SaaSy Predictions for 2023

In this final post of 2022, I revisit notable events which have defined this tumultuous year for cloud companies and offer some predictions on what the next big thing in SaaS might look like in 2023.

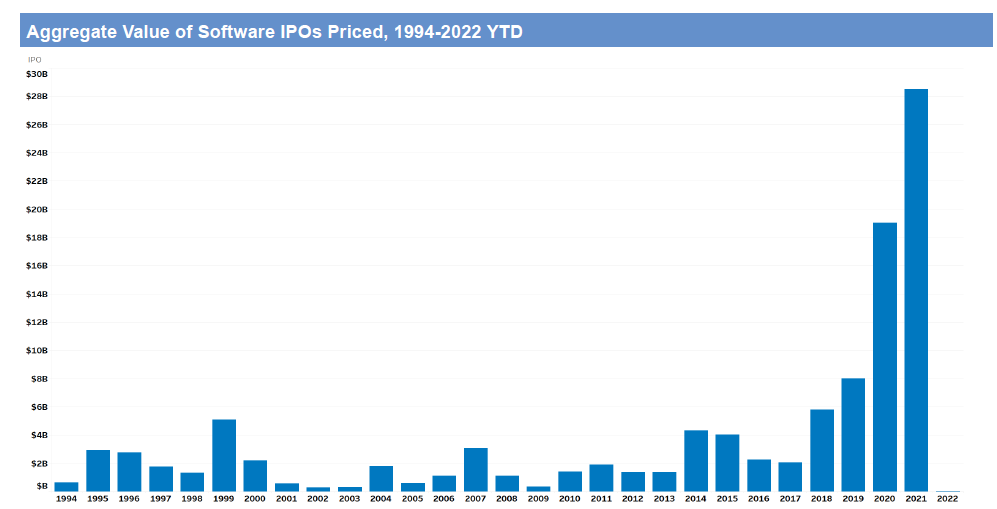

Comparing the cloud economy in 2021 to 2022, we see two drastically diametric narratives. 2021 was one for the record books with total public cloud market capitalization reaching a peak of $2.7T in Nov’21, blockbuster software IPOs yielding a historical high of ~$30bn in proceeds within the year, and sky-high valuation multiples across public and private cloud markets.

In 2022, the tide turned with a drastic reset. At the start of the year, the Fed began raising interest rates (for the first time since 2018) to curb inflation, which catalyzed a fierce SaaS sell-off — the SaaSacre of 2022 — despite cloud companies still demonstrating strong fundamentals at the time. A second wave of impact from a macro double squeeze hit later in the year when recession fears began to impinge upon fundamentals.

Juxtaposed against 2021’s market ebullience, 2022’s recoil represents one of the most severe multiple pullbacks in software downturn history (chart above). Currently, the average EMCLOUD company is trading at ~4.6x EV/NTM revenue which is below historical long-term averages.

Consequently, SaaS IPO activity grounded to a halt this year in startling fashion following the IPO frenzy in 2021 (visualized above). In a similar vein, software M&A activity in 2022 fell below historical averages:

While overall activity was down, software M&A in 2022 was notable for several reasons. It was a record year for PE-backed deals, especially take-privates (exhibit below), as financial sponsors sought to capitalize on the lowered multiple setting. There were also several announcements of blockbuster strategic acquisitions, including Microsoft’s announcement to acquire Activision Blizzard for $69Bn, Broadcom’s announcement to acquire VMware for $61Bn, and Adobe’s announcement to acquire Figma for $20Bn (which marked the highest acquisition multiple paid for any software company of scale in history).

Across public and private cloud markets, the correction of 2022 marked a paradigm shift in valuation heuristics toward capital efficient growth at optimal costs rather than absolute growth at all costs. Referencing the chart below, this was a marked reversal from previous years where software valuations were more correlated with growth alone rather than efficiency score (growth plus profitability). The renewed focus on efficiency has had material implications on the decision-making and trade-off framework for cloud leaders, especially those operating in the growth stage, as demonstrating a path to profitability is now more important than ever before.

2023 Predictions

Suffice to say, the entire SaaS industry has been through a lot in 2022. As we adapt to a rapidly evolving landscape, here are five trends and drivers that I believe will define cloud markets in 2023:

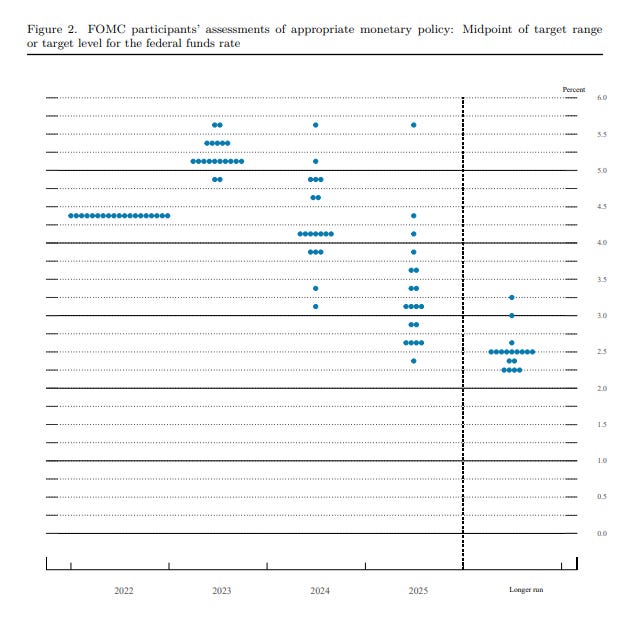

I. More macro stabilization: As highlighted, a lot of the uncertainty in the past year stemmed from changing macro conditions, most notably interest rate hikes in an attempt by the Fed to curb inflation. 2023 should see some stabilization, with several experts expecting interest rates to reach terminal value within the year which may signal the end of hikes:

Interest rates govern multiples with an inverse correlation. Growing clarity around steady-state conditions should assuage the hesitant behavior from market participants that we saw in 2022. As visibility improves around future equilibrium, legendary investor Howard Marks cautions that the extremely low interest rate environment over the last several decades that was a primary driver of returns is likely over, and “it should follow that the investment strategies that worked best over those periods may not be the ones that outperform in the years ahead”.

