for 2022) and share some thoughts on the outlook for the coming year. Taking into account recent trends, here are five observations on the M&A landscape as we enter 2024:

Sponsor-backed take-private deals still dominate, but multiples are starting to compress

Blockbuster M&A from strategics have slowed as a valuation strike-zone has emerged

Continued regulatory scrutiny brings “caveat emptor” and “caveat venditor” implications

Reduced stigma around M&A “soft landings” as operating and fundraising conditions get harder

AI opens the M&A aperture for tech as well as non-tech strategics

I. Sponsor-backed take-private deals still dominate, but multiples are starting to compress

While still below historical averages, M&A activity in 2023 ticked up slightly after a local minima in 2022. Similar to 2022, a majority of activity by deal value was driven by financial sponsor-backed deals, particularly take-private transactions of public companies, as sponsors continued to capitalize on the lowered multiple setting in the public markets:

Some notable PE-backed take-private deals in 2023 include:

Silver Lake’s acquisition of Qualtrics for $12.5Bn (this was the second largest software M&A of 2023 by purchase price)

Francisco Partners and TPG’s acquisition of New Relic for $6.5Bn

Blackstone’s acquisition of Cvent for $4.6Bn

Clearlake and Insight’s acquisition of Alteryx for $4.4Bn

Vista’s acquisition of EngageSmart for $4Bn

Vista’s acquisition of Duck Creek for $2.6Bn

Francisco Partners’ acquisition of Sumo Logic for $1.7Bn

Symphony Technology Group’s acquisition of Momentive for $1.5Bn

In terms of take-private valuations, a trend of multiple compression over time is emerging (chart below). Morgan Stanley estimates that the average TTM sales multiple for take-private transactions was approximately 30% lower in 2023 than in 2022. Still, with the median BVP Cloud company trading at 6.0x current revenue, which is below the average take-private TTM sales multiple in 2023, we may expect momentum for these transactions to continue into 2024 as sponsors further maximize areas of dislocation.

II. Blockbuster M&A from strategics have slowed as a valuation strike-zone has emerged

Unlike 2022 which saw several announcements of blockbuster acquisitions from strategics (including Microsoft’s announcement to acquire Activision Blizzard for $69Bn, Broadcom’s announcement to acquire VMware for $61Bn, and Adobe’s announcement to acquire Figma for $20Bn), such events were few and far between in 2023.

Cisco’s acquisition of Splunk in a $28Bn all-cash deal was one of the only blockbuster strategic deals of the year, and was also 2023’s biggest software M&A deal by purchase price. Cisco has historically been wary of mega deals, with its biggest acquisition prior to Splunk being a $6.9Bn purchase of Scientific Atlanta in 2006. If this deal closes, not only would it be Cisco’s largest acquisition ever, it would also be one of the top 10 tech (not just software) acquisitions of all time by absolute purchase price:

However, while the headline price represents a big number, it is important to note that from a multiple perspective, Cisco is paying ~6.6x forward revenue for Splunk. This is in contrast to, say, Salesforce’s acquisition of Slack in 2020 also for a headline price of $28bn, but that represented a much higher multiple of forward revenue:

Beyond the Cisco-Splunk blockbuster deal, there were several other bright spots of strategic M&A activity throughout the year, such as IBM’s acquisition of Apptio for $4.6Bn. However, on a whole, strategic M&A activity has slowed from historical levels, and startups should be prepared for tepid behavior to linger (more on reasons for this in the next section). Startups should adjust expectations on the valuation front as well. As shown in the chart above, JP Morgan found that 4-8x forward revenue has emerged as a typical M&A strike range for strategics, which is on the lower end of what we’ve seen in the past 5 years, but is more typical of the ranges we saw pre-2017.

