SaaSy Predictions for 2024

In every last post of the year, I reflect on notable events from the past 12 months & offer predictions on the next big thing for the new year. Trigger warning for 2024: a lot more AI content ahead...

Following an annus horribilis for the cloud community in 2022, 2023 seemed more of a tale of two cities. Reviewing my most-read posts for 2023, two distinct themes emerged which aptly captured the split sentiment felt across the startup and VC community over the past 12 months.

On one hand, soberness from 2022 reverberated into 2023’s operating environment as the after-effects of the end of a ZIRP era triggered events such as muted fundraising activity, frozen exit windows, valuation resets, and pivots toward profitable growth. My most-read pieces on these topics:

When the valuation hangover finally hits (25 Sep 2023) This was the top post of the year with ~20k reads!

SaaS IPO window inflection (29 Aug 2023)

Consumption vs. subscription business models during downturns (30 May 2023)

Schrödinger’s Startup Paradox: Locked inside the last round valuation box (24 Oct 2023)

Taking a "dirty" term sheet to preserve headline valuation (6 Jan 2023)

Unicorns are dead. Long live Unicorns! (13 Dec 2023)

Unraveling stock-based compensation overhang in the SaaS industry (3 Apr 2023)

Land vs. Expand: Growth formula shifts during downturns (12 Jul 2023)

Contextualizing the growth vs. profitability trade-off for cloud companies (18 Apr 2023)

Yet in the midst of this gloominess, AI had one of its brightest years in history. On the technology side, we saw AI innovations progressing at unprecedented speed. On the fundraising side, valuations and deal activity for AI startups were reminiscent of more exuberant times. On the distribution side, AI moved into mainstream consciousness, capturing outsized attention not just within Silicon Valley, but also amongst global consumers and world leaders. In a fulfillment of my 2023 prediction, this year was also a notable year for AI as regulators increased scrutiny and moved to formalize guidelines around AI governance. My top AI pieces from this year:

AI’s Linux Moment: Open LLM 'Davids' vs. Closed-Source 'Goliaths' (9 Jun 2023)

AI Model Layer: The New Frontline of the Cloud Wars (19 May 2023)

The B2C2B osmosis fueling AI's Cambrian moment (26 Apr 2023)

With the benefit of a full year of data, here are few additional observations illustrating the discrepancy between the AI haves and the have-nots:

Within the private markets, venture funding reached a 5-year low, but AI/ML startups bucked this trend (chart below). According to Morgan Stanley, AI/ML venture deals now account for 23% of venture dollars deployed, up from 15% in 2022.

Within the public markets, the Magnificent Seven (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla) had a remarkable year, with analysts pointing to AI being a notable catalyst for the dominance of these 7 companies in 2023. Stocks from these seven companies jumped 75% in 2023, significantly outperforming the other companies in the S&P 500 which had risen only a modest 12%:

Within the publicly traded software cohort, JP Morgan found that there is now a material delta in stock performance between publicly traded software companies that are making AI a key priority versus those that aren’t:

Given the extent of the current AI frenzy, it’s somewhat surprising to recall that ChatGPT was only released upon the world a mere ~12 months ago! Will this momentum wane in 2024?

The four waves ushering in the Age of AI

At the risk of adding to VC hubris, I’m going to posit that we’ve barely scratched the surface in 2023, and 2024 should herald another boom year for AI. Here’s the framework underpinning my enthusiasm — I’ve observed in previous tectonic paradigm shifts that there are four waves of contributors who usher in such technological sea changes:

The first wave is spearheaded by academics and technologists who lay the research grounding for the shift. A seminal paper in the current AI revolution is 2017’s “Attention is all you need” which introduced the concept of transformers. But 5 years since this groundbreaking piece, this wave is certainly far from done as research in the field continues to be published at an unprecedented speed (more on this in the Predictions section).

The second wave is driven by infrastructure builders who productize breakthroughs arising from the preceding research wave. Essentially, these stakeholders are building platform tech that other tech can be built upon. In today’s AI revolution, I consider innovations in compute infrastructure, foundational models, as well as AI infrastructure and associated tooling to fall within this group. 2023 was a definitive year for this wave, especially for foundational models which captured the bulk of VC attention (chart below). In a fitting note to close out the year, news of foundational model leaders OpenAI and Anthropic raising rounds at ~$100bn and ~$18bn valuation respectively broke just last week.

The third wave involve application developers who are able to accelerate creation once the preceding infrastructure and tooling layer is in place. As we’ve seen with PC, mobile, internet, and cloud computing revolutions, this application wave is often the most visible chapter of a technological shift since it touches upon client-facing use cases. While there are certainly many new AI apps that have already been funded and launched in the past year, I believe we’re in very early days and 2024 might be the year where the AI app ecosystem truly blossoms.

The fourth wave constitutes capitalists who are attracted to participate in the movement primarily because they see opportunity to make money through facilitating market efficiencies or optimizing processes, rather than creating net new innovations. Through these actions, such stakeholders serve to cement the mainstream nature of a new transformative solution. In today’s AI Spring, this wave could include additional supply chain vendors such as hardware providers focused on specific aspects of scalability or mass production to reduce input costs for AI, or consultants and agencies that serve to expand AI awareness through partnerships.