II. De-stigmatization of flat or down rounds: 2022’s private fundraising climate mirrored the public market recoil, with venture activity (both in deal volume and size) declining in every quarter of 2022, marking the end of 2021’s outlier period:

Amid the backdrop of a tougher market and fundraising environment, there was an uptick in flat or down rounds in 2022 (although this percentage still remains low by historical standards). The pace of such announcements picked up at the end of the year, with several notable late-stage companies taking stock of current conditions and conducting equity raises at reduced valuations from a year ago.

Are there more markdown announcements to come? Morgan Stanley analyzed down-round activity points from prior cycles in 2000 and 2008 and found that most acute re-valuation activity emerged around 20 months from peak exuberance (chart below). This makes sense assuming that typical capital raises provide 18-24 months of runway and companies need to raise prior to their cash reserves dwindling. Layering on this timeline to the peak VC activity we saw in Q4’22 would suggest that there may be more down-round activity to come through the first half of 2023.

While accepting a valuation markdown may not be preferable, as we start to see more of such rounds, founders and investors alike are taking a nuanced view, recognizing that in many cases such resets are more about a correction from sky-high 2021 mispricing and setting up the company for long-term success, rather than a reflection of core business fundamentals. Additionally, if startups need to raise in less favorable conditions, it is perhaps better to accept a clean round with no structure even if it is at a lower valuation, rather than taking a “dirty” structured term sheet just to maintain a previous valuation.

III. Increased vendor consolidation and re-bundling: Midway through the year, I observed how macro pressures were catalyzing consolidation of vendors (especially discretionary point solutions) as enterprises sought to save costs or improve operational efficiency. More rationalization of spend should be on the horizon in 2023, especially within fragmented vendor landscapes in particular layers of the tech stack:

For instance, Morgan Stanley found that the average enterprise uses 10+ different monitoring tools… making it easy to see how consolidation should occur as budgets tighten. Platform providers that can support multiple use cases will likely be favored, even if they may not be the best-in-breed option. As a corollary, pairing this trend with the conducive M&A environment discussed earlier in this post indicates that the ability to fill platform gaps or accelerate product roadmap could emerge as a core driver for increased strategic M&A activity.

IV. Mainstream adoption of FinOps and productivity optimization tools: Related to point III, current macroeconomic pressures compounded with pandemic era software sprawl are causing enterprises to realize that they have limited visibility into managing cloud costs and risk. It may seem counterintuitive, but as organizations increasingly look to re-evaluate tech spend, I expect more enterprises to consider adoption of additional tooling to negotiate better prices with vendors, better visualize usage, and optimize cost-savings across all layers of the stack. There are already a sizeable number of FinOps startups targeting different use cases, and even scaled companies like Datadog have recently launched more offerings in this category.

In a similar vein, in challenging times such as these where corporations are re-evaluating labor expenditures and are attempting to do more with less headcount resources (as seen in the chart above), adopting solutions to visualize and benchmark employee effectiveness of different teams from developers to sales reps could also help companies to boost productivity.

V. Explosion of generative AI continues across more vectors and ushers in fundamental shifts: Earlier this year, my colleagues and I published a roadmap detailing how 2022 would be a breakout year for generative AI. Indeed, 2022 saw several groundbreaking model releases, including DALLE-2, ChatGPT, Stable Diffusion, and Dreamfusion, that helped to reimagine and create new use cases across the knowledge and creative economy. Not only do I expect excitement for generative AI to continue into the next year, but 2023 should be one of the most promising years yet, particularly as anticipation builds for GPT-4 to be unveiled shortly.

I expect more enterprises, and not just individuals or prosumers, to embrace such technology more enthusiastically in 2023. In fact, McKinsey recently published a commentary on how transformative generative AI will be for corporations, making a call to action for businesses to thoughtfully adopt such technology:

Additionally, the beauty of democratized AI access in today’s paradigm leads me to anticipate that beyond a burgeoning AI-native startup ecosystem, we will see more non-AI native providers incorporate generative AI features into their products in 2023 by leveraging partnerships, APIs, and open-source offerings. Startups such as Notion and Canva* have already adopted this approach to launch new generative AI offerings, and incumbents such as Microsoft have also announced intentions to follow suit.

In mid-2022, less than 1% of online content was AI-created. But within the next ten years, my colleagues and I predict that at least 50% of online content will be generated by or augmented by AI, driven by factors such as the ones detailed above. This rise of generative AI will usher in fundamental changes to our current regulation and governance around areas such as intellectual-property, licensing, accuracy, moderation, verification, biases, and authenticity. While I believe in the positive impact generative AI can bring, I also recognize that there is potential for misuse and abuse. 2023 will likely herald more debate and reform around the rules and areas for practical and ethical applications of such powerful technology.

It’s always darkest before the dawn

I’m optimistic that today’s stormy conditions will get clearer in the new year, and that many cloud companies will emerge stronger than ever after going through a crucible 2022. Wishing all of you a happy 2023 (aka FY24 for all my fellow SaaS enthusiasts) and a brighter new year ahead!

*denotes a Bessemer portfolio company

What is your take on the fundraising landscape for early stage SaaS startups in 2023?

Thank you for the great insights!