III. Continued regulatory scrutiny brings “caveat emptor” and “caveat venditor” implications

As mentioned in the preceding section, strategic M&A activity has slowed and less blockbuster deals are being announced. Amongst a slew of potential reasons such as macroeconomic uncertainty, many in the ecosystem have pointed to regulatory scrutiny as a key catalyst for this chill. Within the US, Bloomberg notes that:

“US enforcers have roughly doubled their efforts to block mergers under the Biden administration: in the 12 months through September, the antitrust agencies filed complaints against a record 13 transactions compared to an average of six per year over the previous five years”

Additionally, US regulators are taking increased policy actions to intensify the burden on transacting parties. For instance, in June 2023, the Federal Trade Commission proposed changes to the Hart-Scott-Rodino Act that, according to Cooley, could potentially add costs and time to the M&A filing process.

Beyond antitrust considerations, other geopolitical vectors have added regulatory friction as well. As DLA Piper notes in their Global M&A Intelligence Report:

“The introduction of new or enhanced foreign direct investment regimes in jurisdictions around the world, especially in the UK, North America and Europe, is already impacting on a surprisingly broad swathe of technology deals, particularly in sensitive sectors such as AI, data infrastructure and biotech. Cross-border deals will become more challenging and complex — and this will present execution risks that impact the timing or deliverability of transactions, or even discourage potential acquisitions entirely.”

Indeed, all of the blockbuster strategic M&A deals announced in 2022 demonstrated the heft of the current regulatory environment:

It took Microsoft over 20 months to close its acquisition of Activision Blizzard (its largest acquisition to date). Announced in January 2022, Microsoft had expected the acquisition to wrap up by the end of June 2023, but closing was delayed by a lengthy regulatory review.

Chipmaker Broadcom took over 17 months to close its acquisition of VMWare. After announcing the transaction in May 2022, the deal’s closing date was delayed multiple times as the companies had to overcome in-depth cross-border investigation and regulatory review amid rising geopolitical tensions. Eventual regulatory approval came with additional restrictive conditions.

Announced in September 2022, Adobe’s contemplated acquisition of Figma was mutually terminated after 15 months of scrutiny as both parties saw “no clear path to receive necessary regulatory approvals”. The entire VC community was paying close attention to this landmark deal, since news of this acquisition came in the midst of one of the most challenging years for the software market. Adobe’s proposed price of $20Bn at the time of the announcement represented 50x current ARR which would mark the highest acquisition multiple paid for any software company of scale in history (recall from the preceding section that 4-8x forward revenue has emerged as a more typical strike-zone for strategics).

While strategics may have appetite to conduct more M&A in 2024, I suspect that the regulatory environment creates a “caveat emptor” mindset which will push decision-makers to approach M&A with heightened caution and cause them to think more strategically about potential synergies, since deals construed as being directly competitive are likely to face additional hurdles.

On the other side, the regulatory environment also instigates “caveat venditor” considerations for startups contemplating acquisition, since navigating a long and ultimately unsuccessful sale comes with opportunity cost and can take focus off a target’s core business. I would expect to see more target companies ask for higher break-up fees or hell-or-high-water clauses in case acquirers walk away due to regulatory friction. The break-up fee for the Adobe-Figma deal was $1bn, which was more than 3x Figma’s total capital raised.