2024 Predictions

With this framework in mind, here are my five predictions for 2024 which touch upon the different waves in the AI revolution:

I. LMMs are the new LLMs: Multimodality becomes table-stakes

As OpenAI states in GPT-4V’s system card: “Incorporating additional modalities (such as image inputs) into LLMs is viewed by some as a key frontier in AI research and development.” We’ve just arrived at this exciting frontier as 2023 saw huge strides made in model capabilities extending beyond text to become multimodal systems. Across DeepMind’s Flamingo, Google’s Gemini, PaLM-E, and VideoPoet, Microsoft’s KOSMOS-1, OpenAI’s GPT-4, Salesforce’s BLIP, and Tencent’s Macaw-LLM (amongst many others), this year was truly a landmark year for Large Language Models (LLMs) evolving into Large Multimodal Models (LMMs). This is in addition to other diffusion systems that have also been pioneers on the multimodal front, such as Midjourney which launched V5 and V6 within the year.

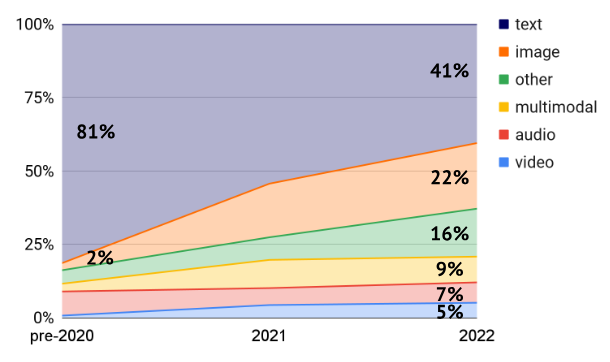

Building on this momentum, I believe 2024 will be another banner year for multimodal use cases, where we will see multimodality grow in ubiquity (chart above) and become table-stakes. If you’re interested in digging deeper into multimodality, I highly recommend reading Chip Huyen’s primer about this topic.

II. Evolution of new techniques will push the limits of AI model capabilities and continue to define the AI infra stack

As highlighted earlier, AI research continues to progress at an astonishing speed (fun fact: searching for “chain-of-thought” on Arxiv indicates that there are ~500 papers with this keyword published just in the past 12 months). In particular, 2023 was defined by the proliferation of many cutting-edge techniques to advance LLM and diffusion model outputs across base performance parameters (such as accuracy and latency) as well as new frontiers (such as reasoning, multimodal, and vertical-specific knowledge). These include techniques such as CoT prompting, fine-tuning, RAG, and RLHF, which have become popular acronyms within a very short period of time:

In 2024, I predict that these techniques will inspire additional concepts and evolve further as an increased level of iteration takes place to solve for real-world scalability and applicability. For instance, we’re already seeing lineage branches such as multi-agent RAG , RLAIF, and Tree-of-Thoughts prompting. All of these techniques will continue to transform and reimagine how we build, develop, operate, and deploy, AI models and apps.

III. Attention is not all you need: Envisioning a sub-quadratic future

2017’s “Attention is all you need” has left an indelible mark on the world through the introduction of transformer architecture. All eight authors of the paper have since left Google to found or join several exciting AI startups such as Adept, Character.ai, Cohere, Essential AI, Inceptive, and Sakana AI.

Beyond these startups, many other prominent GenAI companies are leveraging transformers to build products. But just as transformers overtook the previous paradigm of recurrent neural networks, no paradigm dominates forever. While I do not believe that the transformer architecture will be dethroned as the predominant model architecture any time soon, I suspect that 2024 will be a year where we see more sub-quadratic approaches (such as Hyena, Monarch Mixer, and Mamba) emerge as game-changing contenders.

IV. Domain-specific AI powering a new crop of vertical SaaS

Just as the shift to the cloud energized the Vertical SaaS movement over a decade ago, I foresee the AI platform shift being a powerful catalyst to reinvigorate the Vertical SaaS category. Non AI-native market leaders such as Procore in the construction industry and Veeva in the life sciences industry have already wasted no time in embedding AI capabilities into their application offerings this year. All of this activity is in addition to a budding generation of AI-native vertical SaaS newcomers that have sprouted in the past few months:

The renaissance of vertical AI is upon us, and I’m particularly compelled by AI-first platforms purpose-built for the defense sector; stay tuned for a new roadmap that I’m publishing on this thesis next month!

V. Moving from POC to Prod

2023 was a year when enterprises dipped their toes into the AI revolution by exploring the possibility of incorporating such technology into their stack (chart above). If 2023 was the year of proof of concept (POC), then 2024 should emerge as the year moving from POC to production:

This will be where the rubber meets the road. As enterprise customers move from small explorations to scaled deployments in the coming year, I expect that we will see more refinement of business models and clarity around pricing structures. I also foresee more optimizations to infrastructure and tooling (including a continued emphasis around software and hardware innovations to drive model cost reductions) as AI companies solve for scalability and viable unit economics in production environments.

Additionally, as highlighted earlier, 2023 saw policymakers around the world increase regulation and legislation efforts governing the use of AI. Consequently, I anticipate this discourse to continue with full force in 2024 as companies grapple with the emerging regulatory and legal landscape as more applications go into broader production.

AI Everything Everywhere All at Once in a brighter 2024

I’m filled with optimism as we enter 2024, not just from AI excitement, but also because I believe overall operating outlook is stabilizing and may inflect positively in the coming months (exhibits above). As we head into another fast-faced year, I’m incredibly grateful for the continued support and engagement from all of you subscribers — after all, human readers can never be replaced by AI 😊. Wishing everyone a peaceful holiday season and see you in the new year!

Brilliant piece! Thank you for sharing!