IV. Reduced stigma around M&A “soft landings” as operating and fundraising conditions get harder

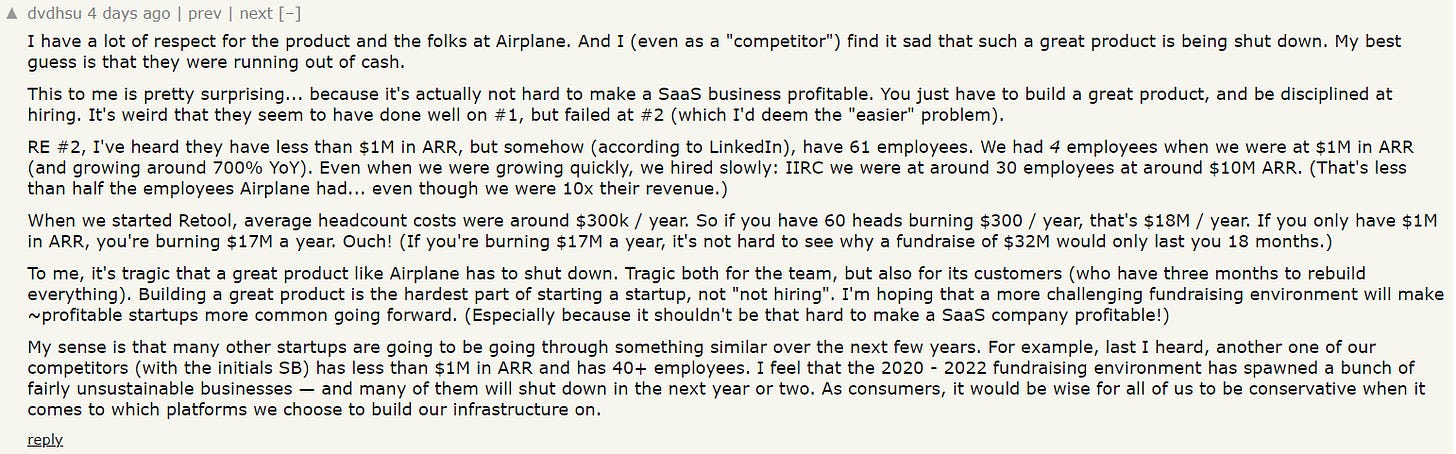

I highlighted Airtable’s purchase of Airplane at the start of this piece. While few details surrounding the deal have been disclosed, the abrupt shutdown of Airplane’s product as part of the acquisition makes the deal sound like an acquihire, drawing speculation on Hacker News that this was more of a “soft landing” to find a home for the company, rather than a highly positive exit outcome for stakeholders. This sent shockwaves through the ecosystem since Airplane was a prominent startup backed by top tier VC firms that had just announced a $32MM Series B less than 1.5 years ago.

The news was so significant that even Airplane’s competitors felt compelled to address the situation. As David Hsu, CEO and founder of Retool, commented on Hacker News:

Airplane is just one of many examples of an emerging trend. Armory, that had raised over $80MM and was last valued at $200MM, was acquired by competitor Harness for $7MM last month. As David Hsu alluded to in his comments, we may just be at the start of a reckoning. Operating and fundraising conditions are tight, and as I’ve noted previously, we’ve already seen a record number of startup shutdowns in 2023, especially from previously high-flying unicorns. Just last week, design startup InVision (that had raised over $350MM and was last valued ~$2Bn) announced that it was shutting down, becoming the latest fallen unicorn. Miro had previously acquired Invision’s Freehand team and technology in November 2023, with InVision’s then CEO joining Miro as part of the deal.

As more startups are faced with the difficult decision of either “hard landing” through a shutdown or “soft landing” by finding a home through acquisition, the latter, while certainly disappointing, may be more palatable as it gives an opportunity for the company’s core assets (such as talent, product, tech, or customer relationships) to live on. In fact, Hunter Walk of Homebrew even goes so far as to encourage struggling companies to openly announce that they are for sale, noting that “‘this didn’t work out the way we hoped’ is the theme song of startups so join the chorus.”

V. AI opens the M&A aperture for tech as well as non-tech strategics

But it’s not all doom and gloom. Mirroring the wider tech market, AI remains a bright spot in M&A. As we saw with Databrick’s high-profile $1.3Bn acquisition of MosaicML last year, strategics remain hungry to leverage M&A as a means to expand AI capabilities and acquire best-in-class AI assets:

This sentiment isn’t limited to the tech industry, as we’ve even seen non-tech companies use M&A to enter the AI fold, with a recent example being Thomson Reuter’s acquisition of legal AI company Casetext for $650MM in cash.

Related to this section, I wanted to end by giving my former RelateIQ teammates at Airkit.ai a shoutout for their recent acquisition by Salesforce to “help Service, Sales, Marketing and Commerce teams move faster into the future of customer engagement in the era of AI”. Congrats on the boomerang back to the Salesforce Ohana!